In an article published in the run up to Christmas 2024, I discussed the growing tendency in many organisations of the traditional Christmas peak starting to diminish, due to a variety of factors. Musing on the question of whether we had “…passed peak peak” (see what I did, there?) I wondered whether a reduction in the scale of ‘peak seasons’ was being paralleled by a growth in other sorts of both structural and spontaneous increases in contacts.

I was reminded of this article – and the discussions with colleagues and partners that inspired it – when I came across what was a new term to me, last week. The phrase is ‘perma-peak’ – the concept of a long-running or perpetual series of periods of high contact demand.

If the old, usually Christmas-related, peak season was the product of a society-wide, predictable (but hard to handle!) patterns of behaviour, then a perma-peak reflects a very different world. One in which both consumers and brands exhibit or can leverage greater personalisation, but in which demand patterns can spread and grow very rapidly:

1. Brands now have the ability to test and flex proposition and pricing, with instantaneous digital communication to customers and prospects

2. Social network effects can massively amplify the features and virtues of an offer or product – be that from an ill-prepared start-up or a settled, established big player. And, of course, negative aspects or faults can also be shared and multiplied, resulting in a flood of questions, complaints or claims

Pattern non-recognition

Despite advances in analytics automation and machine learning / AI, understanding and responding to demand changes in real time remains difficult and rare. Contact centres have always been operationally flexible and able to display great agility, but this is typically still a manual, even instinctive, response.

When insights are predominantly based on pattern recognition, increasing unpredictability makes operational flexibility a consistent challenge.

Likewise, agent assist and self-service tools and guidance will largely be optimised on the basis of prior experience. Unexpected demand spikes might be driven by either new query types and failure demand triggers, or factors in a novel combination.

Planning for the unplannable

In traditionally ‘peaky’ business sectors like retail, peak planning is an intrinsic part of how businesses are run. If you have a Christmas peak then thinking about how to handle it the following year typically starts in January, before the backlog of post-Christmas complex queries and complaints has even gone! Planning for the unpredictable is a different challenge.

So, if we really are entering an era of perma-peaks, will contract centre operations find themselves back in the era of watching service level charts drop precipitously whilst wondering what on earth is going on?

Not necessarily.

Perma-peaks need perma-flex

Just because tried and tested techniques are strained or start to fail, doesn’t mean that they can’t be revisited, adapted and fine-tuned.

• Workforce Management may become more orientated around rapidly identifying the different characteristics of peaks and corralling real-time shift flexing – and less about aligning scheduled staffing to forecast demand

• Your attempts to match staffing to demand may be less focused on seasonal efforts with shift banking and the use of temporary or fixed-term contract workers, but instead looking at incentivising intra-day shift flexibility or the peak use of a ‘gig’ model, using either in-house or outsourced workers

• Customer guidance, contact steering and self-service options will need to be able to be changed and weighted immediately in the light of peaks or troughs in demand. Root causes of demand spikes need to be identified and addressed – including restricting the promotion of or access to certain contact channels for limited periods, if required

• ‘Unforced errors’ by which organisations inadvertently trigger customer contact need to be avoided. Experience shows that the best way of doing this is through ensuring the contact centre has ‘a seat at the table’ when initiatives and campaigns are being designed

Whether you think that your next peak could be with you at any moment – or you’re confident that it will kick in from the 2nd week of October, just like every year – how to do you anticipate, plan and prepare?

Let us know; we’d love to share experiences and ideas.

What’s next? More of the same, that’s what! As we all know, that’s the nature of the regime; it’s here for keeps.

We know from the FCA’s reviews of firms’ mandatory Consumer Duty Board Reports that their initial assessment of the industry’s response to the requirements of Consumer Duty has been broadly “ok for starters, but you can try harder”!

The FCA’s update on its review of the Consumer Duty rules promised some simplification and removal of some arguably unnecessary, prescriptive requirements (in line with the Treasury’s ‘cut red tape’ agenda), but the range and depth of the permanent change in the treatment of customers that the FCA wants to see will remain.

This is to be expected and no doubt most firms are focused on the FCA’s specific callouts for Board Report improvements such as:

- Improving the quality of data – and the insights derived from it

- More fully reflecting the needs of different consumer cohorts, especially those with vulnerabilities

- Ensuring that boards are challenging – and seen to be challenging – the business to meet the Consumer Duty’s requirements

- Clarity on the timescale, action owners and data to drive planned improvements

But one further area for improvement will be particularly relevant to colleagues in the customer experience and/or contact centre space – “Comprehensive view across distribution chains”.

Yanking the chains

The FCA has long recognised the importance – and potential for the risk of service and experience failure – in distribution and supply chains. Many financial services organisations will have already had to review their supply chains to meet the FCA’s expectations around Operational Resilience.

Meeting the outsourced, sub-contracted and third-party challenge

In the context of Consumer Duty, though, the focus needs to be less on the dangers of total failure than the more subtle risks of poor visibility and exchange of information, and inconsistent consumer treatment and experience.

The way in which financial products and services are sold, delivered and supported can often involve multiple partners in the supply chain – covering sales, payments, customer service, claims, redemptions and other functions.

At nearly every point of the customer journey the way in which consumers are supported and interacted with, both through human-to-human dialogue and automated channels, creates a Consumer Duty risk.

Outsourced and sub-contracted relationships need to be managed to ensure that the standards of consumer data and insight; advisor training and empowerment; online and automated information and decision making; consumer recognition; fairness; and effective compliant recognition and resolution; are all delivered as well as they are in-house. To do so will require a blend of initiatives and efforts, including:

- Contracts and service–schedules; contractual management Information and KPIs

- Data and information security assurance, including payments (and the news that Marks & Spencer’s recent £300m cyber-attack is being blamed on a 3rd party supplier’s error highlights the criticality of this area)

- The quality assurance and provision of guidance and information to both customers and advisors

- The ability to share and identify customer profiles and features (especially vulnerability factors)

- Advisor training and coaching

- The provision of self-serve and assisted support tools and concessionary measures

(and all of these are an ongoing commitment, not just a ‘one time fix’)

In Summary

Managing complex customer supply chains can be tricky at the best of times, but adding in a raft of demanding regulatory expectations and requirements makes it more difficult still.

