Outbound contact centres still play a vital role in sales and customer engagement, but are they truly performing at their best? Key performance indicators (KPIs) provide a framework for success, yet the real question is: Are your managers equipped to interpret and act on them effectively?

Are KPIs Being Used to Drive Improvement?

- Call Pickup Rate – Low pickup rates may indicate poor dialling strategies or incorrect customer data. Are managers addressing these issues to improve connection rates?

- Average Call Duration – Longer calls may suggest engagement or inefficiencies. Do managers have the available insight to help distinguish between productive interactions and wasted time?

- Average Handling Time (AHT) – Balancing efficiency with quality is crucial. Are managers optimising processes to reduce delays without compromising service?

- Answering Machine Detection Rate – High voicemail rates waste agent time. Are contact centres adjusting their approach to minimise this?

- Rejection Rate – A high volume of unanswered calls may point to poor targeting or dialling strategies. Are managers refining their approach based on this data?

- Agent Wait Time Between Calls – Excessive downtime signals inefficiency. Are workflows optimised to keep agents engaged and productive?

- Conversion Rate – Success is measured by call outcomes. Are managers analysing why some calls convert while others fail, and adjusting strategies accordingly?

- Occupancy Rate – Are agents being overworked, leading to burnout, or underutilised, resulting in wasted resources? Do managers have the right data and leadership skills to balance their team members’ workloads effectively?

- Data Accuracy – Poor data leads to inefficiencies and failed connections. Are managers ensuring databases remain up to date?

- Right Party Contact Rate – If agents aren’t reaching the intended recipients, performance suffers. Are managers taking steps to improve contact accuracy?

- Customer Satisfaction Score (CSAT) – A positive customer experience is essential. Are managers prioritising training to enhance service quality?

Are Managers Equipped to Act on These KPIs?

Having KPIs is one thing—using them effectively is another. Many contact centres face challenges such as:

- Lack of real-time performance insights.

- Insufficient training for managers to interpret and act on KPI trends.

- Inefficient processes that fail to align with data-driven improvements.

- Gaps in technology preventing optimal call routing and workflow automation.

The Bottom Line: Data-Driven Success Requires Action

Outbound contact centres may track the right KPIs, but without effective leadership, performance will suffer. Are managers investing in the right tools, training, and strategies to ensure their teams operate at peak efficiency? The data is available—are they making the most of it?

There are several universal truths, one of which is that we all have at least one subscription! Though I think that if we were asked to list all the things we pay a monthly or annual fee for we would probably come across some we’d forgotten about. We questioned how many subscriptions we have that you may not feel we’re getting value from?

Another consideration is that even if we’ve not been using our Netflix, Disney+, AppleTV, or whichever service one as much as we’d like, we may be holding onto the knowledge that we will likely binge some boxsets over the festive period and how many of us then realise we are all subscribed to Amazon Prime and other subscriptions may have been unnecessary.

A third is that we are often encouraged to review our discretionary expenditure in January and cancel any that we don’t need or to look for a better deal.

It is always good to speak with experts in a field to understand how these elements all play out, Jonathan West is Client Development Director at Step Change Outsourcing and knows only too well the first-hand challenges of a subscription-based business model having led the Sky Business Division as National Sales Manager and Head of Indirect (Consumer) Channel at Three. Simon Kissane is highly experienced in delivering CX and Contact Centre Performance Improvement having supported a number of interim positions and extensive experience as a Head of CX and Operations in the mobile and broadband space.

What does the data tell us?

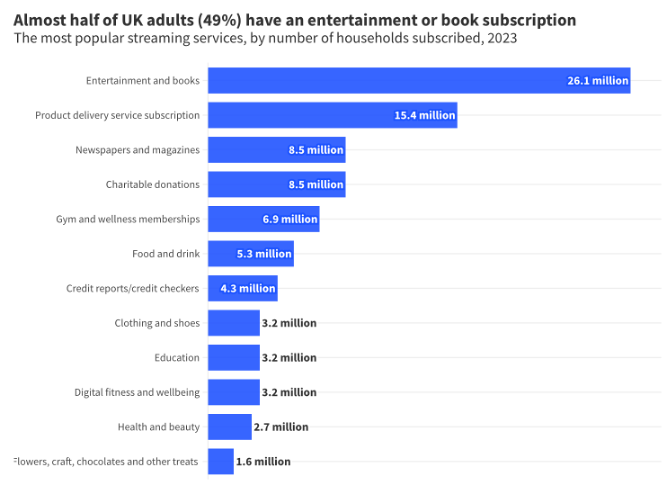

Data from Barclaycard in 2020, Whistl in 2022 and from Statista suggest that on average a UK household has 8 subscriptions ranging from streaming services to food kits, healthcare and pet products.

