I always think back to a certain Benjamin Franklin quote when we talk about learning, that being “Tell me and I forget. Teach me and I remember. Involve me and I learn.” For a quote that is over 300 years old, it certainly does resonate today.

However, with recent challenges in the industry, be that COVID-19, the cost of living and other hardships, opportunities for employees to learn and experience personal growth have been somewhat limited. Surely something needs to change?

What do the stats tell us?

Recent studies underscore the importance of continuous learning and development for call centre professionals:

- 44% of employees in the service sector will require reskilling during 2023 to meet the demands of evolving job roles. This will rise to 57% over the next 5 years (Future Skills);

- 87% of call centre leaders believe upskilling and reskilling are essential, yet only 40% feel prepared to address the skills gap (McKinsey);

- 32% of customers would leave a brand they loved after just one bad experience. With well-trained call centre staff, companies can mitigate these negative experiences (PwC); AND

- Companies that invest in employee training and development see 21% higher profitability due to increased employee productivity (Gallup).

Quite telling stats don’t you think?

What is clear, is that the numbers collectively highlight the critical nature of proactive upskilling and reskilling in the service sector. Businesses that prioritise and act on this will not only safeguard their employees and customers but also realise enhanced profitability and future-readiness.

Making it personal

It’s always important to remember that no two employees are the same. Businesses need to ensure each employee’s learning journey is highly personalised. There needs to be a departure from the ‘one-size fits all approach’ that many standard training and induction courses deliver.

AI-powered, learning and development solutions help with personalising a learner’s journey, as these platforms can identify and close knowledge and skill gaps whilst giving managers the analytics to see exactly where those gaps are.

Rather than having to redeliver training on a whole subject, they can focus on the content that is performing the lowest, thus freeing up time and budget.

Solutions that are bucking the trend

Such solutions are helping to quash these stats by embracing the principles of continuous engagement and development, helping to create a deep sense of ownership in each employee’s learning journey.

I recently sat down with Georgia Harbison, Head of Sales at Cognito Learning, to discuss her thoughts on these statistics:

“The statistics speak for themselves. Investing in L&D and upskilling for contact centre staff is not just a nice-to-have; it’s imperative. As the nature of customer interactions shifts and the role of call centre professionals evolves, continuous learning will be critical to success. Businesses that recognise this and invest in their employees’ growth will not only see improved customer satisfaction, but, will also benefit from improved staff loyalty and productivity as well as enhanced profitability.”

Sound familiar?

If you too are going through a renaissance with your learning & development strategy, then give us a shout. We can help to supercharge your employee’s learning journey.

In the fast-paced world of contact centres, where efficiency and productivity are paramount, the value of team meetings and huddles is often underestimated. Whilst some team leaders thrive, using this opportunity to have rich and helpful conversations with their team, others see it as ‘wasted’ time, and some simply don’t know how to fill the allocated time – so it becomes a coffee/vape break!

In this article, we’ll delve into the importance of team meetings and huddles in contact centres and how they contribute to creating a more cohesive and productive work environment.

5 Reasons Why

- Enhanced Communication and Collaboration – team meetings and huddles can serve as vital platforms for open communication. They can provide an opportunity for team members to discuss concerns, exchange ideas, and offer support. The more this happens, the more trust grows, which in turn fosters a collaborative spirit, enabling individuals to work together seamlessly towards common goals (which aren’t always measured with a metric!) Through regular honest, open and real conversations team trust leads to understanding, ultimately driving improved teamwork, productivity and performance.

- Boosted Morale and Motivation – team meetings offer a space to celebrate achievements, big or small. Recognising individual contributions creates a positive atmosphere and reinforces a sense of purpose and belonging among team members. This, in turn, translates to increased motivation and a greater sense of pride in one’s work. There is a risk that the ‘coaching-culture’ in contact centre creates an environment in which problems are solved, but wins are not noticed. The downside of this (as well as the negative impact on morale and productivity) is that successes are not actively learned from, so cannot be systemised and repeated.