Have you already met this challenge or are you still assessing how to better go about it? Let us know. Get in touch, we’d love to chat.

Summarising calls takes time – anywhere from 10-30% of the call. And agents are almost always under pressure to get the task completed in as little time as is humanly possible to meet AHT and wait targets. This often translates to errors or even missing data. Which not only makes it hard for future agents to follow the story, it can be a regulatory challenge too.

AI-driven autowrap and summarisation tools are helping to alleviate this burden by automating the process, allowing businesses to cut handling times and improve CRM accuracy. According to Jimmy, it’s one of the easiest applications of AI a contact centre can implement.

What is the AI doing in autowrap?

Autowrap and summarisation technology uses natural language processing (NLP) and machine learning to transcribe customer calls in real time. As calls progress, key details such as issues raised, resolutions, and next steps are captured automatically. This eliminates the need for agents to manually document call details, both reducing errors and freeing up time for more customer-centric tasks.

Key Benefits: Time and Cost Savings

By reducing the time spent on manual transcription, businesses can lower wrap times by 50%, which translates to reducing handling times by 5-15%. For a contact centre with 200 agents, taking the mid-point of 10%, this could result in a reduction of up to 20 FTEs, and delivering a 2-3X ROI from day one.

How you take this benefit is then your choice:

a) A productivity gain, even through natural attrition

b) A service improvement by reducing wait times or improving service, with longer call times to allow for better first contact resolution

c) Reinvest in more value driving AI use cases to build maturity

Call Summary Accuracy

With manual transcription, there is always the risk of errors or omissions. AI-driven solutions eliminate these risks by automatically capturing the most relevant data from each conversation, improving both the consistency and quality of CRM records.

Increased accuracy has a number of benefits, whether you run a regulated business or not. First is in future contacts, whether you met a first contact resolution goal or not. Any future calls where a customer refers to a previous call – and reasonably expects there to be some level of ‘corporate memory’ – can be shortened by avoid any lengthy re-explanations of what has gone before. Not only does this provide a future productivity gain, it makes for a far better customer experience too. So even at use case 1, we are already facilitating value generation through slick customer processes that avoid typical customer frustrations, as well as productivity.

What’s more, the data is clean, reliable and available for future analysis and QA. Look out for an article on use case 2, Auto QA, for more on that subject.

When building a business case, these are important considerations; it’s important to remember that your baseline probably isn’t perfection. And so your quality uplift may be greater than you have otherwise anticipated.

Easy Integration: No Overhaul Required

While it is undeniably desirable to integrate Autowrap technology into CRM or policy admin systems, it’s not a pre-requisite to start making these gains. An agent – dubbed the ultimate API in our recent whitepaper– can easily check through the summary, make any necessary amendments if you require it (your benchmark of what is good enough will depend on your business) and copy and paste it in. They’re already used to connecting disparate systems and will be working where you want to capture it anyway.

This means that businesses can buck the trend of AI project failure and quickly adopt the technology with minimal disruption to existing workflows. Once the ‘short, sharp’ solution is working, of course you can consider and implement the deep integrations to automate the task, but you will be most of the way there without it.

Enhancing Agent Experience and Customer Outcomes

As alluded to earlier, the benefits aren’t just about reducing operational costs—they also enhance both the agent and customer experience. By automating mundane, and often poorly executed tasks like call transcription, agents are free to focus on more valuable work, such as problem-solving and building customer relationships.

This not only boosts job satisfaction – which in itself may then also translate to tenure, sickness and recruitment gains – it also contributes to higher-quality customer interactions. Look out for use case 5, ‘Agent Assist’ for more on this topic.

Measuring Success

For any AI implementation, it’s important to measure its success as this will build the case for future implementations. Whether that’s headcount, resource allocation or the gamut of other contact centre KPIs.

In summary, the benefits are:

1. Immediate productivity gains of c. 10% of agent all handling time

2. Improved accuracy of note taking

3. Customer satisfaction gains from better corporate memory and more attentive agents

4. More time available for valuable conversations

5. Employee satisfaction gains – happier agents, longer tenures, less sickness, reduced recruitment

6. Regulatory compliance improvements

7. Easy and scalable implementation to shorten implementation timescales and increase AI success

8. Ability to re-invest gains in building AI maturity

Ultimately, accurate (enough) autowrap is an obvious win in any contact centre.

To find out more about how CCP can help you make the right technology choices, read more here or get in touch.

This series of articles is drawn from our webinar with Jimmy Hosang, CEO and co-founder at Mojo CX. We explored seven key use cases for AI in contact centres, starting from the easiest productivity gains to value generating applications. You can find a summary of all seven use cases here, or watch the webinar in full here.

In today’s outsourcing landscape, success depends on much more than cost savings and process efficiency.

On 25th February 2025, Neville Doughty and Phil Kitchen from the Customer Contact Panel hosted a webinar with Joe Hill-Wilson, CEO and Co-Founder of Learn Amp and Martin Hill-Wilson, Owner of Brainfood Consulting, to discuss Sustainable Operating Models in Outsourcing. One of the most important takeaways from the discussion on sustainable operating models is that Learning and Development (L&D) must be embedded into the core of every outsourcing strategy. Without continuous learning, sustainability simply isn’t possible.

Why Learning and Development is a Sustainability Driver

In outsourcing environments, teams often face rapid change, evolving client expectations, and shifting technologies. This is reflected in the data – 92% of organisations are facing high or very high risk of top talent leaving in the next year (Brandon Hall Group, HCM Outlook, 2024). Without a structured and ongoing approach to skills development, outsourced teams can struggle to keep pace, leading to inconsistent quality, reduced productivity, and higher turnover . During the webinar, 82% of attendees reported that current procurement practice restricts the value they can bring to their clients.

The key takeaway? Organisations that embed L&D into their operating models create more resilient, adaptable, and future-ready outsourcing workforces.