Finder.com suggests 2023 research shows 79% of UK adults (42 million of us) have at least one subscription service. However 23% of us feel these services are too expensive and 51% would be willing to cut that subscription to save money. Some research data which claims that we are spending an average of £500 each annually seems to focus on streaming services.

Further subscriptions which saw significant growth during the pandemic were the subscription box services. Whistl report an 18.9% year on year growth in in in the UK in their reports and referencing data from the Royal Mail in stating the market will be worth £1.8bn in 2025.

Whilst a little dated, the Whistl report shares some insights around key metrics for subscription boxes, their data suggests,

- 81% of households have at least one box subscription

- average spend of £52 per month in 2021 with annual spend to £620

Those subscriptions typically last 9 months

- 40% of us subscribe for convenience and 55% to save time

- 74% wish that companies made it easier to manage subscriptions

“how likely they would be to cancel their subscriptions if they were to increase slightly in price”

Clearly the different types of subscription are driven by differing motivations. Time and convenience are a key element, howeverthe value of the subscription is a vital consideration, too.

Data from the Department for Business & Trade, published in April 2023 (based on research with 2,000 UK adults conducted by Opinium Research in November 2021) showed the following level of subscription holdings:

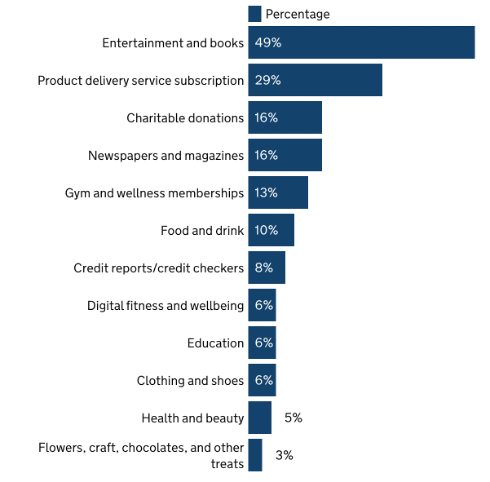

Respondents were asked the critical question as to their expected behaviour if prices were to increase and unsurprisingly, they were more likely to consider cancellation as listed below by subscription type (key sectors):

- 79% Food & Drink

- 76% Digital fitness and wellbeing

- 73% Health and beauty

- 66% Flowers, craft, chocolates and treats

- 64% Entertainment and books

- 64% Product delivery services

- 38% Charitable donations

Subscriptions to telephone and broadband services don’t seem to appear in the data. Perhaps they have ‘crossed the line’ into the utilities space? Digital connectivity may have become a physiological need, in the words of Maslow even. This seems fair considering that we all need data connectivity to live our day to day lives today.

But if we consider for a moment the broadband and fixed landline space, the regulator Ofcom has been busy making changes in the past few months that could impact the sector. On this basis, have sensitivities around price and service ever been so important to that sector – and are there considerations that can be applied across all subscription markets?

So, what does that mean to the customer contact community?

Well, there is a chance that a broken process earlier in the year – which made your contact centre hard to deal with – is going to result in customer retention issues when that customer reaches the end of their contract.

Or that automation process that you are thinking of implementing due to pressure from the business to reduce operational costs needs to be just right, or else it may result in driving customers not only to self-service, but away from your business altogether.

It could mean that you have an amount of retention work to do, or that you need to start thinking about additional marketing spend next year to attract new customers to maintain your numbers, never mind growing the customer base.

For many customers managing, their relationships digitally – like with NOW TV, for instance – should be easy. But my personal experience of trying to cancel a NOW subscription over the weekend was time-consuming and frustrating:

- Cancellation was not possible via the App which means logging onto my account,

- then being asked no fewer than 6 times whether I really wanted to cancel,

- and being presented with offers and discounts to retain me.

This feels like an example of when an understandable business desire to create a bit of friction has gone too far, turning off customers from coming back in the future.

