The year ahead promises to be a turning point for customer contact. AI and automation are advancing at an unprecedented pace, yet businesses are facing economic uncertainty, rising costs, and rapidly shifting customer expectations. The pressure to adopt new technology and improve service levels means leaders must make bold, strategic choices.

At the end of 2024, we held our annual ‘Big Conversation’ to uncover key challenges for the year ahead and hear directly from cross-sector contact centre leaders about how they’re addressing them. These insights have shaped our latest whitepaper, 2025: A Year of Difficult Conversations?. In this paper, we explore those challenges in detail and outline priorities and solutions. One theme dominates: success in 2025 will depend on how well businesses navigate ‘difficult conversations’—both within their organisations and with their customer and suppliers.

How can you make the right tech decisions in the age of AI?

AI can be a powerful tool for improving operational efficiency. However, the reality is stark: according to Gartner, 80% of AI projects fail, which is twice the failure rate of non-AI projects. Despite this, the pressure in the boardroom to “do something with AI” is stronger than ever. The key question isn’t whether to implement AI, but how to do so strategically and safely.

When AI is implemented well it can deliver valuable results. But the risks of adopting this still fledgling technology can be significant—wasted investment, damage to reputation, and disruption to operations. The businesses that succeed with AI will be those that clearly define its use cases, align them with business goals, invest in high-quality, integrated data, and ensure that AI complements human expertise rather than replacing it. AI has the potential to be a game-changer—but only with careful consideration.

How do we meet economic, regulatory and resource challenges?

While grappling technology decisions, contact centres also face ongoing economic headwinds, regulatory challenges and a 15% decrease in headcount since 2019.

As businesses introduce new contact channels and explore innovative solutions, the fundamental customer need remains unchanged—a fast and effective response

But despite the rise in self-serve and co-pilot automation, customer satisfaction in the UK has declined. While automation is handling simple queries, agents are left to tackle only the most complex cases with fewer resources overall. Agents have little respite from more intense interactions and operations have fewer agents available. Even with future AI implementations, research predicts relatively modest headcount reductions of a maximum of 15%.

What’s more, in 2025, UK contact centres will need to absorb and manage an 8-10% increase in agent costs. Meanwhile the ongoing cost of living crisis means customers remain stressed and regulatory requirements add to operational demands —all against the backdrop of a muted growth forecast and ongoing economic challenges. No wonder things feel pressured.

Consequently, leaders are exploring various ways to optimise their service models, including offshoring, automation, or refining their approach.

Getting It Right: From Good to Great

One thing is clear. Transformation isn’t optional—it’s essential. The businesses that thrive in 2025 will be the ones that take a proactive approach. The most successful organisations will define clear, achievable AI use cases, align data, technology, and human expertise, prioritise governance, security, and compliance, and engage employees in AI adoption from the start.

The path ahead will present both opportunities and challenges, but with the right strategy, tackling today’s difficult conversations can pave the way for a stronger competitive edge tomorrow.

Read our paper for more detailed analysis of the challenges, but more importantly, how to tackle those challenges and put in place a positive programme of change.

The Whitepaper is free to download and immediately accessible below. We would love to hear your experiences too. Follow us on LinkedIn to share your thoughts.

As part of our recent webinar with Zoom, we discussed how a brand is far more than just a name or a product; it’s the sum of what the public thinks, feels, and believes about a business. It’s built on both tangible elements like product features and packaging, and intangible ones like emotional connections, marketing, and even independent conversations beyond a brand’s control. Delivering on the brand promise—a commitment to customers about what they can expect—is therefore paramount to success. But when businesses fail to deliver, the consequences are costly and far-reaching.

Businesses increasingly turn to outsourcing partners to support customer service and contact centre operations. However, ensuring these partners can uphold the brand promise is critical. By exploring the importance of a brand promise, the risks of failure, and the value of the right outsourcing partner, organisations can better position themselves for success.

What is a Brand Promise, and why does it matter?

A brand promise communicates the essence of a company’s mission, values, and purpose. It represents what customers should expect when interacting with the business. For example, Red Bull’s brand promise encapsulates the idea of “freedom” and giving “wiiings” to people and ideas. They successfully integrate this into their sponsorships of extreme sports and events, translating their values into tangible experiences that reinforce their mission.