Challenges in Sustainable Learning for Outsourced Teams

The panel discussed the various challenges companies face when it comes to embedding learning into outsourced operations:

- Geographical and Cultural Gaps: How can we create a unified learning experience for teams spread across different countries, cultures, and time zones?

- Engagement and Adoption: With high attrition rates common in outsourced environments, how do we motivate teams to actively engage in learning?

- Measuring Impact: How can we quantify the ROI of learning programs in outsourcing partnerships?

What Effective L&D Looks Like in Sustainable Outsourcing

When looking at solutions for the challenges discussed, the panel noted the importance of centralised learning platforms that deliver consistent, engaging content to all locations. Platforms like Learn Amp help organisations create:

- Standardised onboarding programs to accelerate time-to-competence.

- Bite-sized, mobile-friendly learning content to fit learning into busy shifts.

- Social learning spaces that encourage peer-to-peer knowledge sharing.

- Data dashboards to measure engagement, skills development, and business impact.

Embedding L&D into Operating Models: 3 Key Strategies

Treat L&D as a Business Process, not a Project

Learning shouldn’t be an afterthought or an annual event. It needs to be a continuous, embedded process that evolves with the business and its outsourcing needs.

Make Learning a Shared Responsibility

Learning success shouldn’t fall solely on HR or L&D teams. Operations managers, team leaders, and employees themselves all need to co-own learning outcomes.

Measure What Matters

Sustainable learning models measure not just completion rates, but real business impact: faster onboarding; fewer errors; higher customer satisfaction; and improved employee retention. The LinkedIn Workplace Report shared that 94% of employees would stay longer if companies invested in their development.

Key Takeaway

If there’s one key takeaway from the webinar, it’s this: sustainable outsourcing depends on sustainable learning. When organisations invest in embedding learning into every stage of the outsourcing lifecycle, they create an employee experience where team members thrive.

If you would like to access a copy of the recording it is available here: Webinar Link

The year ahead promises to be a turning point for customer contact. AI and automation are advancing at an unprecedented pace, yet businesses are facing economic uncertainty, rising costs, and rapidly shifting customer expectations. The pressure to adopt new technology and improve service levels means leaders must make bold, strategic choices.

At the end of 2024, we held our annual ‘Big Conversation’ to uncover key challenges for the year ahead and hear directly from cross-sector contact centre leaders about how they’re addressing them. These insights have shaped our latest whitepaper, 2025: A Year of Difficult Conversations?. In this paper, we explore those challenges in detail and outline priorities and solutions. One theme dominates: success in 2025 will depend on how well businesses navigate ‘difficult conversations’—both within their organisations and with their customer and suppliers.

How can you make the right tech decisions in the age of AI?

AI can be a powerful tool for improving operational efficiency. However, the reality is stark: according to Gartner, 80% of AI projects fail, which is twice the failure rate of non-AI projects. Despite this, the pressure in the boardroom to “do something with AI” is stronger than ever. The key question isn’t whether to implement AI, but how to do so strategically and safely.

When AI is implemented well it can deliver valuable results. But the risks of adopting this still fledgling technology can be significant—wasted investment, damage to reputation, and disruption to operations. The businesses that succeed with AI will be those that clearly define its use cases, align them with business goals, invest in high-quality, integrated data, and ensure that AI complements human expertise rather than replacing it. AI has the potential to be a game-changer—but only with careful consideration.

How do we meet economic, regulatory and resource challenges?

While grappling technology decisions, contact centres also face ongoing economic headwinds, regulatory challenges and a 15% decrease in headcount since 2019.

As businesses introduce new contact channels and explore innovative solutions, the fundamental customer need remains unchanged—a fast and effective response

But despite the rise in self-serve and co-pilot automation, customer satisfaction in the UK has declined. While automation is handling simple queries, agents are left to tackle only the most complex cases with fewer resources overall. Agents have little respite from more intense interactions and operations have fewer agents available. Even with future AI implementations, research predicts relatively modest headcount reductions of a maximum of 15%.

What’s more, in 2025, UK contact centres will need to absorb and manage an 8-10% increase in agent costs. Meanwhile the ongoing cost of living crisis means customers remain stressed and regulatory requirements add to operational demands —all against the backdrop of a muted growth forecast and ongoing economic challenges. No wonder things feel pressured.

Consequently, leaders are exploring various ways to optimise their service models, including offshoring, automation, or refining their approach.

Getting It Right: From Good to Great

One thing is clear. Transformation isn’t optional—it’s essential. The businesses that thrive in 2025 will be the ones that take a proactive approach. The most successful organisations will define clear, achievable AI use cases, align data, technology, and human expertise, prioritise governance, security, and compliance, and engage employees in AI adoption from the start.

The path ahead will present both opportunities and challenges, but with the right strategy, tackling today’s difficult conversations can pave the way for a stronger competitive edge tomorrow.

Read our paper for more detailed analysis of the challenges, but more importantly, how to tackle those challenges and put in place a positive programme of change.

The Whitepaper is free to download and immediately accessible below. We would love to hear your experiences too. Follow us on LinkedIn to share your thoughts.

In early February I attended the IP Integration “Spotlight” event at the Midland Hotel in Manchester where we were provided access to some great insights from the team and from Steve Morrell of ContactBabel, what follows are my thoughts and reflections arising:

Something around customer adoption of automated solutions has been playing on my mind, it often happens when I suggest someone talk to an automated bot solution so they can experience first-hand how far the technology has come, where it is going and what the real possibilities are.

Being in the CX world and having several partners on our network that have such solutions, I have a number saved to my phone, just for this type of conversation. If I pull the phone from my pocket, find the number, dial it and hand it someone to have a conversation then I often feel that the “conversation” isn’t as free flowing as it should be. Why? Well that is a great question.