However, the first that businesses with digital based relationships may know of my intent to cancel is when I’ve clicked on a box and my money stops the following month. Many will then commence an e-mail campaign, or outbound calling perhaps, to ‘win-back’.

One touch switching

The implementation of the Ofcom rules on one touch switching from September 12th enabled customers to move to a new provider with just one contact. This means that alternative network providers (alt-nets) – despite huge investment in their infrastructure – are now in a place where customers can simply walk away without having to contact them, similar to my cancellation of my NOW TV subscription.

The new provider manages the switching process and the incumbent has little option but to go with it. Are the developing the expectations that customers will have about the ease of cancelling their telco and broadband subscriptions being mirrored across other services?

Additional considerations

In our discussion, Simon, Jonathan and I also considered whether there is a clear role for NPS in customer retention and operational performance. This was a topic which was discussed also on a Scorebuddy webinar that I supported, recently. With the level of insight available from the contact centre, do you really still need to ask the question around likelihood to recommend a product or/service? It could be that you can see this through all the other data and insights at your disposal. However, you need to ensure that you have the time and knowledge to implement the changes needed, which is where businesses can fall short.

“CX has never been so important, moments of truth matter and there is a need for experience and empathy”

When it comes to growing any form of subscription business, there is a clear need to balance acquisition with the realities of ongoing customer service. The work of retention and win-back teams should not be underestimated, but if you get the customer service right then retention is less likely to be needed.

Scaling a business to cope with customer demands can be challenging. The transition from small in-house operations with wider departments helping where they can in supporting customer needs in those moments of truth (when something hasn’t been delivered as promised) can take people away from their roles in the wider business and risk future growth ambitions. Where customers have bought/subscribed via a click then the first time your team speak with them could be at the point of disconnection and considering the costs of developing your business or network, there is a need to maximise customer lifetime value.

When growing a business and a contact centre team, you need to ensure that you are properly supporting and developing your staff. As businesses grow it is not just customers numbers where retention may become a challenge. With Simon and Jonathan I discussed these challenges around recruitment and training, this is where we have seen outsourcers taking the load, so that “you do you and let the outsourcer do the heavy lifting”.

Is your customer contact approach fit for purpose?

With the potential challenges of growth and increasing costs in 2025 from minimum wage and national insurance increases ahead, maybe it is time to review where you are on your journey and whether there are opportunities to optimise current operations – through either process review or implementation of new contact centre technology?

Perhaps you’ve reached a point where you need additional support from an outsource partner who has walked this path before and can help you grow customer numbers and/or evolve to the next stage of your growth, whether that is with

- acquisition activity

- out of hours support,

- peak capacity or

- end to end customer service which allows you to focus on your core activity and growing your business.

You may have an existing operation that requires review, but whatever your customer contact challenge feel free to contact us so we can talk it through.

At Customer Contact Panel we have extensive experience in supporting our clients in identifying the right fit solution for their business.

I often think that managing your contact centre performance on a day-to-day basis is like standing on a sandy beach watching the waves come in. Without fail going in, out and always, always, dependent on the weather. Sometimes it’s so monotonous you can drift off in the sun, waves lapping at your feet, then suddenly find you’re floating. Then there are those grey stormy days when it feels like we are going to drown, freezing from head to toe, no wetsuit, now fleecy towel.

So, what should be the first thing in the ‘beach bag’ to make sure we don’t drift off in the sun and don’t freeze our bits off when it gets stormy? The answer – Something that shows us our quality of performance, whatever the weather. Quality is the one baseline that we can use, whatever the weather. Properly defined, it can be our deckchair, sunshade as well as our wetsuit and fleecy towel. Get ‘quality’ right and there is no sunburn, no more shivering, chilled to the bone.

Technology should be looking at everything we do

In a contact centre technology world now dominated by AI and multiple customer engagement channels, it’s essential that whatever we use to measure quality is looking at everything we do, all of the time. It’s also desirable that whatever we deploy to help us understand and manage quality can help us perform to the best of our potential and make the very most of the people we have at our disposal.

Whether those people are internal or outsourced, it’s our day to day / hour to hour performance that drives us, whatever our resourcing model, however performance is defined. In simple terms, performance is always a multifaceted measure, made up of different time and process-based outcomes delivered to our desktop by the tech’ that enables our everyday customer engagement. Think of those performance outcomes as the ‘what’, then quality is all about the ‘how’. Keeping track of ‘how’ effectively provides us with the tram lines of what is acceptable / not acceptable to the customer and defines the boundaries of what is ‘on brand’ and what is not.