Delivering on this promise consistently builds trust, fosters advocacy, and encourages loyalty. Customers who feel a brand aligns with their expectations and values are more likely to:

- Pay a price premium for products and services.

- Recommend the brand to others, driving organic growth.

- Maintain long-term relationships, increasing customer lifetime value.

The cost of failing to deliver on the Brand Promise

When businesses fail to meet expectations, trust is eroded. Research reveals that 31% of customers are willing to pay more for excellent service, but failure to deliver service quality results in significant revenue loss. Poor service costs UK businesses an estimated £7.3 billion per month in employee time spent resolving issues. Additional consequences of falling short on service delivery include:

- Damaged Reputation: Dissatisfied customers share their negative experiences online, influencing potential buyers before they even engage with the brand.

- Increased Marketing Costs: Companies must invest heavily to rebuild trust and mitigate reputational damage.

- Lower Customer Lifetime Value: Customers experiencing poor service are unlikely to return, reducing their overall spending potential.

Service delivery directly underpins the price premium brands can command. Without great service, even the best product offerings lose their appeal—and profitability.

Managing customer experience at scale

The challenge for brands lies in scaling customer experiences while maintaining human, natural, and supportive interactions. Customers expect more than just advanced technology; they demand seamless, elegant, and intuitive service that delivers the right information at the right time. Poor customer satisfaction—as seen in the UK Customer Satisfaction Index, which recently dropped to its lowest point since 2015—reflects the critical need for investment in experience.

To understand how service impacts decision-making, organisations should explore:

- Price Premium Expectations: How much more are customers willing to pay for exceptional service?

- Perceptions of Good Service: What defines great service from a customer’s perspective?

- Service’s Influence on Purchasing Decisions: How does a seamless experience drive loyalty and sales?

Leveraging outsourcing to deliver consistent experiences

Outsourcing has been a transformative tool for businesses over the past 40 years, enabling growth, transformation, and improved customer service outcomes. To realise these benefits, organisations must select their outsourcing partners carefully, considering solution fit, commercial alignment, and cultural compatibility.

- Solution Alignment: The partner’s solution must match the company’s specific needs, including sector expertise, channel coverage, geography, and appetite for automation. Proven experience with similar challenges can offer peace of mind.

- Commercial Mechanisms: The cost of service should account for the entire support structure—not just front-line agents—to ensure scalability and sustained quality. Contracts should incentivise mutual success and allow for evolving requirements over time.

- Cultural Fit: Partners must embody the company’s values and approach, representing the brand authentically to customers. Building a genuine partnership requires mutual respect and clear processes for engagement.

Mitigating outsourcing risks

To minimise risk, businesses must define clear objectives, success measures, and realistic timelines before outsourcing. Processes should be fully documented, and knowledge transfer planned meticulously to ensure a smooth transition. Continuous communication with the outsourcing partner is essential for alignment.

Outsourcing also enables access to specialised skills, flexible scaling, and cost efficiencies, all of which support business growth without overextending internal resources. The key is selecting a partner who acts as an extension of the organisation’s team—not just a supplier.

Conclusion

Delivering on the brand promise is a strategic imperative that builds trust, drives loyalty, and sustains growth. Poor service is not just an operational issue but a risk to brand value and viability. Businesses that prioritise exceptional customer experiences can protect and enhance their reputations, achieving sustainable success.

Outsourcing, when approached thoughtfully, can be a powerful enabler of these outcomes. By choosing the right partner and fostering a collaborative relationship, organisations can mitigate risks, enhance service quality, and uphold their brand promises with confidence.

At Customer Contact Panel (CCP), we’ve witnessed first hand how these factors are influencing decision-makers, especially CX leaders and CFOs. If you’re in the midst of making an outsourcing choice, you’ve probably got one of the following on your mind.

Growing Customer Demands: Meeting High Expectations

It’s not just about answering calls anymore. Customers want fast, personalised, and empathetic interactions that feel seamless and aligned with your company values. This means businesses must be more careful than ever when choosing an outsourcing partner. A BPO’s cultural fit with your company is crucial—they need to speak your tone, align with your brand, and uphold the level of service your customers expect – all of which take time which you don’t have. So, companies are scrutinising potential partners more closely, ensuring they’re a perfect match.