I suppose it could be that for the past 15 years when contact centres have effectively forced customers to speak to automated voice response systems, we have typically limited customer so saying one word “listen to the following list of options and then say the option you would like” or “in a few words please say why you are calling today” so for years we’ve been saying ‘please speak to this automated system in a short staccato format’. Now, in a matter of a couple of years, some businesses are offering customers the opportunity to speak freely to their bots or automations, whilst others are still on the limited few words space. No wonder consumers get confused – and the acceptance and adoption of voice automation could well be held back as a result.

Voice is here to stay?

The truth is that voice interactions are still our favoured route of contact as customers, when it comes to getting things done and obtaining reassurance that we’ve been heard. Whilst the death of voice in contact centres has been forecast for the past 20 years, the reality remains that voice is here to stay, millennia of evolution cannot be undone so quickly. Data shared at our webinar on the State of the Customer Experience Market with David Rickard of Everest Group in November (article link) validated this, as their research highlighted that 72% of revenues amongst the outsource community were still coming from voice-based activity in 2023 when both agent supported voice and conversational AI driven interactions were considered.

The data shared in the room in Manchester by Steve Morrell of ContactBabel corroborated this view, with 64% of interactions being cited as voice in his forthcoming 2025 report. Also that we are so keen to ensure that we speak to someone that we will now wait in the longer queues that have been identified post pandemic and that we have accepted these as the norm.

So, as a human race we have a deep attachment to use of voice, however I’m still receiving articles daily which suggest otherwise – and ours is an industry which is based on employing people to talk to customers. We need to acknowledge that ‘the bots’ or automation is coming for our lunch, which according to an article in the New York Times on February 1st it may however already be in a place to arrange someone to bring our lunch and where may that end?

An article by Kevin Roose details several tasks which he managed to complete using OpenAI’s Operator, a new AI agent in the week prior. Most of the tasks it did autonomously with minimal intervention. It met its brief of being an AI agent that uses the computer to accomplish valuable real-world tasks, without the need for supervision, to complete tasks in the background with a handoff back to the user to enter passwords or payment card details. However, in Kevin’s article he talks of how it ordered lunch to be delivered to a colleague’s house and responded to LinkedIn messages well, up to the point where it started signing him up to attend webinars, amongst other tasks. There were, however, several tasks where the automation struggled or needed an amount of reassurance or confirmations. Because of which he felt that it would have been faster to do the tasks himself, but acknowledged that the AI agent is at an early stage of development.

What we do know is that the evolution of technology is only gaining pace. Peter Diamandis, founder of the XPRIZE (https://www.xprize.org/) , is cited as having said in 2020 that “the next 10 years will bring more progress than the last 100 years” Given the pace of change in the past 5 years, it is reasonable to assume that Moore’s Law will hold true in this instance – and that we need to be ready for this.

As humans we like voice, we choose voice. But if personal assistants in the form of OpenAI’s Operator or DeepSeek were to be adopted by the general public (your customers) to complete their home admin tasks, then these systems won’t have the same emotional connection to voice conversations and will be happy to interact directly with a company bot. However, how quickly will we reach that point?

Public adoption is key then?

We can implement the best solutions in the world, but if nobody uses them, what use are they?

Whatever is coming next, we have a dependency on customers to embrace and use those solutions, whether that is voice automation in the contact centre or the potential for the eventual use of “their own” automation by customers to engage with brands to resolve issues.

We’ve seen before conversations around ‘brand by-pass’. Now, using an Alexa or alternative voice-activated AI assistant to complete simple tasks is clearly the gateway to us getting to a point of asking technology to, say, engage with our utility provider to amend our direct debit or to find a cheaper insurance renewal. At this point we as individuals will have less input to what brands we choose to purchase, so then the brands that will succeed are those that are easiest for our automations to interact with.

But before we get to this utopian vision of admin free lives with our AI assistants ensuring the effective running of our homes and lives, we need to pass a point of public adoption of AI.

A 2023 report from Ipsos shows that 66% of people they surveyed globally expect that products and services using artificial intelligence will profoundly change their daily life in the next 3-5 years. Whilst this is the average, the range of responses on a country and demographic level vary considerably, with the proportion expressing this belief in South Korea as high as 82%, whilst France sees the lowest number agreeing with this sentiment at 51% (we in the UK see 58% agreeing with this statement).

Products and services using artificial intelligence will profoundly change my daily life in the next 3-5 years – 66%

So, whilst there is broad agreement that services using artificial intelligence will change our lives, what people are willing to adopt and how is a key consideration, acknowledging that some will be unable to adopt due to a variety of reasons.

The conversation at the Spotlight event therefore quite naturally centred on work that could be done to implement changes or applications of AI to better support the contact centre agents in delivering service efficiently without too much impact to the customer, generating a series of marginal gains which support the agent in resolving customer queries, potentially reducing call durations and in turn queues and repeat contacts – a series of win/win scenarios which:

- Improve service

- Reduce pressure on the contact centre team

- Reduce repeat contacts

- Reduce the time customers spend trying to get through

- Reduce costs

- Improve staff wellbeing

Changes which fulfil the appetite of businesses to implement changes and leverage AI, but consider how willing customers are to adopt these changes.

Is some re-programming required?

If we want the possible AI solutions to be successful, we will have to consider how we guide customers to use these solutions most effectively. Our industry has created a sub-optimal situation through a combination of poor customer experiences in the past, limited system capabilities and a “tell me in three words” approach. If we want customers to embrace the possibilities of technology, then we need to bring them on the journey.

Consider how self-serve check-outs have become the norm when we are out shopping in recent years . There is a journey that I’ve certainly been on to this point, which I discussed with IPI’s Sam Grant at lunch.

Coming prepared, we need our customers to come to the contact prepared to engage with AI.

Similarly, from prior experiences I soon learned that I need to stop putting my shopping bag in the bottom of my basket, then putting my items of purchase on top of it, which created friction in the process when I needed to get to my bag to enable me to pack items as I scanned them. So, ideally, we need our customers to come to the contact prepared to engage with AI (unless they don’t want to?)

Offering a choice? Do I want to self-serve or would I prefer to queue?