Look at easy-to-deploy applications

Keeping performance ‘on brand’ is something that contact centre managers (inhouse or out of house) have high on their ‘to do’ lists, whatever the beach, whatever the weather. And in our experience, quality is the one area where we see AI driven applications having an immediate benefit. Easy to deploy on a SAS model with usage-based costing models available, these applications can watch every wave, every temperature and air pressure change. Providing you with an early heads up to get off the deck chair and start putting on your wet suite.

Certainly, nailing quality monitoring is the smartest way I can think of as an entry point to deploying an AI strategy. Whilst the landscape may look confused, given that all vendors say the same thing, what we know is that the ‘best in class’ applications are easy to deploy (with ‘out of the box’ CRM / CCaaS integrations) giving you immediate insight and potentially freeing up valuable resources. We have even seen applications providing individual coaching programmes to save additional time and effort for your managers and training teams.

It worked in the 80’s

All of this somehow reminds me of that Bananarama song…. “It ain’t what you do, it’s the way that you do it”. For those of you who are much too young to remember, Bananarama are an English female pop band who have had success on the pop and dance charts since 1982. Rather than relying on harmony, the band generally sings in unison, as do their background vocalists. Although there have been line-up changes, the group enjoyed most success as a trio made up of lifelong friends. In the 1980s, Bananarama were listed in the Guinness World Records as the all female group with the most chart entries in the world, a record which they still hold.

If quality is a record that your organisation wants to hold, then get in touch. Let us help you with your AI conversation and provide some additional insight on what’s out there in the world of tech’ so you can have a relaxing time on the beach!!!

Article 2 of 3

Insurers have long since leveraged data and analytics to gain actionable insights and drive operational improvements. After all, data is at the heart of underwriting, pricing and claims management. Advanced analytical techniques are being increasingly used to analyse large volumes of data, identify patterns, and optimise processes. Insurers are employing predictive analytics and AI for claims forecasting, fraud detection, and risk assessment, allowing them to make data-driven decisions and streamline operations. These run hand in hand with the operation itself and it’s critical the teams work closely together, especially when outsourcing is involved. Insurers are gaining strategic advantage in several ways. Here are some examples:

1. Enhanced Risk Assessment

By leveraging vast amounts of structured and unstructured data, insurers can refine their risk assessment processes. Advanced analytics and AI models analyse historical data, market trends, customer behaviours and external factors to improve risk prediction and pricing accuracy. This enables them to identify profitable segments, develop targeted products, and optimise underwriting decisions.

Insurers rarely let go of this core competence and fully outsource, so if the demand surfaces, it’s likely to be augmenting rather than replacing the mother ship’s in-house capability.

2. Fraud Detection and Prevention

Insurers are employing data analytics and AI algorithms to detect and prevent fraudulent activities. By analysing data patterns and anomalies, insurers can identify suspicious claims, behaviours or patterns that indicate potential fraud. Advanced fraud detection models help insurers mitigate financial losses, improve operational efficiency, and protect honest policyholders from inflated premiums.

Typically, outsourcers work across industry verticals and so bring a distinct advantage in terms of sharing learnings from one business sector to another.

3. Personalised Customer Experiences

By analysing customer data, insurers are gaining insights into individual preferences, behaviours and risk profiles, allowing them to tailor products, pricing, and services to specific customer segments. This level of personalisation enhances customer satisfaction, improves retention rates (increasingly important after the pricing reforms) and drives customer loyalty.

In an industry challenged with differentiation beyond brand recognition and price, personalisation is ever more important to the policy holder.

4. Process Optimisation

Of course, the need to identify and eliminate inefficiencies, reduce waste, and enhance operational performance doesn’t go away just because you enhance your technical capabilities elsewhere. Techniques such as Lean Six Sigma continue to be used to analyse processes, identify bottlenecks, and implement improvements. Reengineering processes to simplify and automate workflows, reducing cycle times and enhancing overall operational effectiveness will continue.

Through the use of process mining (we rate this software highly) and analysis, insurers can identify bottlenecks, eliminate inefficiencies, and create a pipeline of opportunities, driven by date, primed for automation.

If you would like to discuss further the challenges in the Insurance sector, the benefits of data analytics, AI and insights or generally about any of the points raised, feel free to contact us hello@contactcentrepanel.com

Watch out for the next article in the series considering the impact of Talent Management and Skills Gaps.