- Problem-Solving and Knowledge Sharing – wouldn’t it be great if every day ran smoothly, and all customer concerns were easily dealt, in a timely manner, using intuitive and interconnected tech … but things don’t always go that way. Sharing experiences and best practices in huddles/meetings can lead to innovative problem-solving approaches from within the team. The co-creation of solutions is both empowering and motivating. Moreover, it allows for the dissemination of knowledge, ensuring that all team members are equipped with the tools and information needed to excel in their roles.

- Priority and Self Management – huddles and team meetings provide an opportunity to set priorities, allocate resources, and streamline workflows. By ensuring that everyone is aligned with organisational objectives, daily targets and team goals, these gatherings contribute to a more structured and efficient operation.

- Empowering Employee Voice – every team member plays a vital role in the success of a contact centre, and their perspectives are invaluable. Huddles and team meetings can (and should) create a safe space for employees to voice their opinions, concerns, and suggestions. This not only makes them feel heard and valued but also allows for a diversity of ideas that can lead to innovative solutions and improved processes. This further builds the sense of trust, belonging and connectedness to the organisation, which further helps performance and productivity.

Conclusion

Team meetings and huddles are not merely obligatory gatherings; they are indispensable tools for creating a cohesive and productive work environment in contact centres. Think about it, a simple huddle can contribute significantly to the success of the organisation as a whole – that’s surely worth 5 minutes of the day?

By recognising and leveraging the value of these meetings, contact centres can build stronger, more resilient teams that are poised for success in today’s competitive business landscape.

Looking for ways to empower your team and unlock their potential? Get in touch, we’re here to help.

For many the OOO (out of office) was in action over the summer, the best I ever received went along the lines of “I’m away, returning on DD/MM, when I return I will delete all my emails, so mail me again after that date” I was outraged at the time, but now I’m older, well… I still couldn’t do it.

Anyway, now people are back and it seems, are back to the actual office in increasing numbers, what 5 things would make our roles more productive and effective between now and the end of the year?

We are fortunate to speak with lots of people at Contact Centre Panel and through our conversations over the years these are my standout quotes:

- If everything is a priority, then nothing is a priority: wise words, if you are trying to do too many things then it is likely that none of them will get done, make a shorter list or ask for help where you need it.

- Focus on your core: I do mean business not the type developed by doing the plank (that said I maybe need to do both types), clearly all businesses need to evolve but know when you need to perhaps outsource part of the work so that you can focus on what you do best.

- Learn from others’ mistakes: come on we can’t all sit here and pretend we got it right all of time, taking the experiences of others to improve your own operations, customer experience or sales doesn’t mean you have to hand everything over to an outsourced solution it may be that you need someone to come in and support for a while, but use their experience, it could be a shortcut.

- If you are going to automate it: make sure you fixed the processes first. Also ensure that you are automating the right processes not just the ones that you don’t like doing.

- Look after your people: there is a well quoted Richard Branson post that I’ll probably be paraphrasing but make sure you give your people the tools and the support they need to shine, helping to do the right thing for your customers. Those things may not be easy, but if you train and support your people right they’ll be loyal to your brand and create fans.

If we can help with any of these then don’t be shy, just ask.

What Winter does highlight is the vice like grip the cost of living still has on us Brits, and it’s no wonder why we are all worrying about money.

Whilst some are trying to tackle the gap in pay in their own way (overtime or 2nd jobs), over two-thirds (68%) of UK employees with money worries do not tell their employer about their concerns [Wagestream]. Of this 68%, most cited the feeling of shame and embarrassment, or a cultural belief that you shouldn’t talk about your finances with others. Some cited a lack of trust in their employer – or a fear of discrimination or job loss once their issues had been divulged.

Tackling the mental health stigma

Whilst progress has been maintained in tackling the mental health stigma as a society, people are much more likely to talk about their mental health in the workplace. If we want to open the conversation so people can improve their financial wellbeing, we need to do the same with money.

3 ways employers can tackle the money stigma at work

- Train money champions to signpost and be visible: There’s been progress on the mental health stigma and one of the reasons is the success of the Mental Health First Aiders and similar schemes. Without training, it can be hard for managers and colleagues to know what should and shouldn’t be said, but this type of training gives confidence that makes people approachable but also more likely to open a conversation.

