BPO operations are built for constant change. Contracts ramp quickly, headcount fluctuates, and compliance expectations never ease, all while margins remain under pressure. Yet one area that underpins all of this is still rarely treated as strategic infrastructure: how devices are provisioned, managed, and recovered at scale.

For many BPOs, device management sits in the background. It is often fragmented across internal IT teams, multiple suppliers, and manual processes that have evolved over time. While this may work at smaller volumes, it quickly becomes a constraint as operations scale.

When Devices Slow Performance

In high-velocity BPO environments, time is directly linked to revenue. Delays in device onboarding mean agents cannot go live, training investment is underused, and programmes lose momentum. Offboarding creates equal risk. High churn and contract changes mean devices leave the estate constantly, and without tight controls this exposes data, compliance, and asset recovery issues.

Alongside risk, cost quietly increases. Idle devices, unnecessary new purchases, repeated configuration work, and reactive support all erode margins, often without being visible as a single problem.

Why Traditional Models Fall Short

Many BPOs still rely on capital-heavy purchasing or piecemeal provisioning models that were never designed for workforce volatility. Buying new devices for each ramp-up ties up capital and leaves surplus stock when demand drops. Limited asset visibility makes it difficult to track usage, ownership, and compliance, especially as remote and hybrid delivery models expand.

A Managed, Circular Alternative

An increasing number of BPO providers are adopting a fully managed, circular IT and asset management model. This approach treats devices as operational infrastructure rather than one-off purchases. Devices are pre-configured, securely deployed, supported in-life, rapidly recovered, refreshed, and redeployed based on forecast demand.

The operational impact is clear:

- Faster onboarding with ready-to-deploy devices

- Reduced risk through controlled offboarding and certified data security

- Lower cost per agent by maximising reuse and limiting capital spend

- Improved productivity through consistent configuration and support

- Measurable ESG benefits through extended device life

Turning a Constraint into a Lever

When device management is treated strategically, it stops limiting growth and starts enabling it. Onboarding accelerates, offboarding becomes predictable and auditable, and costs align more closely to active headcount rather than peaks and troughs.

In a market where speed, compliance, and efficiency define success, rethinking device management is no longer optional. A modern, circular approach to IT and asset management is becoming a foundational capability for BPOs looking to scale without adding risk or complexity.

Want to know more?

This Location Watch report draws on insights from Ryan Strategic Advisory’s May 2025 CX Technology and Global Services Survey (Peter Ryan, 2025) and ArvatoConnect’s Onshore-Offshore: Why the CX Value Equation is Changing (James Towner, 2025). As well as CCP’s relationship with scores of UK outsourcing decision makers and over 240 global BPOs.

The Rise of Offshoring

Since the 1990s, offshoring has become a dominant trend in business process outsourcing. Companies initially turned to India for its low labour costs, English proficiency, and large talent pool. In the 2000s, India was joined by the Philippines as another low-cost hub, particularly suitable for customer service and voice-based operations, leveraging its Western (especially US) cultural alignment. More recently, South Africa has gained attention for its quality, favourable time zones, and relatively lower cost base compared with Europe, providing a viable alternative for UK and European clients.

Yet, despite the global rise of offshore destinations, the UK has maintained its position as a key outsourcing market, valued not for cost alone but for quality, governance, and operational reliability. Its mature infrastructure, strong compliance standards, and professional capability continue to make the UK a premium outsourcing environment, where strategic partnerships prioritise service excellence and trust over purely economic considerations.

Value-Driven Outsourcing Partnerships

In 2025, UK enterprises show a clear preference for value-driven outsourcing partnerships that combine advanced technology capabilities with proven operational excellence. Ryan Strategic Advisory’s May 2025 CX Technology and Global Services survey found that AI proficiency, know-the-customer analytics, and competitive pricing are now the top three competitive differentiators for BPO providers. UK buyers emphasised the importance of strong client references and sector-specific expertise, underscoring the country’s preference for relationship-based, high-governance engagements.

Budget Stagnation and Operational Challenges

A notable trend emerging in the UK market is budgetary stagnation. Over 60% of UK CX leaders indicated that their 2025 budgets will remain flat or decline. This is accompanied by concerns over agent attrition and declining service levels, particularly in voice and digital delivery channels. As a result, many UK enterprises are reassessing delivery models, prioritising investment in AI, automation, and analytics to improve productivity without sacrificing quality. The consequence is a heightened focus on “cost-neutral transformation”, shifting spend from headcount to enabling technologies without increasing overall CX budgets.

Research also highlights that poor AI rollouts can alienate agents: 26% of UK contact centre staff are considering leaving due to unclear AI integration strategies, emphasising the need for transparent change management and training (ArvatoConnect, 2025, Impact of AI on Agents).

Onshoring and Reshoring Trends

While offshoring continues to feature in many delivery strategies, particularly to India, the Philippines, South Africa and Egypt, the latest research indicates that some UK buyers are developing a renewed focus on onshore delivery. ArvatoConnect’s 2025 findings report that:

• 73% of UK brands would choose to onshore CX if cost were not a factor

• 34% are actively planning to reshore services that were previously relocated overseas within the next year.

Key drivers behind this transition include:

• Improved staff retention (31%) and access to local talent and cultural familiarity (26%)

• Customer preference for localised support (26%) and better service quality (21%)

• Simpler management structures, regulatory confidence, and access to advanced technologies (25%)

Correctly planned and executed, onshoring is increasingly seen as a future-proof strategy rather than nostalgia. Proximity improves employee engagement, cultural alignment, customer trust, and ensures tighter compliance control, especially for highly regulated industries.