However, what we sometimes lose sight of, is that some of these numbers are people. Real people with hopes, fears and challenges that we can help with.

Let’s meet Carol. She is a 38-year-old married mum of two who lives in the Midlands and has worked for a number of years as a supervisor at a local office. She’s been there some time and is well paid for her work. She has two kids in school and her husband works at the local food factory. Carol and her family have lived in their house for a little over 10 years and everyone is settled and happy.

Doing the weekly shop, Carol notices that the price has started to go up. Her gas and electric monthly payments have increased by 50% a month and her petrol bills have also increased. They continue to make ends meet, even with the prices rising until one day disaster happens.

Carol’s husband, Mike, is made redundant from his job. As he’s been there 4 years, he receives a pay-out, but it won’t last too long. Unfortunately, Carol earns too much to be eligible for any additional support from the Government.

Carol is now in a place she’s never been in. Worried about paying the bills, Mike’s looking for work and the kids are wanting to go on holiday.

Whilst this is an example, it’s all too frequently happening to our consumers, customers and neighbours. As leaders, policy setters and influential people, we need to be asking ourselves, are we doing enough for the Carols and Mikes?

If Mike or Carol reach out, do we have the right training and support for our customer service people to ask the right questions and provide the right advice and assistance? Do we, or should we, have dedicated teams who are trained to handle those more detailed conversations when they are needed?

Does our website or app provide clear direction and signposting for the customers’ options? Are we making it as easy as possible for Carol or Mike to engage with us, in what is, in their eyes, a scary and embarrassing conversation?

If Mike or Carol aren’t engaging with us, are we going above and beyond to promote engagement and support, or are we blindly following the same old process?

We all have business pressures on costs, budgets and forecasts. By assessing and reviewing what you have, re-purposing existing spends and revising how and what you do, you can be surprised at how much you can support Carol, sometimes at no or very little cost.

Ultimately, what we would all like is for Carol and Mike to have support and an agreed upon plan, at a future date, when Mike is back in work and things are moving in the right direction.

The impact of inflation has been no different for the outsourcing industry, affecting centres and staff alike in many different ways. In this article, I wanted to explore just a few of those impacts and some potential solutions to leverage those pinch points.

Areas affected

- Cost of labour – as inflation rises, so do the wages and benefits that companies need to offer to attract and retain employees. This can impact contact centres that rely on a large workforce of customer service representatives. Higher labour costs can lead to increased overhead, which can ultimately result in higher prices for customers.

- Cost of technology – inflation can also impact the cost of technology and infrastructure. Contact centres require technology and equipment such as telephones, computers and software to support their operations. As the cost of these items rise due to inflation, contact centres may have to invest more money to maintain or upgrade their systems. This can result in higher expenses and potentially reduced profits.

- Cost of training & development – another way inflation can impact contact centres is through the cost of training and development. As the cost of living rises, so does the cost of training and development programs for customer service representatives. Companies may have to spend more money to provide training programmes that are effective in improving the quality of service provided by their employees.

So, what can be done to reduce the burden of inflation in the industry?

Well, whilst a lot rests on national and global financial markets, there are a few things your centre can do to minimise these impacts.

Potential solutions

- Operational efficiency – businesses can almost certainly take stock of how they are performing operationally, cutting any excess ‘fat’ from their operations. However, if not done properly, this could have a detrimental impact to service standards – which may impact sales or third party contracts in the long term.

- Streamlining processes – businesses should review operational processes to ensure they are maximising time and costs per process undertaken. Look at your contact flows and see if there is room for improvement. Can you reduce handling time here, or increase the rate of first contact resolution?

- Implement technology – whilst you may not want to radically move your operations from being people centric to tech first, there are many ways that implementing the right technology can help to reduce operational costs over time. Take multi-lingual customer service for example. Can you look at bringing in translation technology for low volume voice locations, switching to a digital only service for these countries and locations?

- Home and hybrid working – the introduction of new post-pandemic working models has meant that many businesses have been able to reduce office space and associated costs. If your business has kept or returned to the traditional office based model then it may be worth considering.

The good news is that inflation globally is due to come down over the next 12 months. Here in the UK, the Bank of England forecasts inflation to reduce to 4% by the end of 2023 – falling to it’s 2% target shortly after that.