When I’m approaching the tills, I can see a queue for a till with a cashier or I can see available self-serve checkouts. If I can also see someone there by the self-serve tills to support me, then I can make an informed decision.

Unexpected item in bagging area! Solutions need to be flexible enough to minimise friction.

That bag I just dug out from my basket, I’ve tapped that I’ve brought my own bag, but it is perhaps heavier than the scales expect, therefore I’ve got an unexpected item. I’m removing and resetting the bag but there is a red flashing light and now I’m waiting for someone to come help me. We’ve all been there (please tell me this wasn’t just me!). The solution has now evolved, though, replacing scales either with additional trust by the retailer, or with cameras, but the result is a smoother customer experience.

Authorisation for purchase There will be times when someone must step in. If so, ensure it is done in a timely fashion.

OK I bought wine, it’s the weekend, please don’t judge me. The process to verify that I’m of age and can make that purchase has parallels also. We need to ensure that if a customer needs support then it is quickly available. Now I want those annoying flashing lights to flash brighter, because I need help to complete my purchase.

How do you want to pay? Payments need to be frictionless, tap and go, no creased banknotes!

The same will apply to your callers they need to be able to make the payment without being moved to another channel and of course you need to ensure you are properly protecting that payment data.

Do you require a receipt? perhaps we need to acknowledge that customers will want validation of their conversation, of what was committed to and that they can trust that it will be done.

It has taken me a long time to reach the point of clicking no to a paper receipt. I want to be able to evidence that I’ve paid and not just walked round the shop popping things in my bag. Part of the reason so many of us are still reverting to speaking to a human when we have an issue, other than our lived experiences of trying to explain a complex situation in 3-word blocks, has to be that we can say “I talked to …. And he said he’d sorted it”.

What does it all mean?

People are complex. The implementation of self service and automation of the simpler query types means that average contact centre conversations are now much longer than they were and with rising staff costs there is a clear pressure on businesses to make changes to reduce customer servicing costs.

There is a broad spectrum of solutions available to support businesses address these challenges, whether outsource or technology. These need to be properly aligned to your objectives, and it is likely that you may need to speak with someone around how to select, prioritise and deploy these solutions.

If you need to chat then feel free to drop us a line.

As part of our recent webinar with Zoom, we discussed how a brand is far more than just a name or a product; it’s the sum of what the public thinks, feels, and believes about a business. It’s built on both tangible elements like product features and packaging, and intangible ones like emotional connections, marketing, and even independent conversations beyond a brand’s control. Delivering on the brand promise—a commitment to customers about what they can expect—is therefore paramount to success. But when businesses fail to deliver, the consequences are costly and far-reaching.

Businesses increasingly turn to outsourcing partners to support customer service and contact centre operations. However, ensuring these partners can uphold the brand promise is critical. By exploring the importance of a brand promise, the risks of failure, and the value of the right outsourcing partner, organisations can better position themselves for success.

What is a Brand Promise, and why does it matter?

A brand promise communicates the essence of a company’s mission, values, and purpose. It represents what customers should expect when interacting with the business. For example, Red Bull’s brand promise encapsulates the idea of “freedom” and giving “wiiings” to people and ideas. They successfully integrate this into their sponsorships of extreme sports and events, translating their values into tangible experiences that reinforce their mission.

Delivering on this promise consistently builds trust, fosters advocacy, and encourages loyalty. Customers who feel a brand aligns with their expectations and values are more likely to:

- Pay a price premium for products and services.

- Recommend the brand to others, driving organic growth.

- Maintain long-term relationships, increasing customer lifetime value.

The cost of failing to deliver on the Brand Promise

When businesses fail to meet expectations, trust is eroded. Research reveals that 31% of customers are willing to pay more for excellent service, but failure to deliver service quality results in significant revenue loss. Poor service costs UK businesses an estimated £7.3 billion per month in employee time spent resolving issues. Additional consequences of falling short on service delivery include:

- Damaged Reputation: Dissatisfied customers share their negative experiences online, influencing potential buyers before they even engage with the brand.

- Increased Marketing Costs: Companies must invest heavily to rebuild trust and mitigate reputational damage.

- Lower Customer Lifetime Value: Customers experiencing poor service are unlikely to return, reducing their overall spending potential.

Service delivery directly underpins the price premium brands can command. Without great service, even the best product offerings lose their appeal—and profitability.

Managing customer experience at scale

The challenge for brands lies in scaling customer experiences while maintaining human, natural, and supportive interactions. Customers expect more than just advanced technology; they demand seamless, elegant, and intuitive service that delivers the right information at the right time. Poor customer satisfaction—as seen in the UK Customer Satisfaction Index, which recently dropped to its lowest point since 2015—reflects the critical need for investment in experience.

To understand how service impacts decision-making, organisations should explore:

- Price Premium Expectations: How much more are customers willing to pay for exceptional service?

- Perceptions of Good Service: What defines great service from a customer’s perspective?

- Service’s Influence on Purchasing Decisions: How does a seamless experience drive loyalty and sales?

Leveraging outsourcing to deliver consistent experiences

Outsourcing has been a transformative tool for businesses over the past 40 years, enabling growth, transformation, and improved customer service outcomes. To realise these benefits, organisations must select their outsourcing partners carefully, considering solution fit, commercial alignment, and cultural compatibility.

- Solution Alignment: The partner’s solution must match the company’s specific needs, including sector expertise, channel coverage, geography, and appetite for automation. Proven experience with similar challenges can offer peace of mind.

- Commercial Mechanisms: The cost of service should account for the entire support structure—not just front-line agents—to ensure scalability and sustained quality. Contracts should incentivise mutual success and allow for evolving requirements over time.

- Cultural Fit: Partners must embody the company’s values and approach, representing the brand authentically to customers. Building a genuine partnership requires mutual respect and clear processes for engagement.

Mitigating outsourcing risks

To minimise risk, businesses must define clear objectives, success measures, and realistic timelines before outsourcing. Processes should be fully documented, and knowledge transfer planned meticulously to ensure a smooth transition. Continuous communication with the outsourcing partner is essential for alignment.