AI, Automation, and Cost Parity

This rebalancing reflects a shift from a cost-driven model to one focused on resilience, agility, and customer intimacy. AI and automation are now reducing the cost of UK-based service delivery by up to 30%, narrowing the traditional economic advantage of offshore operations:

• AI-powered digital agents in the UK: £16 per hour

• Offshore human agents: £15–£17 per hour (depending on which location)

This near-parity redefines the value equation for outsourcing decisions.

Strategic Insights from ArvatoConnect

As ArvatoConnect’s Chief Growth Officer, James Towner, notes:

“Offshoring’s economic promise is fading. Today’s smartest brands are strategically resetting and planning to reshore customer experience for cultural alignment, talent retention, customer preference, and tech-driven agility.”

The emerging model blends 70% digital/AI interactions with 30% human advisors, focusing human talent on empathy, compliance, and complex issue resolution.

Hybrid and Onshore Investments

Ryan Strategic Advisory’s global survey observed limited enthusiasm for expanding offshore capacity among UK enterprises. Instead, organisations are investing in hybrid and onshore models, leveraging automation and analytics to enhance efficiency.

• BPOs are re-emphasising UK delivery centres in cities such as Manchester, Glasgow, and Newcastle

• Investments are going into next-generation CX hubs integrating AI, cloud contact platforms, and multilingual service delivery

And as ArvatoConnects research suggests, providers are piloting AI-enabled ‘micro-hubs’ that balance cost efficiency with high-quality onshore delivery, while maintaining compliance and engaging the local workforce. Of course, the most innovative offshore BPOs are just as focused on automation and AI-driven investment as their UK peers, but technology may be serving to ‘level the playing field’”

Conclusion: The UK’s Resilient Outsourcing Ecosystem

The UK’s BPO and onshoring landscape combines technological sophistication, regulatory stability, and deep sectoral expertise, creating a solid foundation for high-value service delivery.

As brands continue to prioritise data protection, cultural coherence, and high-quality service, the UK’s position as both an outsourcing and reshoring leader is set to strengthen through 2026 and beyond. In the mid-term, the integration of automation, AI support for agents, and reductions in volumes and handling times will provide an opportunity to bring more operations closer to home. This positions the UK not just as a premium delivery location, but as a cost-efficient, technology-enabled alternative to traditional offshore destinations.

In our earlier whitepaper, we explored how AI adoption is reshaping customer contact – an area in which great risk and reward intersect. Six months on, the case for agentic AI has grown stronger, particularly in sensitive customer interactions where honesty and trust are essential.

Drawing on academic research and industry data, we now understand that AI can do more than just automate processes. It can unlock “more honest” conversations, especially in situations where fear of judgment by others or shame might inhibit disclosure.

This isn’t just a theory! Research from Stanford, MIT CSAIL, and NUS Business School reveals a striking trend: people are more open with AI than with human agents in contexts like mental health, financial distress, addiction, and relationship issues.

Why?

Because AI doesn’t judge.

Stanford calls this the social desirability bias, where people moderate their speech based on perceived perceptions. Removing this perception leads to greater honesty.

The ‘confession booth effect’, a term coined by NUS, also demonstrates this. In anonymised AI conversations, people admitted behaviours they hid from humans, like not reading terms and conditions or sharing passwords. In an insurance use case, initial disclosure accuracy rose by 40% when AI agents led the conversation.

MIT CSAIL found that people expend less mental energy managing impressions when talking to AI. This frees cognitive bandwidth for self-reflection and better problem-solving.

Now taking this approach, judgment-free AI agents can be implemented in high-trust, high-friction industries, such as mental health screening, legal triage, financial support, and trust & safety work. These artificial agents are more scalable and effective than humans.

The paradoxical truth is that people often feel more ‘heard’ by AI than by humans, because they don’t feel the need to pretend.

Yet traditional AI platforms struggle with emotional nuance, privacy, and secure escalation. It is essential to overcome these hurdles with strict compliance (GDPR+), contextual accuracy, and human-aligned escalation protocols.

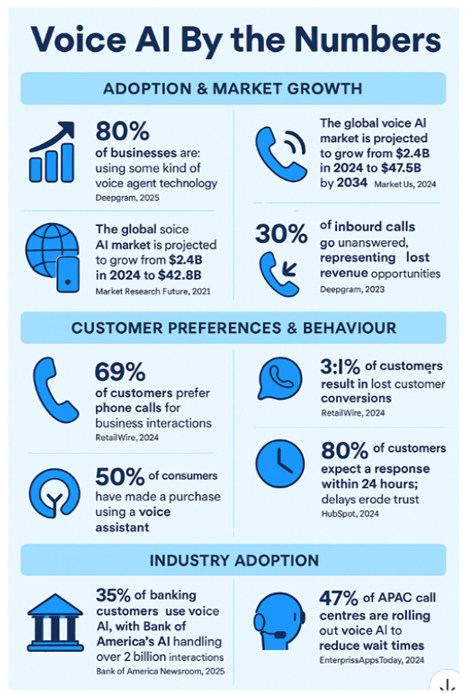

The case for AI grows when combined with market data

Perhaps considered in the context of the long forecast demise of voice as a channel, recent research from the Synthflow white paper brings together a number of key usage stats which when considered with the findings of the academic research support the notion that AI voice will be here to stay?

What does all this mean for CX leaders?

- Trust is key. Sensitive topics require the psychological safety of customers to be part your AI solution.

- Design your AI agent around customer fears, not just FAQs.

- Measure resolution accuracy and emotional sentiment, not just AHT.

- Voice AI, when built correctly, can be the most honest channel for customers.

- Integrated agentic AI ensures a consistent experience across platforms.

Customers don’t need AI to sound human. They need AI to “feel safe”. The leading approach to agentic AI will redefine what honest, efficient, and compliant customer interactions can be – especially in a world in which truth drives trust, and trust drives revenue.