Looking for support to help reduce costs but maintain the highest level of service? Do get in touch, we are here to help.

Today, it’s more important than ever before that enterprises deliver a world-class customer experience for their target audiences. A great CX builds brand loyalty, adding significantly to total customer lifetime value and turning casual customers into word-of-mouth evangelists.

The challenge is that many businesses still struggle to make effective use of their data to help them understand their customers and deliver a highly personalised, interactive experience based on that knowledge.

Earlier this year, analyst firm Corinium Intelligence surveyed data-focused executives from 100 global enterprises about their efforts to create world-class digital customer experiences. The resulting report, entitled How Data is Driving Next Generation Customer Experiences, revealed the top challenges facing global CX brand managers and how the world’s most innovative business leaders are working to overcome them.

Here’s a summary of some of the key findings from that report.

Macroeconomic Challenges Hamper Efforts to Improve CX

The past several years have been volatile, to say the least. The COVID pandemic had massive implications for the global economy, prompting the closure of many brick-and-mortar stores and accelerating digital transformation and cloud adoption in the retail space.

As companies shift into post-pandemic recovery mode, many of the broader economic challenges that originated during the pandemic persist. Supply chain performance has improved, yet the availability of many products and raw materials remains uncertain. Costs are rising. Many companies find it difficult to hire and retain skilled workers.

As a result, automation and cost savings have been key areas of focus, eclipsing efforts to improve overall CX. The Corinium study found that 79% of global CX leaders viewed cost savings as the highest priority, and 74% were focused on a return to “business as usual” in the wake of the pandemic and its aftermath. Many CX leaders feel as if they are merely treading water, rather than moving forward with initiatives that lend strategic value to their organizations.

Harnessing Data for Next-Gen Customer Experiences

The solution is the intelligent application of data. The Corinium study found that only 37% of organisations surveyed have a well-developed enterprise data architecture capable of supporting high-quality, data-driven, and personalized CX.

The companies surveyed by Corinium rated the quality of their CX at an average of 6.7 out of 10. That means most organisations see plenty of room for improvement. Using data to drive a personalised CX is an obvious winning strategy, but many are still poorly equipped to turn that potential into a reality.

The Corinium report outlined seven key business benefits of a data-driven approach to CX. Better targeting and personalisation capabilities, for example, deliver the right messages to the right people at the right time. When companies communicate relevant, timely information, their messages are simply more likely to get through. A holistic data-driven approach increases conversion rates as well, and it improves the customer journey across multiple channels within a company’s omnichannel landscape.

Data Quality and Data Governance Are Key

The authors of the Corinium report noted that problems with data quality and data governance hamper efforts to move forward aggressively and effectively with key initiatives aimed at improving CX. Data accessibility is the number one barrier to creating data-driven customer experiences. Lack of relevant or current data comes in second place.

Legacy systems and a lack of integration are frequent root causes of these problems. Many organizations also lack the kind of current, high-quality data for enrichment, including mobility and geospatial information that add powerful context alongside existing customer data.

Great CX is dependent on a unified and coherent approach to customer communications, yet 56% of respondents in the Corinium study agreed or strongly agreed that siloed, uncoordinated communications prevent their companies from delivering seamless digital experiences for their customers.

Proactive programs to manage data quality at scale are a necessary precursor to personalised, targeted digital CX. Data governance ensures information can be effectively accessed across the internal organisational boundaries that often stand in the way of effective data access.

CX Investments Are on the Rise

According to the CX leaders who responded to Corinium, most have made significant investments in customer communications over the past two years, or they plan to do so in the near future. The most popular initiatives include text messaging technology, customer relationship management software, and omnichannel communications platforms. Data integrity is also a high priority for top global brands, incorporating enterprise integration to eliminate silos, data quality to ensure accuracy and completeness, and data enrichment to provide richer, more valuable context.

To learn more about trends in customer experience management and next-generation CX, download the full Corinium report today.

The impact of this on already stretched consumer spending budgets could have a knock-on effect by reducing demand for products or services.

Increasing numbers of people are using the ‘safety net’. Research published by StepChange Debt Charity in January estimates that ‘4.4 million people struggling to keep up with household bills and credit commitments borrowed £13 billion to pay bills and make it through to payday’ . The research suggests that ‘65% of those using credit as a safety net have kept up with credit repayments by recently missing housing or utility bills, using more credit or cutting back to the point of hardship’.