- Never waste an opportunity to talk about money: It’s not only societal trends that offer opportunities to talk about money. Internal changes, such as promotions, are good opportunities to encourage employees to review their short-term and long-term financial goals. The same is true of external changes in an employee’s life: for example when people apply for mortgages they often talk to their HR department. o Don’t waste these opportunities to start a dialogue – it’s a great way to build trust with employees. In fact, nothing says you’re more open to having a conversation than by clearly showing you’re interested in starting one. If you have money champions, using them to start conversations within their departments or cohorts can be an easy way to take action at scale.

- Celebrate Talk Money Week throughout your organisation: Talk Money Week is a yearly campaign aimed at encouraging conversations about money – it’s not limited to the workplace, but it’s an ideal existing initiative that organisations can use as a catalyst for their own plans. In 2023, Talk Money Week begins on November 6th. Spearheaded by the Money and Pensions Service, Talk Money Week offers a participation pack for employers looking to take part, that includes various useful materials and insight so you can get off to a good start. It’s a great way to start a conversation internally and provides a yearly date for your diary.

Are there ready-made solutions out there?

We have seen some innovative solutions out there that are tackling this issue head on. However, the best solutions we’ve seen at CCP work with some of the top brands in the UK to provide in-depth financial education materials to help staff with budgeting. One includes the use of an intuitive app which provides employees with an easy way to help manage finances all in one place.

Such solutions have seen huge improvements, with one UK business citing the following since introducing said programme and app:

- Increased retention by up to 16%

- Increased shifts worked by up to 26%

- Reduced payroll queries by up to 40%

By rolling out such a programme, the business in question has been able to retain good people, who are doing a great job in looking after their customers.

That feels like a win-win to me!

Looking for help?

Need help in planning a better financial future for your employees? Let us know,

For lots of contact centres the recruitment and retention of frontline advisors continues to be their biggest challenge. The labour market has shifted, maybe permanently, and potential colleagues’ expectations have changed. At the same time technology developments promise to revolutionise contract centres and how they operate.

Good people are hard to find and good people expect to be recruited honestly and treated properly in work. So, are your current recruitment approaches fit for purpose?

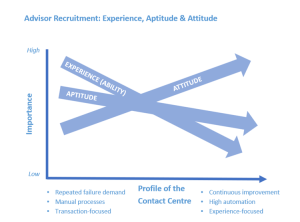

Attitude, Aptitude and Experience

Recently I came across the ‘3As’ hiring model that Ralph Kasuba developed in the late ‘noughties when recruiting technology hires. The three As are the three sets of characteristics that candidates have and Mr Kasuba suggested the priority order in which they should be assessed:

- Attitude – your innate approach to work

- Aptitude – your ability and willingness to adapt, learn and develop

- Ability (or Experience) – what you bring to the table in terms of qualifications, technical skills and experience

The model was developed when Kasuba’s team were struggling to appoint candidates for technical roles; they would pass a pre-assessment but then never get through a team interview with their prospective peers. The 3As sought to make sure that the candidates’ ‘fit’ with the organisation and team were right before going on to assess the level and extent of their – vital – technical skills.

So, do the ‘3As’ help us in today’s contact centre world? Potentially, but perhaps not yet!

The present

Everywhere you turn nowadays you can read predictions and descriptions of the onward march of technology in the customer interaction and contact centre space. Innumerable articles – most written by Chat GPT and some with the aid of human intervention – explain that the old contact centre world of complex manual processes and work-arounds is about to disappear under the shiny onslaught of machine learning and AI.

If these articles are even partly correct then the sort of people we need to attract to work in the frontline of contact centres needs to change. However, as long as contact centre advisors are expected to the below, then Experience and Aptitude will continue to trump Attitude in attracting and selecting candidates:

- Cope with multiple tools and systems (with more added all the time)

- Retain a good understanding of internal and customer-facing processes ‘in their heads’

- Prioritise multiple demands and requirements (mandatory statements, data protection compliance, data capture goals, up or cross-sell targets, quality management criteria, etc)

The future?

As systems are integrated, real time guidance is available to advisors to help them identify and resolve issues and – crucially – the contract centre is seen as a means of identifying and fixing broken processes, then things will change. Maybe then recruiting people mostly for their empathy, enthusiasm and communication skills will become possible.

In the meantime, if we want to retain the right people to help and support our customers it will continue to be necessary to accept that “what they do” is more important than “the way that they do it”.