Organisations that have adopted AI in their contact centres have often seen significant improvements, such as halved response times, 40–70% operational cost reductions, and increased contact handling capacity. However, as some partners have noted in their recent engagements with members of the the CCP team, these gains can be followed by a flattening curve and then a performance dip, if not implemented correctly.

We have revisited our February 2025 whitepaper, ’2025: A Year of Difficult Conversations’, in which we explored how AI, automation, and digital transformation would drive new operational and ethical challenges in customer contact. We previously highlighted the tension between cost optimisation, customer experience, and why thoughtful project governance will be required.

We thought it would be good to consider what may have changed and what lessons should be revisited.

Six months of continued observation and implementation across the market have revealed risks that automation without the appropriate planning and controls can have on your future operating model are more nuanced. While short-term AI gains are impressive, traditional approaches may erode long-term value through burnout, agent attrition, and customer dissatisfaction. This is the ‘AI Paradox’: the risk that productivity gains today may fuel tomorrow’s operational decline.

Beneath the surface, a gradual yet detrimental erosion of the human layer is occurring. Collaborating with AI often leads to front-line staff experiencing reduced recovery time, increased complexity in remaining ‘manual’ queries, and escalating customer expectations. Without adjustments to team structure, support, or metrics, burnout becomes a growing threat.

This productivity half-life, a period where efficiency peaks and subsequently declines due to human strain, is no longer merely a theoretical risk. Businesses are starting to witness this AI-driven degradation in tangible figures: within 18 months of implementing traditional AI, attrition rates rise by 65%, customer satisfaction scores decline by 20-30%, and agent engagement scores fall concurrently as the technology matures.

Agentic AI presents a more sustainable alternative. Instead of perceiving AI as a replacement for human input, CCP’s partners are illustrating how task-completing AI agents can alleviate the burden on agents, facilitate judgment-free conversations, and ensure capacity for the most significant human interactions when needed. Consequently, it not only yields improved outcomes for customers but also contributes to enhanced retention, reduced training expenses, and a more resilient workforce.

Mitigating the AI Burnout Trap: Lessons from the Last Six Months

- Implement phased AI rollouts with human impact measures.

- Adopt agentic AI that empowers humans, preserving judgment for complex cases.

- Shift success metrics from AHT to FCR, CSAT, and agent engagement.

- Involve agents in AI workflow design and iteration.

- Regularly audit the AI-human balance: check whether tech amplifies or exhausts people?

- Track attrition, training costs, and productivity when calculating your ROI.

- Lead with transparency and ethics when deploying conversational automation.

Make certain you are on the right course

In short: if your AI roadmap doesn’t include agent wellbeing, then you’re building in risk. Efficiency must be sustainable, not just measurable.

Six months on, the market is beginning to learn this the hard way. The good news? There’s still time to course-correct. The AI paradox isn’t inevitable it’s just the result of decisions made without the full picture.

If you’d like to discuss in more detail how you can leverage the experience of our team and our partners, then feel free to contact us.

This Location Watch was prepared with valuable contributions from Temo Magradze, Founding Partner of Evolvexe BPO, as well as Davit Tavlalashvili, Head of the Investment Department, and Ketevan Kanashvili, Senior Investment Relations Manager at Enterprise Georgia. It also draws on research and insights from Ryan Strategic Advisory, specifically the report “2025 CX Technology and Global Services Survey”. Their perspectives on the evolution of Georgia’s outsourcing industry are especially insightful in highlighting why the country is gaining attention from UK, EU and North American companies as a nearshore and offshore delivery hub.

Georgia is rapidly gaining recognition as a promising BPO destination, thanks to its modern infrastructure, strategic government support, and a clear ambition to grow within the global outsourcing ecosystem. The recent BPO Leaders Summit 2025 in Tbilisi, hosted by Enterprise Georgia and Ryan Strategic Advisory, brought together industry experts, investors and government officials who confirmed the country’s strong potential.

1. Outsourcing Popularity & Market Positioning

As Temo Magradze emphasises, Georgia’s outsourcing industry has grown significantly in recent years. Its appeal lies in affordability, a highly skilled workforce, and a government eager to attract investment. Positioned at the crossroads of Europe and Asia, Georgia combines geographic advantage with a dynamic, pro-business climate, making it an increasingly popular hub for European operations.

According to the Ryan Strategic Advisory – 2025 CX Technology and Global Services Survey (see screenshot), Georgia scores 2.8, placing it slightly below mid-tier in offshore favorability. Yet, several countries ranked lower continue to be regarded as more mature outsourcing destinations due to their established ecosystems and long-standing track records:

- Turkey (2.6) – Longstanding BPO hub with strong multilingual capabilities, particularly in European market support.

- Colombia (2.7) – A leading nearshore delivery market for North America, well known for Spanish-English bilingual services.

- Nigeria (2.7) – Growing rapidly in scale with an established IT-enabled services sector and a deep labor pool.

- Slovenia (2.7) and Bulgaria (2.7) – Both EU member states with recognized nearshore outsourcing reputations, especially in IT, finance, and multilingual service delivery.

Although these markets rank lower than Georgia in the 2025 survey, they are considered more mature thanks to their larger delivery ecosystems, deeper outsourcing experience, and stronger global visibility. The fact that Georgia now scores ahead of such established players underlines its growing credibility and demonstrates how it is winning favorable attention against locations traditionally chosen for offshore and nearshore outsourcing.

2. Cost Competitiveness & Commercial Advantage

Labour and operational costs in Georgia are 40–50% lower than in established Central and Eastern European hubs such as Poland. Average salaries for customer service roles remain in the £456–£608 range, while programmers earn around £1,140 monthly.