Customer debt is a likely challenge to be managed, as 13.2% of households (3.2M) in fuel poverty in 2020 will increase. There will be increasing numbers of vulnerable customers to support through the months ahead, so focus needs to be on ensuring that this is done well, and that processes are effective and appropriate. Agents need to know how to manage vulnerable customers to treat them fairly and with empathy, whilst controlling call durations to minimise operating costs without impacting outcomes. Compliance with FCA regulations is always a requirement but there could be further scrutiny. Additional capacity may be required in your business to support increased collection volumes, so it could be a good time to look to outsourced contact centre support. It will enable your business to gain the capacity that is needed, whilst ensuring the processes are managed most effectively. The right outsourcers will have income and expenditure tools and effective technologies to ease the process for the customers who may have difficulty in talking through their situation.

Those working in the energy collections market have the additional pressure of having to abide by the ruling to never ‘switch off’ customers’ energy even if they are in deep arrears. This puts further emphasis on the operations work these firms will need to do.

Businesses and households alike are facing challenges, perhaps the key is to ensure that there is compassion for how customers in debt are supported through these difficult times, use wider expertise if needed to ensure that they are well supported now and to in turn maximise your success rates using resource and technology. Effective support in harder times also ensures the loyalty of customers in the future so consider it an investment to protect your business now and for better times ahead.

So, at the last minute and just in time for Christmas, the EU and UK agreed a post-transition Brexit trade deal. If you read our article published just a few days before Boris and Ursula settled their fish-based disputes, then you would hope that the deal included the vital EU ‘adequacy’ ruling on UK personal data protection rules. Unfortunately, this was not the case.

The parties have agreed a 4-to-6-month extension to the current arrangements, so personal data can continue to flow between the UK and the EU, but that looks like the final extension.

What does ‘Processing Personal Data’ really mean?

It is a broad definition. ‘Personal data’ is essentially anything that can be used to identify a real, living person and ‘Processing’ covers just about any activity that involves that data. It is not just for the use of communications e.g. making calls, sending emails and messaging on social channels, but analyse, segmentation and even simple data back-up on storage can count as processing.

Implications of a no adequacy ruling

If the EU does not give the UK an ‘adequacy ruling’ then, as stated by the government, the implications for data handling are that UK data being passed to Europe will be covered by existing laws, but if EU data is sent to the UK, it could contravene data privacy regulations. For pan-European operations, this will pose serious new risks.

If the UK’s rules are not considered adequate by the EU, then a raft of new contractual arrangements using Standard Contractual Clauses (SCCs) will be required. According to a report from the New Economics Foundation and UCL European Institute ‘The Cost of Inadequacy’, “the aggregate cost to UK firms would likely be between £1 billion and £1.6 billion”. Most of which would be the cost of commercial legal work to implement the necessary SCCs.

Are you feeling lucky?

So, should you start to worry about this now and give your lawyers a call?

You may well imagine that as the UK uses the EU-wide General Data Protection Regulation (GDPR) as the basis for its data protection rules and the 2018 Data Protection Act, then the European Commission would have no alternative than to grant the UK an ‘adequacy’ ruling. But that is not the case. A large number of data privacy professionals and data right groups argue that the UK does not reflect EU standards in its collection and processing of personal data, especially in the areas of national security and data sharing with other friendly states, so shouldn’t be granted ‘adequacy’. It is worth noting that the European Commission has so far ruled only a small number of countries’ personal data protection to be adequate (Andorra, Argentina, Canada, Faroe Islands, Guernsey, Israel, Isle of Man, Japan, Jersey, New Zealand, Switzerland and Uruguay).

Do not forget the Privacy Shield

In the meantime, if you have clients in the USA or use technology solutions with data centres in the US, there is something else you need to pay attention to. Since 2016 an arrangement agreed between the US government and the EU called the ‘Privacy Shield’ provided a framework for US and EU companies to compliantly transfer personal data across the Atlantic. Last summer the Privacy Shield collapsed when the European Court of Justice ruled it invalid over concerns that US corporations are subject to making personal data available to US Government agencies.

This may seem like old news, but many organisations are only just waking up to the implications of it. For most companies, there is a solution that will allow appropriate personal data transfers to continue, but unfortunately, once again that is likely to be reliant on Standard Contractual Clauses, lawyers and considerable expense.

What to do?