If you’d like to discuss how well your recruitment model aligns with your present realities (and future ambitions) just drop us a line, we’d love to chat with you.

P.S. if you want to read more about the ‘3As’ approach you can do so by clicking here.

This year, a further bank holiday has been proclaimed in honour of the Coronation of His Majesty King Charles III. It will fall on Monday 8 May, following the Coronation on Saturday 6 May. With another unexpected UK public holiday approaching, business owners will yet again be left wondering whether their employees are automatically entitled to the day off. Unfortunately, it’s not a simple yes or no answer – it will all come down to the employee’s contract.

The law on working bank holidays

Unfortunately for employees, there is no statutory right to time off for bank/public holidays. However, employers may choose to include these days as part of employees’ annual leave entitlement.

Therefore, whether employees are entitled to time off on 8 May will very much depend on the specific wording of such clauses.

What do we need to look for?

Within an employee’s contract, holiday entitlement will typically be expressed as either:

X days’ holiday, plus bank holidays; or

X days’ holiday, which includes bank holidays.

This will be a key factor in whether they can take advantage of any new bank holidays.

For example, if the contract states something along the lines of:

“You are entitled to X days’ paid holiday each year. In addition, you are entitled to take public holidays.”

In this situation, because bank holidays form part of the employee’s set holiday entitlement and because you have expressly provided the public holidays in question, the employee won’t have a contractual right to the extra bank holiday in 2023.

What if we’re closed, but staff don’t have a contractual right to time off?

If you intend to shut up shop for the day and your contracts don’t give employees the right to the extra bank holiday, employers have two options.

First, you can require employees to use a day of their normal annual leave entitlement on 8 May so that they don’t miss out on a day’s pay. Employers have plenty of time to do this, as they are only required to give two days’ notice for the one day of leave, but it would make sense to get the date in the diary well in advance. We recommend confirming this in writing to avoid any issues.

Alternatively, as many did with the additional bank holidays in 2022, you could choose to permit an extra day’s paid leave as a discretionary gesture. The fact you allowed employees to take these extra days off last year doesn’t bind you to make the same decision in 2023; however, given the well-documented benefits of reward and recognition, this may pay dividends.

Concerned your contracts could come back to bite you?

Inadequate or outdated contracts can present real problems for employers, as well as expose your business to legal risk. Our Employment Law specialists know exactly what makes a good employment contract, from the essential legal requirements right down to the subtle nuances in wording that can help to protect your interests.

To ensure that yours are robust, compliant, fit for purpose and offer maximum flexibility for your organisation, email CCP@worknest.com to request your free consultation.

A recent article in The Times suggested that working from home is no longer popular with employers and that patience for reduced productivity is running out. Recently I was on a 17:15 flight from Leeds on a Monday evening and as I looked down at the city and the lights below, the queuing traffic suggested that we were returning to the office in ever-increasing numbers.

Changes to legislation in Q4 of 2022 made it feel like employers were obliged to consider any request for remote working as a priority and one that could not be declined. However, against a backdrop of increased pressure to reduce costs, has the tide now turned?

Has the mindset of the working population changed such that there isn’t the appetite for spending a whole working week in the office? I saw a post about the increasing numbers of over 55s who have become “economically inactive” and how the government are looking to incentivise them to return to the workplace. What an opportunity these people present to contact centre employers. However, even with an incentive I don’t think that is going to be an easy option. Put simply, people’s priorities have changed.

In a recent conversation with a salesperson, he made what was a critical assessment of the nation post-Covid. It probably wasn’t what I wanted to hear, but he was perhaps accurate in his assessment. Post-pandemic, many people have become less generous with their time, they are less courteous, as if not letting someone out at a junction or trying to cut a queue will somehow recompense them for the time “lost” due to the pandemic.

Perhaps this can be applied to the appetite that some people now have for work? For employers with increased costs and potentially falling revenues, if we enter a recession then productivity will be critical.

I didn’t want to hear it as I always prefer to see the best in humanity.

That being said, have we all truly implemented the best processes and support required to make homeworking sustainable for the long term? Are the best practices to support people, seen at the start of the lockdowns, still being actively pursued? Have you gone back and checked in on your technology? Are you confident that everything possible has been done to make working from home viable and if necessary have you ensured that the right conversations about productivity and performance have been had?