One of Georgia’s strongest incentives is its International Company Status, which grants significant tax advantages, including reduced corporate tax rates. Coupled with government-backed grants and subsidies, this positions Georgia as one of the most cost-efficient outsourcing environments in the region.

3. Workforce, Language Skills & Talent Pool

Georgia boasts a multilingual workforce fluent in English, German, Russian and other European languages. Deloitte research estimates over 500,000 multilingual professionals across major cities. The most common roles include customer support, IT helpdesks, finance and accounting, and software development.

Universities and vocational institutes actively integrate English and technical training. Georgia’s education system, including institutions such as Kutaisi International University (developed with Germany’s Technical University of Munich), is producing a steady pipeline of outsourcing-ready professionals, many of whom are multilingual and STEM-focused.

4. Time Zone, Accessibility & Nearshoring Appeal

Situated in the UTC+4 time zone, Georgia overlaps conveniently with European working hours, while also complementing North American operations by enabling round-the-clock coverage.

Infrastructure for travel and remote collaboration is strong: Tbilisi, Kutaisi and Batumi airports all provide direct flights to key European hubs. This accessibility allows easy site visits and integration with international teams.

5. Infrastructure & BPO Ecosystem

Georgia has invested heavily in digital infrastructure, with 97% broadband coverage and widespread 4G/5G access. Tbilisi remains the primary outsourcing hub, but as Temo highlighted to me, there is rapid growth of secondary cities. For example, Evolvexe recently launched a major tech support project with ASUS from Kutaisi, servicing Germany, Switzerland and Austria. Batumi is also attracting investment and fast becoming a secondary BPO location.

6. Government Support & Incentives

The government, through Enterprise Georgia, plays a pivotal role in supporting BPO expansion. Simplified business registration (often completed in a single day), tax incentives, and subsidies for training make it easier for foreign companies to establish operations. While GITA focuses on supporting IT infrastructure and the ICT Association concentrates on IT-related initiatives rather than BPO specifically, these organisations contribute to the broader tech ecosystem that benefits the sector.

Industry associations, such as the ICT Association, also provide a strong bridge between policy-makers and BPO operators, ensuring that the sector’s needs are addressed. Tavlalashvili and Kanashvili stress that this alignment of public and private stakeholders has been critical to the sector’s momentum.

7. Industry Success Stories

Georgia is already home to a mix of international and local players. Companies such as Making Science Sweeft (software development) and Evolvexe Outsourcing (customer support and tech services) demonstrate the ability of Georgian firms to deliver value across Europe and North America. Majorel, Concentrix, EPAM Systems and Viber have also scaled their operations in Georgia, validating the country’s growing importance on the global outsourcing map.

8. Cultural Fit & Service Excellence

Georgians are often described as the “first Europeans”, with a cultural heritage rooted in hospitality, loyalty and respect for education. This translates into a natural customer-service orientation, where tone, empathy and relationship-building come naturally. This cultural foundation gives Georgian agents an edge in handling sensitive, customer-facing interactions with empathy and professionalism.

9. Innovation, Growth & Future Trends

Georgia is moving beyond traditional call centres into higher-value areas such as software development, fintech, AI-enabled services and digital operations. With IT exports surpassing $1 billion in 2024, the country is positioning itself as not only a cost-effective outsourcing hub but also a source of innovation and digital transformation expertise.

Looking ahead, Temo Magradze predicts that in the next three to five years, Georgia will transition from being primarily a low-cost option to a recognised hub for quality-driven, technology-enabled outsourcing, while still maintaining a commercial edge over EU and US markets.

Final Thoughts

Georgia is establishing itself as one of the most dynamic emerging BPO destinations in Europe. Its multilingual workforce, strong government backing, cost advantages and expanding digital ecosystem make it an attractive nearshore and offshore option for companies across the UK, EU and North America.

As Magradze, Tavlalashvili and Kanashvili each highlight, the country’s unique blend of hospitality-driven service culture and tech-driven innovation gives Georgia a competitive edge. While the sector is still developing compared with more mature hubs, Georgia’s momentum is undeniable, positioning it as a location to watch very closely in the years ahead.

Want to find out more or meet vetted providers in Georgia? Drop us a line, we’re happy to help you explore your options.

Of all the contact centre use cases for AI, Pure Voice AI is the most disruptive – and potentially the most transformative. Unlike Agent Assist or auto-wrap that augment human performance, Pure Voice AI replaces the agent entirely for certain interactions.

What is the AI doing in Pure Voice AI?

Pure Voice AI uses fully autonomous AI agents capable of holding spoken conversations with customers—with no human agent in the conversation. For an inbound call, the AI could triage the call, and if it can deal with the interaction itself, it doesn’t need to trouble a human agent. If the enquiry does need a human agent, it can monitor who’s available and route the call to the next best available agent.

Ultimately, the idea is that these AI agents can answer questions, resolve issues, and even handle sensitive interactions such as payment disputes or appointment scheduling.

It’s far more sophisticated than IVR (interactive voice response) trees or chatbots. Pure Voice AI uses advanced natural language understanding, real-time decisioning, and speech synthesis to hold dynamic, human-like conversations.

Key benefits: 24/7 service

The benefits case here is far less about cost reductions, agent productivity gains and optimisations, as use cases 1-6 have already delivered well here.

It is far more about providing round the clock service and enhancing brand experience. Because we all have lives, and work, that mean calling between set hours can sometimes be difficult. But the reason many contact centres are not 24/7 with human agents is because the business case of the cost and overheads – from staff costs to heating and lighting – doesn’t stack up.