Outsourcing also enables access to specialised skills, flexible scaling, and cost efficiencies, all of which support business growth without overextending internal resources. The key is selecting a partner who acts as an extension of the organisation’s team—not just a supplier.

Conclusion

Delivering on the brand promise is a strategic imperative that builds trust, drives loyalty, and sustains growth. Poor service is not just an operational issue but a risk to brand value and viability. Businesses that prioritise exceptional customer experiences can protect and enhance their reputations, achieving sustainable success.

Outsourcing, when approached thoughtfully, can be a powerful enabler of these outcomes. By choosing the right partner and fostering a collaborative relationship, organisations can mitigate risks, enhance service quality, and uphold their brand promises with confidence.

At Customer Contact Panel (CCP), we’ve witnessed first hand how these factors are influencing decision-makers, especially CX leaders and CFOs. If you’re in the midst of making an outsourcing choice, you’ve probably got one of the following on your mind.

Growing Customer Demands: Meeting High Expectations

It’s not just about answering calls anymore. Customers want fast, personalised, and empathetic interactions that feel seamless and aligned with your company values. This means businesses must be more careful than ever when choosing an outsourcing partner. A BPO’s cultural fit with your company is crucial—they need to speak your tone, align with your brand, and uphold the level of service your customers expect – all of which take time which you don’t have. So, companies are scrutinising potential partners more closely, ensuring they’re a perfect match.

Technology: The New Wild Card

Right now, you’re being asked to do more with less or deliver a better service with the same budget. With inflation, high interest rates, and currency fluctuations, offshoring doesn’t feel like a financial guarantee anymore. Add in automation—think AI tools and chatbots – and CFOs are starting to wonder if tech could be the silver bullet to that beast of a budget. Whilst AI and Automation can scale fast, they can come with hefty initial costs. Businesses are now weighing their options:

- Do they stick with outsourcing (onshore, nearshore, or offshore)? or

- Do they double down on tech?

It’s a tough decision. Get it right, and they could boost customer loyalty; get it wrong, and it might lead to a backlash.

ESG: Outsourcing in a Politically Charged World

Outsourcing is no longer just about cutting costs; it’s also about navigating complex ethical and political waters. With Keir Starmer pushing for stricter ESG (Environmental, Social and Governance) standards, businesses are questioning their outsourcing partners, especially if those countries are known for poor labour practices or environmental issues. Throw in political instability and outsourcing now feels like a risky gamble. Operations could grind to a halt at any time, and businesses can’t afford that.

On top of that, data security is tighter than ever. With the UK government’s more stringent regulations, especially for industries like finance and healthcare, outsourcing is becoming bogged down in compliance red tape. A single data breach could ruin a brand’s reputation and customers’ trust—so finding a partner who understands data security is more important than ever.

Lastly, with the UK’s £22 billion budget shortfall and a focus on reshoring jobs, companies are balancing cost savings against their political and ethical responsibilities.

How CCP Makes Your Life Easier

At CCP, we get it – outsourcing feels complex. But we’re here to simplify it for you. We help businesses make smart, informed and equitable choices through services such as:

- Partner Matching: We connect businesses with a handpicked network of pre-vetted outsource partners (220+ partners infact), cutting down on the time and risk of finding the right partner.

- Cultural Fit Analysis: We ensure your outsourced team aligns with your brand’s values and service style, so there’s no misstep in tone or approach.

- Technology Sourcing: We know how difficult it is to cut through the sales patter and find the right tech for your customer contact needs. Well look no further, we have a network of 120+ pre-vetted and audit technology partners – who will get right to the point.

The Bottom Line

Outsourcing decisions are taking longer now because the stakes are higher. Customers expect nothing less than excellent service, and businesses are being much more careful about who they partner with. But with the right approach, outsourcing remains a powerful tool.

At CCP, we guide businesses through the process, ensuring they find the right fit, reduce risks, and build lasting partnerships. In fact, 93% of CCP’s clients maintain long-term relationships with their outsourcing providers – proof that our approach works.

With CCP by your side, navigating the increasingly complex outsourcing landscape is much smoother, helping you make the right decisions for today’s customer demands and tomorrow’s success.

It’s often said that everyone has an opinion. In the same way, most of us feel like every contact centre has a seasonal peak (or more than just one). Most often the peak comes in the run-up to Christmas, with a secondary surge in the New Year. But – even for consumer retail – is the contact centre Christmas peak no longer quite the scary summit it once was?

Just last week, the CCP team heard from an outsourced contact centre partner with deep capabilities in the retail and delivery sectors. It was having its traditionally busy pre-Christmas peak season – but only because it had gained a new client. Otherwise, 2024 contact volumes are notably down on previous years.

So, have we passed peak peak?

(Here I should say a big ‘thank you’ to Rochelle Weinstock and Nev Doughty for the fascinating chat I had with them the other week about a whole series of CX topics and challenges, including the Christmas Peak, which inspired this post).

Types of peaks

Broadly, there are two types of customer contact demand peaks:

- Structural Peaks

These might be the result of predictable external factors, like Christmas. Or internal factors that tend to drive customers to make contact, such as billing or renewal cycles, pricing increases and so on

2. Spontaneous Peaks

These are, by definition, not predictable and can’t accurately be planned for with any degree of confidence. For an ecommerce or insurance firm this could be the impact of bad weather, or for just about any type of organisation, a failure of customer-facing technology and systems will trigger contact. Other events that can drive a surge in contacts are less the acts of God (or the technology gremlins), but more personally identifiable.

A colleague recently told me that lots of financial services and utility firms’ contact centre planning managers live in dread of an unhelpful mention or piece of consumer advice from Martin Lewis on breakfast TV!

Closer to home, we are all familiar with the confusing marketing email campaign, changed app or IVR menu options or a competitor’s service failure – all of which encourage customers to make contact, service levels to plummet and customer experience to degrade.