Only then should we consider such a decision to bring everyone back into the office full-time.

Perhaps contact centre outsourcing with all our technology, management information, people, processes and approach are better set to make homeworking deliver. Maybe this is our time to shine and working for a contact centre will gain more kudos as it becomes a way to maintain that critical work-life balance that so many people are searching for. If this is the case, then we may have an opportunity to attract and retain the best people to deliver great customer experiences.

With the average award for unfair dismissal sitting at £10,812, missteps can be costly. It’s therefore essential that employers understand what a fair dismissal process looks like and what might constitute unfair dismissal.

What is a fair dismissal?

The key ingredients to a fair dismissal process are:

1. Having a valid reason to dismiss; and

2. Acting reasonably in the circumstances.

In relation to the first criteria, the Employment Rights Act 1996 lists five potentially fair reasons for dismissal. These are:

- Dismissal related to an employee’s conduct (e.g. theft, fraud, bullying or negligence)

- Dismissal related to the employee’s capability or qualification for the role (e.g. long-term sickness absence or performance concerns)

- Redundancy (e.g. business closure)

- Dismissal because of a statutory restriction, i.e. if continuing to employ the person would break the law, such as a driver losing his driving licence

- Dismissal for some other substantial reason. This is a ‘catch-all’ category that employers may rely upon if none of the other potentially fair reasons for dismissal apply (e.g. the employee is handed a long prison sentence, their conduct outside of work brings the employer into disrepute, or they refuse to accept changes to contractual terms)

From a legal standpoint, however, it’s not enough that the employer has a valid reason to dismiss; you must also be able to demonstrate that you acted reasonably in the circumstances.

What is a fair dismissal procedure?

While there is no legal definition of ‘reasonableness’, in determining whether a dismissal was fair, an Employment Tribunal will consider a number of factors, including whether the employer:

- Properly investigated the issues and considered mitigating circumstances

- Informed the employee of the issues in writing and notified them of the potential for dismissal

- Conducted a disciplinary hearing with the employee to give them an opportunity to respond

- Allowed the employee to be accompanied at any hearings

- Informed the employee of the decision to dismiss in writing and gave the employee the chance to appeal

What makes a dismissal unfair?

A dismissal will be considered unfair if:

- The reason for dismissal does not fall under the scope of one of the five potentially fair reasons for dismissal outlined above

- The employer did not follow a fair disciplinary or dismissal process and/or the decision to dismiss was outside the range of reasonable responses open to the employer.

In cases of misconduct or performance concerns, employers should follow the procedures set out in the Acas Code of Practice on Disciplinary and Grievance Procedures, as an Employment Tribunal will take this into account when assessing whether an employer has acted reasonably.

If it is found that an employer has unreasonably failed to follow the relevant procedure in the Code, a Tribunal may consider that the dismissal is unfair.

Likewise, in redundancy situations, the main elements to a fair redundancy process are:

- Warning employees of redundancies

- Creating and applying fair and non-discriminatory scoring criteria and consulting with employees and exploring suitable alternative employment options

If you fail to follow a fair selection or consultation process, you may find that the dismissal is deemed unfair.

An employee with at least two years’ service may be able to submit a claim to a Tribunal for unfair dismissal. Claims must generally be submitted within three months of the date the employee’s employment was terminated.

To read the article in full, follow this link.

Like most trades, the contact centre industry has an arcane language all of its own. Terms like ‘shrinkage’, ‘containment’ and ‘adherence’ are regularly used by contact centre people, often as a bit of a badge of honour, to show that they’re in the know. (Though if you ask two or three contact centres for their definition of those phrases, then you’re likely to soon find yourself in the middle of a heated argument!)

That’s detailed, technical terminology, but what about the names we give ourselves and the work we do in our contact centres?

Who are you?

What do you call your front-line people? Perhaps 40 or 50 years ago being an agent sounded important or even glamorous. Like an FBI agent or a secret agent. But for lots of people nowadays, the term ‘Agent’ is synonymous with ‘Call Centre Agent’ and all the bad connotations that that description brings with it – boredom, micro-management and insecurity.