Smoothing demand

Not only is calling at set times difficult, it creates spikes in demand, for example around lunch time or just after work. What’s more, pro-active outbound calls can also be scheduled for more customer friendly times of day.

Multi-lingual cover

Where a contact centre needs to serve multiple languages, there is typically a primary language that most human agents speak, with a handful of specialists available for secondary languages. Which means that those secondary languages are a scarce resource, both in terms of availability and recruitment. With Pure Voice AI in the mix, it can detect the language being spoken and switch seamlessly into it.

Implementation considerations

While everyone is trying to rush to this use case, without computer use, proper integrations, optimised and redesigned processes, there is no real opportunity to leap-frog to full voice AI. Because the foundations are simply not in place to support it.

What can we expect to see?

While not quite there yet, it is just around the corner, and there will undoubtedly be a proliferation of pure voice AI, especially for outbound. Though businesses should expect regulation to swiftly follow.

As we await the true potential of Pure Voice AI, it is a case of charting a path to how you achieve this in future, not the focus for today. Down that road lies complexity, risk and far greater likelihood of project failure. When you could be realising value right now and incrementally from use cases that build the maturity on which to develop pure voice AI. A far safer path to value on every front.

To find out more about how CCP can help you make the right technology choices, read more here or get in touch.

This series of articles is drawn from our webinar with Jimmy Hosang, CEO and co-founder at Mojo CX. We explored seven key use cases for AI in contact centres, starting from the easiest productivity gains to value generating applications. You can find a summary of all seven use cases here, or watch the webinar in full here.

As self-serve improves, agents are increasingly left with the most complex queries.

Of course, it’s not always the case as many customers continue to prefer conversations over digital interactions, or are even digitally excluded, but for the most part, the expectation is that agents deal with call after call still, but with less and less respite where the query is nice and straightforward. And complex queries often involve multiple systems or multiple previous contacts, as they aim to follow the story. Which, if we go back to use case 1 – autowrap, we know our corporate memory can be patchy.

Yet customer expectation is that all of the necessary information is at the agent’s fingertips. And why shouldn’t they think that? Customers are often time poor and a bit frustrated already, so a longer than necessary call that may or may not answer their enquiry simply compounds their frustration.

What is the AI doing in Agent Assist?

As with all use cases to date, the AI is listening to calls to summarise key points. In Agent Assist – or ‘conversational guidance’, it is also retrieving and analysing previous data, so that, as with use cases such as auto coaching, it can make suggestions and guide processes during the customer interaction. It is, in effect, accessing and presenting the corporate memory that customers expect, but with bells on as it is also providing direction to the agent.

Key Benefits of Agent Assist: Assess customer needs

From the outset, the AI can help an agent understand what type of call they’re dealing with. Is this a customer with a quick query who is in a hurry, so it needs to be efficient, or do they have more complex needs that need to be addressed? Or even, is there an opportunity to cross- or up-sell to this customer?

Not only does this help to direct the nature of the call, it has an obvious impact on how the brand is perceived and even on topline revenue if it is possible to make a sale. Equally, it can prevent a clumsy attempt at a sale at the wrong moment, which could denude rather than enhance customer lifetime value.

This is also a key consideration in the push to self-serve, as customer experience becomes less personal and less represented by the people of the organisation. While a poor customer experience on a call can erode brand value, a great one can build far more than pure self-serve experiences.

Lower cognitive overload

In the context of agents needing to take more calls that are more complex, fatigue and cognitive overload is real. So while the last 15 years have been about focusing more on natural conversations and active listening, in a high-pressure, high-volume environment, doing that on every call is intense.

Of course, some agents may enjoy the need to think on their feet more than others, and therefore may be the ones who are trickier when it comes to adoption, but there are times when we all need a break from the mental strain of 100% concentration.

Optimise handling time

Agent assist can help to optimise handling time by keeping the agent on track, and reducing the amount of time spent unnecessarily building rapport. Of course some rapport is good, but if overdone, it can be confusing for the customer and result in repeat calls to resolve their actual query, rather than have a nice chat.

Accelerating the development of new starters

Dynamic conversational guidance allows new starters or less experienced agents to fly solo faster. They need to refer less to their supervisors for guidance (which in itself interrupts the flow of the call) and build confidence more quickly.

All of which translates to an increase in customer satisfaction from the use of corporate memory to deliver a better experience and faster call handling with responses that are right first time.

Implementation Considerations: Agent behaviour change

Aside from non-negotiables, such as good data (an absolute pre-requisite here) and systems integration, a key consideration for Agent Assist is to understand that it requires a much greater change in agent behaviour than the uses cases to date. Because you are in effect re-engineering conversations. So while it can accelerate the performance of a new starter, a longer tenured agent may be more ‘stuck in their ways’.

That means it typically takes 8 to 16 weeks to realise all the benefits of agent assist, possibly more if everyone is remote rather than office based. However, a two-to-four-month window to embed such change is both a really short time in the grand scheme of things and a small price to pay for the benefits available. Even considering that there will be a degree of things being a little slower in the first instance as you go through the J-curve of implementation.

However, almost all those aiming to realise AI benefits are jumping straight to this use case. Whereas they could prove the case for AI on much quicker and easier wins that are less likely to fail. What’s more, if those use cases have been implemented first, they lay the foundations for agent assist, and make both implementation and adoption easier and faster too. Without having proved the case for AI to the humans in the equation, adoption is slower, if accepted at all, and the benefits won’t come.

Knowledge base quality

Secondly, jumping too quickly to pure LLM Agent Assist and simply connecting to a knowledge base of historic conversations, then presenting information based on that alone as guidance, is a dangerous place to be. Because that assumes that all previous conversations were exactly as you wanted them, and not littered with the conversations of poorly trained or poor performing agents. Mojo’s advice here is to use the LLM to read in your script and build out the flow for that script and the associated dynamic pop ups. And it is essential that the knowledge base is part of continuous improvement too.