And that’s the important thing. As we all know, peak demand is notoriously hard to manage operationally

- Short-term extra staffing is difficult to resource and – especially with growing customer management complexity – quality in the short-term will rarely match that of existing staff

- Asking existing staff to repeatedly work overtime can sap enthusiasm and goodwill

- Degraded service levels can lead to repeated contacts across multiple channels, as well as post-contact process backlogs

But the longest-term impact is on your customers, who will remember their personal experience of failure demand, lengthy wait times and delayed resolutions long after the end of the peak season.

Can you defeat the peak?

As already mentioned, the traditional Christmas peak seems to be diminishing for a variety of reasons including:

- Online retailers are increasingly managing to automate or self-serve most simple query types

- For many consumers the cost of living crisis not only continues, but is worsening – with the Office for National Statistics (ONS) reporting a 0.7% fall in retail sales in October and an increase in the energy Price Cap due in January. Which means that for lots of customers Christmas is a reduced affair

- The institutionalising of Black Friday (or, more accurately, a ‘Black Friday period) serves to smooth the retail impact of Christmas

People working flat-out in retail–focused contact centres right now may smile ruefully reading that, because for them the Christmas peak is still a big deal, but it’s definitely typically less than it used to be.

So, what about other ‘structural’ peaks? We’re all a bit weary of reading about what AI might do for us, but the advent of affordable, scale data analytics and manipulation tools can make a real difference. If an organisation suffers under the long-term impact of initial ‘lumpy’ customer acquisition, annual price changes or contract renewal cycles, then proactive efforts can be made to test and flex communications and offers to best serve both retention and ‘contact smoothing’.

Spontaneous peaks sound like, by definition, they can’t be combatted. Well, up to a point, but a lot of unintended consequences can be better understood. And if colleagues and business partners understand the cost and customer experience impact of their actions then that can be a game-changer. If colleagues regard the contact centre function as fixed cost of doing business, then they will have little incentive to help influence its demand.

Although it’s often easier said than done, ensuring the contact centre has representation and a voice in planning decisions helps guard against ill-timed, confusing or unsettling communications, offers and changes in proposition. In many organisations, the contact centre is closest to the customer base and so best placed to anticipate unintended impacts and customer responses.

Can tech help?

Of course, if you can’t avoid a planned or unanticipated surge in contacts, technology can help you cope. Appropriately deployed technology will help reduce handling time, allow for more self-service and make your frontline advisors’ lives easier – at any time of the year.

But tools to specifically help you manage peak volumes include:

- Queue-buster tools, which allow queuing callers to request a call-back instead

- Visual IVR, which can help steer customers from live calls to a digital self-service option, if appropriate

- Rapid analysis of contacts received to update online guidance, FAQs and your chatbot

And, of course, outsourced contact centre resource can be invaluable in helping you handle an immovable peak.

Your peak experience

What’s your peak experience? Have you found that the traditional Christmas peak is diminishing – or is it just moving to different times?

Would you like to discuss the tools and techniques that are available to both reduce peak surges and better equip you to handle them? Then get in touch, we’d love to chat.

There are several universal truths, one of which is that we all have at least one subscription! Though I think that if we were asked to list all the things we pay a monthly or annual fee for we would probably come across some we’d forgotten about. We questioned how many subscriptions we have that you may not feel we’re getting value from?

Another consideration is that even if we’ve not been using our Netflix, Disney+, AppleTV, or whichever service one as much as we’d like, we may be holding onto the knowledge that we will likely binge some boxsets over the festive period and how many of us then realise we are all subscribed to Amazon Prime and other subscriptions may have been unnecessary.

A third is that we are often encouraged to review our discretionary expenditure in January and cancel any that we don’t need or to look for a better deal.

It is always good to speak with experts in a field to understand how these elements all play out, Jonathan West is Client Development Director at Step Change Outsourcing and knows only too well the first-hand challenges of a subscription-based business model having led the Sky Business Division as National Sales Manager and Head of Indirect (Consumer) Channel at Three. Simon Kissane is highly experienced in delivering CX and Contact Centre Performance Improvement having supported a number of interim positions and extensive experience as a Head of CX and Operations in the mobile and broadband space.

What does the data tell us?

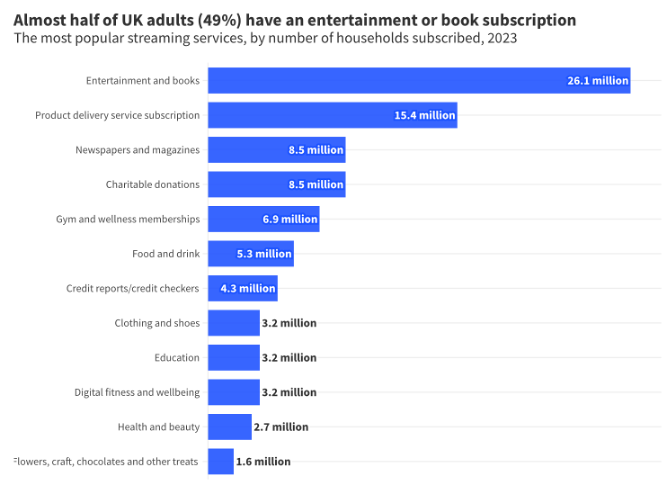

Data from Barclaycard in 2020, Whistl in 2022 and from Statista suggest that on average a UK household has 8 subscriptions ranging from streaming services to food kits, healthcare and pet products.

Finder.com suggests 2023 research shows 79% of UK adults (42 million of us) have at least one subscription service. However 23% of us feel these services are too expensive and 51% would be willing to cut that subscription to save money. Some research data which claims that we are spending an average of £500 each annually seems to focus on streaming services.

Further subscriptions which saw significant growth during the pandemic were the subscription box services. Whistl report an 18.9% year on year growth in in in the UK in their reports and referencing data from the Royal Mail in stating the market will be worth £1.8bn in 2025.