So, instead are they ‘Advisors’? Do they advise? If so, that implies a level of authority and resultant customer trust? Or perhaps they guide customers. Should you call your front-line people “Guides”? Our IT colleagues aren’t wide off the mark, because they run help desks and who wouldn’t want to be helped?

‘Associates’ is a professional-sounding term, albeit with a with a slight sense of vagueness that might make people sound unhelpfully semi-detached from the organisation. If you’re really ambitious, your people might be called ‘Ambassadors’, ‘Gurus’ or ‘Experts’. That sounds great, but you have to be sure that real world status and empowerment go with the lofty job titles, or the gesture will just feel disingenuous.

Here’s an idea: ask your front-line people what they would like to be called. Kick off the empowerment with some self-definition!

Where are you?

And where do these people work (physically, virtually or both)?

‘Call Centres‘ were re-branded as ‘Contact Centres‘ years ago (even if that memo still hasn’t reached everybody, particularly consumers). The name change was as much to do with trying to escape the negative, scripted telemarketing associations of 1990s call centres, as it was reflecting the move to a multichannel world in the noughties.

But things just keep getting more varied and confusing. We can debate all day whether customer experience does or doesn’t mean the same as customer service. Or we can argue about the extent to which customer service embraces all that is entailed in customer management. But more contemporary terminology is reflected in workplaces and business units – which might be why I frequently spend time with organisations in which no one seems to agree what the ‘contact centre’ is now called.

You might be running a ‘support centre‘ or a ‘service unit’, a ‘customer hub’, ‘customer home’ or ‘customer experience factory’. In a sense it doesn’t matter – unless you aspire to really make a difference. In order to do that, you need to engage your frontline people, both actively make things better for your customers but also, vitally, take those learning and insights into the wider business. Only then can the hard work on the front line translate into a genuinely improved customer experience, propositions, technology and processes.

If the name you give to a unit or department helps the people in it and your colleagues and stakeholders all understand what you’re trying to achieve and how, then that’s a great start.

So, what’s yours called? And why? Let us know at hello@contactcentrepanel.com

So, what exactly are Super Agents? The term, which is also described as ‘Power Agents’ or ‘High-Performing Agents’, refers to customer service representatives who handle a large volume of contacts and consistently achieve high levels of customer satisfaction, productivity and sales. These agents are typically characterised by their strong communication skills, ability to handle complex interactions and navigate multiple systems and tools.

Super Agents often have a deep understanding of the product or service they are representing and are able to quickly and accurately provide information to customers. They are also adept at handling difficult customers and resolving complaints quickly.

Super Agents can improve overall contact centre performance by handling more contacts, reducing handle time and increasing sales or upsells. They also tend to have a lower turnover rate, which can lead to cost savings for the organisation.

There are several ways to create and maintain Super Agents in a contact centre. Here are a few key strategies that organisations can use:

- Recruitment and hiring: Screen candidates based on specific criteria such as communication skills, problem-solving abilities and customer service experience. This helps to ensure that new hires have the potential to become Super Agents.

- Training and development: Provide comprehensive training and development programmes for agents. This should include product and service knowledge, as well as communication and problem-solving skills. Agents should also have access to ongoing training and development opportunities throughout their career to continue to improve their abilities.

- Performance management: Establish clear performance expectations and metrics for agents and provide regular feedback on their performance. Use performance management tools such as real-time monitoring and analytics to track agents’ activities and identify areas for improvement.

- Incentives and recognition: Create incentives and recognition programmes to reward top-performing agents. This can include bonuses, time off or other rewards that recognise their achievements and motivate them to maintain their high level of performance.

- Empowerment: Giving agents the autonomy and support to make decisions and provide solutions to customers issues, this improves the sense of job ownership and motivation.

- Technology: Provide agents with the technology and tools they need to effectively handle customer interactions. This can include CcaaS solutions with advanced routing and queue management capability, CRM software and knowledge management systems.

It is worth noting that Super Agents, also need to continuously learn, adapt and advance, it is important that organisations continuously evaluate and update their strategies for creating and maintaining a team of high-performing agents.

If you need help sourcing the right technology to empower your agents or need guidance around training and development, performance management or recruitment, get in touch.