Measuring Success

There are some obvious key metrics that will be impacted by Agent Assist, from AHT and FCR to CSAT. More broadly, agent progression and job satisfaction can be measured through agent feedback, and customer lifetime value through customer analytics.

In summary, the key benefits are:

-

Increased agent satisfaction through reduced stress and increased performance

-

Increased customer satisfaction through faster and more accurate call handling

-

Reduced average handling time through more pointed conversations

-

Increased FCR through more accurate assessment and solutions

-

Improve opportunity spotting for x-sell and up-sell and guide to a sale

-

Improved customer lifetime value (CLV/LTV)

Done well, Agent Assist tools can enhance the capabilities of contact centre agents through intelligent support that enables agents to navigate complex queries or attempt to make sales with confidence. Which leads to more effective and satisfying customer interactions, greater customer lifetime value and even the potential to shift mindset from the contact centre as a cost centre to a value-driving profit centre.

To find out more about how CCP can help you make the right technology choices, read more here or get in touch.

This series of articles is drawn from our webinar with Jimmy Hosang, CEO and co-founder at Mojo CX. We explored seven key use cases for AI in contact centres, starting from the easiest productivity gains to value generating applications. You can find a summary of all seven use cases here, or watch the webinar in full here.

Moving up the value chain of AI use cases, consistent and effective agent coaching is a vital to the performance of contact centres. From areas that are critical to risk management, such as in regulatory compliance, or value-driving in improving customer experience and brand perception.

Traditionally, coaching relies on the same small samples and manual evaluations as QA (per use case 2), which inevitably means observations are sporadic and opportunities for improvement missed.

What is the AI doing in Auto Coaching?

Auto Coaching harnesses artificial intelligence to analyse agent interactions. It ‘listens’ to the conversation to identify areas of strength and opportunities for development. These data-driven insights then inform an AI-generated, individual agent coaching plan. Providing their coach with the tools to cater to individual agent needs and foster continuous improvement.

Key benefits: Efficiency

When you consider that 60-80% of a team leaders’ time is spent gathering information (Mojo time and motion studies) from the likes of Excel or Power BI to knit together a story of performance – to bring together call data, performance stats and behavioural insights into one place – and deliver coaching sessions, it’s easy to see the benefit of AI taking on this task.

Not just in efficiency, where it is possible to shift from a 1:12 or 1:15 manager to agent ratio to closer to 1:18 without losing effectiveness, but increasing team leader job satisfaction. Where they feel that more of the work they do is making a difference. As with previous use cases, how you take this efficiency benefit is a choice. Either in headcount reduction, or in delivering more coaching – which in turn drives customer experience improvement, or redeploying resources to more strategic tasks elsewhere.

Coaching quality and consistency

What’s more, each coaching conversation will itself improve in quality, because the feedback is based on and prioritised by a much greater data sample both for individual agents and the agent population as a whole. It also ensures agents receive consistency in their feedback, not just in one-to-one manager/agent relationships, but again all managers across the whole contact centre are delivering the same messages on the same coaching points to improve the quality of interactions overall. Which means opportunities are no longer missed, and the opportunity cost diminishes, while also improving customer experience.

An example of this, particularly when integrated with other speech analytics and the QA scorecard of use case 2, could be for offshore contact centres, where the agents speak the language of their customers, but colloquialisms, dialect, accent, vocabulary, fluency, speech pacing or cultural differences result in misunderstandings or frustrations.

Personalised rapid development

With AI in the mix, you no longer need to wait to deliver coaching on specific issues. Or hope that you’ve picked up the key ones from the samples you have when reviewing manually, because the AI is dedicated to finding them on a daily basis. Meaning coaching points for individual agents can also be delivered in real-time, or near-real time depending upon implementation.

The consequence of this targeted, personalised rapid development is that team leaders are able to have the right coaching conversation in the right moment – or even that the agent can ‘self-coach’. Coaching becomes both more efficient and more effective. Agents develop more rapidly, picking up development points as they occur, not days later when it’s easier to have forgotten it (or perpetuated bad habits) and in bite sized pieces, making the feedback more digestible and memorable. Their job satisfaction is improved though faster progression and the business wins through better customer service, better selling or more impactful risk management.

Automated role play

A further step in the development of this use case is the potential for AI to synthesise customer calls for training at varying levels of complexity. Either to pick up systemic issues within the whole operation, or to pick up specific agent needs on the job, or as part of the grad bay, which can then itself also be automated in the analysis and scoring of agent responses, per use case 2.

Here we see real driving both efficiency and effectiveness throughout the contact centre. And again, by providing agents with confidence in a safe environment, other KPIs such as attrition can be positively impacted.

Implementation Considerations

As with all other AI use cases, integrations and data privacy are key considerations. But in this case, it’s important to consider your accuracy thresholds for the AI, and how you will test for accuracy so that team leaders are confident in the AI’s ability to deliver. Furthermore, you will need to educate team leaders and agents on how to use AI-generated feedback. Always think ‘Human-in-the-loop’ (HITL) to ensure coaching is still accompanied by all of the empathy necessary to make it successful.

Measuring Success

For this use case, consider monitoring agent metrics such as first-contact resolution, number of coaching points and CSAT as a measure of coaching effectiveness on a one-to-one basis, measures of coaching preparation time or manager/agent ratios as measures of effectiveness. Then more broadly consider agent retention rates as a measure of higher satisfaction and reduced turnover.