Whilst a little dated, the Whistl report shares some insights around key metrics for subscription boxes, their data suggests,

- 81% of households have at least one box subscription

- average spend of £52 per month in 2021 with annual spend to £620

Those subscriptions typically last 9 months

- 40% of us subscribe for convenience and 55% to save time

- 74% wish that companies made it easier to manage subscriptions

“how likely they would be to cancel their subscriptions if they were to increase slightly in price”

Clearly the different types of subscription are driven by differing motivations. Time and convenience are a key element, howeverthe value of the subscription is a vital consideration, too.

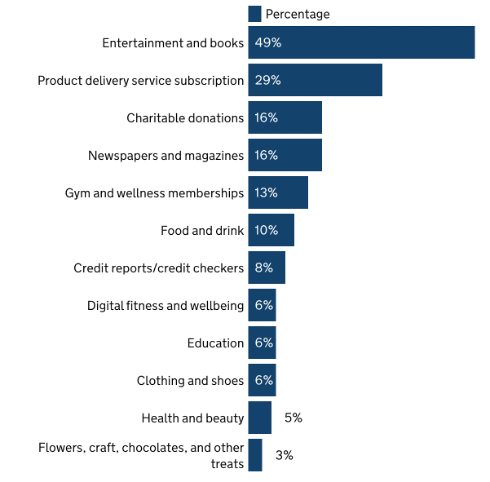

Data from the Department for Business & Trade, published in April 2023 (based on research with 2,000 UK adults conducted by Opinium Research in November 2021) showed the following level of subscription holdings:

Respondents were asked the critical question as to their expected behaviour if prices were to increase and unsurprisingly, they were more likely to consider cancellation as listed below by subscription type (key sectors):

- 79% Food & Drink

- 76% Digital fitness and wellbeing

- 73% Health and beauty

- 66% Flowers, craft, chocolates and treats

- 64% Entertainment and books

- 64% Product delivery services

- 38% Charitable donations

Subscriptions to telephone and broadband services don’t seem to appear in the data. Perhaps they have ‘crossed the line’ into the utilities space? Digital connectivity may have become a physiological need, in the words of Maslow even. This seems fair considering that we all need data connectivity to live our day to day lives today.

But if we consider for a moment the broadband and fixed landline space, the regulator Ofcom has been busy making changes in the past few months that could impact the sector. On this basis, have sensitivities around price and service ever been so important to that sector – and are there considerations that can be applied across all subscription markets?

So, what does that mean to the customer contact community?

Well, there is a chance that a broken process earlier in the year – which made your contact centre hard to deal with – is going to result in customer retention issues when that customer reaches the end of their contract.

Or that automation process that you are thinking of implementing due to pressure from the business to reduce operational costs needs to be just right, or else it may result in driving customers not only to self-service, but away from your business altogether.

It could mean that you have an amount of retention work to do, or that you need to start thinking about additional marketing spend next year to attract new customers to maintain your numbers, never mind growing the customer base.

For many customers managing, their relationships digitally – like with NOW TV, for instance – should be easy. But my personal experience of trying to cancel a NOW subscription over the weekend was time-consuming and frustrating:

- Cancellation was not possible via the App which means logging onto my account,

- then being asked no fewer than 6 times whether I really wanted to cancel,

- and being presented with offers and discounts to retain me.

This feels like an example of when an understandable business desire to create a bit of friction has gone too far, turning off customers from coming back in the future.

However, the first that businesses with digital based relationships may know of my intent to cancel is when I’ve clicked on a box and my money stops the following month. Many will then commence an e-mail campaign, or outbound calling perhaps, to ‘win-back’.

One touch switching

The implementation of the Ofcom rules on one touch switching from September 12th enabled customers to move to a new provider with just one contact. This means that alternative network providers (alt-nets) – despite huge investment in their infrastructure – are now in a place where customers can simply walk away without having to contact them, similar to my cancellation of my NOW TV subscription.

The new provider manages the switching process and the incumbent has little option but to go with it. Are the developing the expectations that customers will have about the ease of cancelling their telco and broadband subscriptions being mirrored across other services?

Additional considerations

In our discussion, Simon, Jonathan and I also considered whether there is a clear role for NPS in customer retention and operational performance. This was a topic which was discussed also on a Scorebuddy webinar that I supported, recently. With the level of insight available from the contact centre, do you really still need to ask the question around likelihood to recommend a product or/service? It could be that you can see this through all the other data and insights at your disposal. However, you need to ensure that you have the time and knowledge to implement the changes needed, which is where businesses can fall short.

“CX has never been so important, moments of truth matter and there is a need for experience and empathy”

When it comes to growing any form of subscription business, there is a clear need to balance acquisition with the realities of ongoing customer service. The work of retention and win-back teams should not be underestimated, but if you get the customer service right then retention is less likely to be needed.

Scaling a business to cope with customer demands can be challenging. The transition from small in-house operations with wider departments helping where they can in supporting customer needs in those moments of truth (when something hasn’t been delivered as promised) can take people away from their roles in the wider business and risk future growth ambitions. Where customers have bought/subscribed via a click then the first time your team speak with them could be at the point of disconnection and considering the costs of developing your business or network, there is a need to maximise customer lifetime value.

When growing a business and a contact centre team, you need to ensure that you are properly supporting and developing your staff. As businesses grow it is not just customers numbers where retention may become a challenge. With Simon and Jonathan I discussed these challenges around recruitment and training, this is where we have seen outsourcers taking the load, so that “you do you and let the outsourcer do the heavy lifting”.

Is your customer contact approach fit for purpose?

With the potential challenges of growth and increasing costs in 2025 from minimum wage and national insurance increases ahead, maybe it is time to review where you are on your journey and whether there are opportunities to optimise current operations – through either process review or implementation of new contact centre technology?

Perhaps you’ve reached a point where you need additional support from an outsource partner who has walked this path before and can help you grow customer numbers and/or evolve to the next stage of your growth, whether that is with

- acquisition activity

- out of hours support,

- peak capacity or

- end to end customer service which allows you to focus on your core activity and growing your business.

You may have an existing operation that requires review, but whatever your customer contact challenge feel free to contact us so we can talk it through.

At Customer Contact Panel we have extensive experience in supporting our clients in identifying the right fit solution for their business.