To manage your risks there are two key pieces of advice we can give to all businesses who use private data in any way, whether for outbound sales, customer service or sales order processing:

- Minimise the amount of data you store per contact. The less data you store, the less likely it is to get you in trouble. Avoid storing risky data such as payment details unless absolutely necessary to your business model.

- Minimise the places you hold data. If your data is stored and processed in only one location, the amount of regulation is minimised. Also, the lower number of transfers your data has to undergo, the lower the risk of breaches of privacy, or indeed of your business inadvertently falling foul of the regulations in one region or another.

As a last consideration, check all your IT service providers. Do you really know where your call recordings and network data backups are stored? Identifying where your data is held is essential. If hosted in the cloud then find out where the data servers are located and if your technology provider is unable to provide this information, then your business could be at risk and alternatives should be considered.

If you are unsure how to assess your risks and responsibilities now the UK has left the EU, get in touch. We can advise you about the risks you need to consider and potential ways to mitigate them.

As we head towards the end of December 2020, it is looking increasingly likely that Britain will leave the EU without a deal, or with an “Australia type deal” as described in some parts of the press. Although GDPR has been passed into UK law in the Data Protection Act 2018, leaving the EU without a deal will have some significant implications for how the rules around data privacy will apply in the UK in 2021.

The UK Government’s current stance is that ‘The EU is conducting a data adequacy assessment of the UK. If the EU grants positive adequacy decisions by 1 January 2021, it would mean that personal data can flow freely from the EU/EEA to the UK, as it does now, without any action by organisations.’

However, if we leave without a deal and the EU hasn’t given us an “adequacy ruling” then, as stated by the government, the implications for data handling are that UK data being passed to Europe will be covered by existing laws, but if EU data is sent to the UK, it could contravene data privacy regulations. For pan-European operations, this might pose serious new risks.

What is the UK’s data privacy situation as we leave the EU?

If the UK’s rules aren’t considered adequate by the EU, then a raft of new contractual arrangements using Standard Contractual Clauses (SCCs) will be required. This is according to a report from the New Economics Foundation and UCL European Institute ‘The Cost of Inadequacy’. The report estimates “The aggregate cost to UK firms would likely be between £1 billion and £1.6 billion.”, most of which would be the cost of commercial legal work to implement the necessary SCCs.

Add to this, the arrangement between the US and EU called the ‘Privacy Shield’ which was struck down by the EU over concerns that US corporations are subject to making data available to US Government agencies, which the EU considers a data risk. This creates additional implications for data sharing wider than the EU and UK in the western hemisphere.

How can you prepare to be Data Privacy compliant?

The EU has released some draft Standard Contractual Clauses which data controllers and processors can use to remain compliant in 2021 and beyond. Already, several commercial law firms are preparing advice which data owners can use to assess their position with respect to data from the UK, EU and other countries including the US. This may come at a price, so here is a very summary of the impacts that we expect to see:

If you have UK data which you store and process in the UK, your operations are not likely to be affected in the short term, as long as they are already compliant.

If you have UK data which is stored or processed in the EU, you are also not likely to be significantly affected in the short term. The EU’s rules should be enough to protect you against the most likely risks.

If you have EU data which you store and/or process in the UK, you should review your risks and the new SSCs may be needed to assure your compliance. This will apply if you use many nearshore outsourced customer service or data processing teams.

If you are a global operation with data from different regions which is transferred across borders, your situation may be complex and will need looking at carefully.

What is best practise in tomorrow’s data handling world?

To manage your risks there are two key pieces of advice we can give to all businesses who use private data in any way, whether for outbound sales, customer service or sales order processing:

- Minimise the amount of data you store per contact. The less data you store, the less likely it is to get you in trouble. Avoid storing risky data such as payment details unless absolutely necessary to your business model.

- Minimise the places you hold data. If your data is stored and processed in only one location, the amount of regulation is minimised. Also, the lower number of transfers your data has to undergo, the lower the risk of breaches of privacy, or indeed of your business inadvertently falling foul of the regulations in one region or another.

As a last consideration, check all your IT service providers. Do you really know where your call recordings and network data backups are stored? Identifying where your data is held is essential. If hosted in the cloud then find out where the data servers are located and if your technology provider is unable to provide this information, then your business could be at risk and alternatives should be considered.

If you’re unsure how to assess your risks and prepare for your future once the UK leaves the EU, get in touch. We can advise you about the risks you need to consider and potential ways to mitigate them.