In summary, the key benefits are:

• Significant reduction of the 60-80% of time leader spent preparing coaching

• Shift of manager/agent ratio from c. 1:12 to 1:18

• Higher job satisfaction and reduced attrition among agents

• Higher job satisfaction among team leaders

• Improved CSAT and brand perceptions as service improves across the board

As we move up the value-chain, the AI does get more difficult to implement. However the payoff also tends to get bigger too. Auto Coaching can be considered a strategic investment in agent development, to foster a culture of continuous improvement, that leads to enhanced performance and customer satisfaction.

To find out more about how CCP can help you make the right technology choices, read more here or get in touch.

This series of articles is drawn from our webinar with Jimmy Hosang, CEO and co-founder at Mojo CX. We explored seven key use cases for AI in contact centres, starting from the easiest productivity gains to value generating applications. You can find a summary of all seven use cases here, or watch the webinar in full here.

To explore why, I spoke with three top-class BPO and Jamaica experts, each of whom brings their unique perspective, from testing multiple outsourcing destinations around the world to Jamaican nationals deeply engaged in the country’s thriving BPO ecosystem.

According to Brad Meiller of Spectrum Brands, who has over a decade of client-side global outsourcing experience from in both retail and telecommunications, and whose philosophy is closely aligned with CCP’s own, while cost and service quality matter, it’s cultural alignment that often makes the biggest difference. And in his view, Jamaica ticks all the right boxes.

1. English-Speaking Advantage

As a native English-speaking country with strong cultural ties to the UK and US, communication is seamless, nuanced, and naturally aligned with Western service expectations. This fluency translates to higher first-call resolution rates and empathetic customer service experiences. And it’s not just language. Jamaican agents bring tone, warmth and cultural familiarity to the table too.

Jamaica is the third-largest English-speaking nation in the Western Hemisphere, and its accent is well-received by British customers.

2. Infrastructure & BPO Ecosystem

Jamaica’s government has invested heavily in digital infrastructure and the BPO sector, recognising it as a key pillar of economic growth. The island now boasts multiple outsourcing hubs in cities like Kingston, Montego Bay, and Portmore, all supported by reliable high-speed internet, business parks, and international flight access.

Connectivity is robust and reliable, with redundant data centres in locations such as Miami ensuring business continuity. The country also hosts two incubators, 220 seats in Montego Bay and 140 in Kingston. This provides scalable options for both startups and growing teams.

Modern network infrastructure, including low-latency fibre and support from the Universal Service Fund, gives Jamaica the capacity to meet UK standards. Ongoing developments like Starlink’s entry to the market continue to strengthen Jamaica’s digital resilience.

Big names like Concentrix, Teleperformance, Sutherland and Alorica already operate successfully on the island, proof that Jamaica can handle high-scale, high-performance outsourcing operations. And with global success stories like Amazon, Netflix, and Target leveraging Jamaican talent, the island’s credentials are hard to ignore.

3. Strategic Time Zone Alignment

Many BPOs in Jamaica provide 24/7 coverage, with service hours tailored to key markets including the UK. For UK businesses, Jamaica’s location also supports efficient logistics. Direct flights from Kingston and Montego Bay to London, Manchester, and Birmingham make it one of the most accessible Caribbean destinations. And with such a solid telecoms infrastructure , remote work is also a viable staffing option, particularly useful for late-night or flexible coverage.

4. Talent Pool & Education

With a literacy rate above 88% and a large youth population, Jamaica is producing thousands of skilled graduates annually, many of whom are turning to the BPO industry for stable careers. Institutions like the University of the West Indies and local vocational programmes are directly feeding the outsourcing workforce, with a strong focus on service, IT, and administrative support.

There is also strong industry-academia alignment. The Global Services Association of Jamaica works hand-in-hand with universities and training programmes to ensure the labour force is future-ready. And not just for entry-level roles, but for higher-value positions in areas like IT development, integrations, and knowledge-based work.

Jamaican education initiatives such as the HEART/NSTA Trust program provide training across a range of skills such as language communication, sales, data entry, CRM, and IT, ensuring a steady flow of qualified professionals.

5. Competitive Costs with Cultural Fit

While Jamaica may not always be the cheapest, it offers incredible value-for-money when you factor in native English fluency, low agent attrition, cultural compatibility, and a growing pool of trained talent.

At time of writing, the exchange rate between the British Pound (GBP) and Jamaican Dollar (JDM) remains competitive, as highlighted in recent research by Peter Ryan Strategic Advisory, a leading market research and consulting firm focused on CX and BPO.

Critically, the service offering goes beyond standard customer service. Jamaican providers cover front- and back-office functions, including sales, debt collection, IT support, and more.

Importantly, Jamaica is no longer viewed solely as a destination for transactional CX work. It’s now recognised for complex support roles, higher agent touchpoints, and knowledge process outsourcing (KPO) – including finance and accounting services aligned with UK qualification standards.

6. Government Support & Incentives

With special economic zones (SEZs), tax incentives, and strong partnerships with international investors, the Jamaican government has rolled out the red carpet for global businesses. Whether you’re setting up from scratch or partnering with an existing provider, the regulatory environment is built for speed and scalability.

The country’s legal system is modelled closely on the UK’s, providing familiarity and confidence for British and Commonwealth investors. The same is true of its education system, which mirrors the UK structure and standards.

Jamaica’s 2023 Data Protection Act aligns the country’s data policies with international standards, making it suitable for regulated industries like banking, healthcare, insurance, and utilities.

During the April 2025 Outsource2Jamaica event we attended, the government’s commitment was front and centre – Jamaican Prime Minister Andrew Holness personally welcomed international guests and industry speakers, underscoring the strategic importance of the sector.

As Gloria Henry of the Port Authority of Jamaica and Conrad Robinson of the Jamaica Promotions Corporation (JAMPRO) – both are helping position Jamaica not just as a viable outsourcing option, but as a strategic hub for global service delivery – explained, Jamaica isn’t just promoting itself, it’s backing up its vision with significant public investment. Over $15 million has already been invested into talent development through global training programmes.

JAMPRO also offers “concierge-style” support to businesses entering the Jamaican market, further streamlining the setup and integration process for UK firms.

Final Thoughts

Jamaica is a smart, scalable, and soulful choice for businesses looking to outsource. With its blend of cultural alignment, language fluency, government backing, and operational maturity, Jamaica stands out as a trusted and future-ready BPO partner for UK businesses, particularly for those seeking alternatives to traditional offshore delivery points.

And as Brad Meiller shared with me, BPO selection processes across global organisations often involve extensive RFPs and a lot of box-ticking. Thanks to the strengths outlined above, Jamaican BPOs make that box-ticking exercise remarkably straightforward.

Want to find out more or meet vetted providers in Jamaica? Drop us a line, we’re happy to help you explore your options.

With thanks for their insights to Brad, Peter, Gloria, Conrad and CCP’s Phil Kitchen, who all attended the Outsource2Jamaica event in April 2025.

Summarising calls takes time – anywhere from 10-30% of the call. And agents are almost always under pressure to get the task completed in as little time as is humanly possible to meet AHT and wait targets. This often translates to errors or even missing data. Which not only makes it hard for future agents to follow the story, it can be a regulatory challenge too.

AI-driven autowrap and summarisation tools are helping to alleviate this burden by automating the process, allowing businesses to cut handling times and improve CRM accuracy. According to Jimmy, it’s one of the easiest applications of AI a contact centre can implement.

What is the AI doing in autowrap?

Autowrap and summarisation technology uses natural language processing (NLP) and machine learning to transcribe customer calls in real time. As calls progress, key details such as issues raised, resolutions, and next steps are captured automatically. This eliminates the need for agents to manually document call details, both reducing errors and freeing up time for more customer-centric tasks.

Key Benefits: Time and Cost Savings

By reducing the time spent on manual transcription, businesses can lower wrap times by 50%, which translates to reducing handling times by 5-15%. For a contact centre with 200 agents, taking the mid-point of 10%, this could result in a reduction of up to 20 FTEs, and delivering a 2-3X ROI from day one.

How you take this benefit is then your choice:

a) A productivity gain, even through natural attrition

b) A service improvement by reducing wait times or improving service, with longer call times to allow for better first contact resolution

c) Reinvest in more value driving AI use cases to build maturity

Call Summary Accuracy

With manual transcription, there is always the risk of errors or omissions. AI-driven solutions eliminate these risks by automatically capturing the most relevant data from each conversation, improving both the consistency and quality of CRM records.

Increased accuracy has a number of benefits, whether you run a regulated business or not. First is in future contacts, whether you met a first contact resolution goal or not. Any future calls where a customer refers to a previous call – and reasonably expects there to be some level of ‘corporate memory’ – can be shortened by avoid any lengthy re-explanations of what has gone before. Not only does this provide a future productivity gain, it makes for a far better customer experience too. So even at use case 1, we are already facilitating value generation through slick customer processes that avoid typical customer frustrations, as well as productivity.

What’s more, the data is clean, reliable and available for future analysis and QA. Look out for an article on use case 2, Auto QA, for more on that subject.

When building a business case, these are important considerations; it’s important to remember that your baseline probably isn’t perfection. And so your quality uplift may be greater than you have otherwise anticipated.

Easy Integration: No Overhaul Required

While it is undeniably desirable to integrate Autowrap technology into CRM or policy admin systems, it’s not a pre-requisite to start making these gains. An agent – dubbed the ultimate API in our recent whitepaper– can easily check through the summary, make any necessary amendments if you require it (your benchmark of what is good enough will depend on your business) and copy and paste it in. They’re already used to connecting disparate systems and will be working where you want to capture it anyway.

This means that businesses can buck the trend of AI project failure and quickly adopt the technology with minimal disruption to existing workflows. Once the ‘short, sharp’ solution is working, of course you can consider and implement the deep integrations to automate the task, but you will be most of the way there without it.

Enhancing Agent Experience and Customer Outcomes

As alluded to earlier, the benefits aren’t just about reducing operational costs—they also enhance both the agent and customer experience. By automating mundane, and often poorly executed tasks like call transcription, agents are free to focus on more valuable work, such as problem-solving and building customer relationships.

This not only boosts job satisfaction – which in itself may then also translate to tenure, sickness and recruitment gains – it also contributes to higher-quality customer interactions. Look out for use case 5, ‘Agent Assist’ for more on this topic.

Measuring Success

For any AI implementation, it’s important to measure its success as this will build the case for future implementations. Whether that’s headcount, resource allocation or the gamut of other contact centre KPIs.

In summary, the benefits are:

1. Immediate productivity gains of c. 10% of agent all handling time

2. Improved accuracy of note taking

3. Customer satisfaction gains from better corporate memory and more attentive agents

4. More time available for valuable conversations

5. Employee satisfaction gains – happier agents, longer tenures, less sickness, reduced recruitment

6. Regulatory compliance improvements

7. Easy and scalable implementation to shorten implementation timescales and increase AI success

8. Ability to re-invest gains in building AI maturity

Ultimately, accurate (enough) autowrap is an obvious win in any contact centre.

To find out more about how CCP can help you make the right technology choices, read more here or get in touch.

This series of articles is drawn from our webinar with Jimmy Hosang, CEO and co-founder at Mojo CX. We explored seven key use cases for AI in contact centres, starting from the easiest productivity gains to value generating applications. You can find a summary of all seven use cases here, or watch the webinar in full here.