Technology: The New Wild Card

Right now, you’re being asked to do more with less or deliver a better service with the same budget. With inflation, high interest rates, and currency fluctuations, offshoring doesn’t feel like a financial guarantee anymore. Add in automation—think AI tools and chatbots – and CFOs are starting to wonder if tech could be the silver bullet to that beast of a budget. Whilst AI and Automation can scale fast, they can come with hefty initial costs. Businesses are now weighing their options:

- Do they stick with outsourcing (onshore, nearshore, or offshore)? or

- Do they double down on tech?

It’s a tough decision. Get it right, and they could boost customer loyalty; get it wrong, and it might lead to a backlash.

ESG: Outsourcing in a Politically Charged World

Outsourcing is no longer just about cutting costs; it’s also about navigating complex ethical and political waters. With Keir Starmer pushing for stricter ESG (Environmental, Social and Governance) standards, businesses are questioning their outsourcing partners, especially if those countries are known for poor labour practices or environmental issues. Throw in political instability and outsourcing now feels like a risky gamble. Operations could grind to a halt at any time, and businesses can’t afford that.

On top of that, data security is tighter than ever. With the UK government’s more stringent regulations, especially for industries like finance and healthcare, outsourcing is becoming bogged down in compliance red tape. A single data breach could ruin a brand’s reputation and customers’ trust—so finding a partner who understands data security is more important than ever.

Lastly, with the UK’s £22 billion budget shortfall and a focus on reshoring jobs, companies are balancing cost savings against their political and ethical responsibilities.

How CCP Makes Your Life Easier

At CCP, we get it – outsourcing feels complex. But we’re here to simplify it for you. We help businesses make smart, informed and equitable choices through services such as:

- Partner Matching: We connect businesses with a handpicked network of pre-vetted outsource partners (220+ partners infact), cutting down on the time and risk of finding the right partner.

- Cultural Fit Analysis: We ensure your outsourced team aligns with your brand’s values and service style, so there’s no misstep in tone or approach.

- Technology Sourcing: We know how difficult it is to cut through the sales patter and find the right tech for your customer contact needs. Well look no further, we have a network of 120+ pre-vetted and audit technology partners – who will get right to the point.

The Bottom Line

Outsourcing decisions are taking longer now because the stakes are higher. Customers expect nothing less than excellent service, and businesses are being much more careful about who they partner with. But with the right approach, outsourcing remains a powerful tool.

At CCP, we guide businesses through the process, ensuring they find the right fit, reduce risks, and build lasting partnerships. In fact, 93% of CCP’s clients maintain long-term relationships with their outsourcing providers – proof that our approach works.

With CCP by your side, navigating the increasingly complex outsourcing landscape is much smoother, helping you make the right decisions for today’s customer demands and tomorrow’s success.

It’s often said that everyone has an opinion. In the same way, most of us feel like every contact centre has a seasonal peak (or more than just one). Most often the peak comes in the run-up to Christmas, with a secondary surge in the New Year. But – even for consumer retail – is the contact centre Christmas peak no longer quite the scary summit it once was?

Just last week, the CCP team heard from an outsourced contact centre partner with deep capabilities in the retail and delivery sectors. It was having its traditionally busy pre-Christmas peak season – but only because it had gained a new client. Otherwise, 2024 contact volumes are notably down on previous years.

So, have we passed peak peak?

(Here I should say a big ‘thank you’ to Rochelle Weinstock and Nev Doughty for the fascinating chat I had with them the other week about a whole series of CX topics and challenges, including the Christmas Peak, which inspired this post).

Types of peaks

Broadly, there are two types of customer contact demand peaks:

- Structural Peaks

These might be the result of predictable external factors, like Christmas. Or internal factors that tend to drive customers to make contact, such as billing or renewal cycles, pricing increases and so on

2. Spontaneous Peaks

These are, by definition, not predictable and can’t accurately be planned for with any degree of confidence. For an ecommerce or insurance firm this could be the impact of bad weather, or for just about any type of organisation, a failure of customer-facing technology and systems will trigger contact. Other events that can drive a surge in contacts are less the acts of God (or the technology gremlins), but more personally identifiable.

A colleague recently told me that lots of financial services and utility firms’ contact centre planning managers live in dread of an unhelpful mention or piece of consumer advice from Martin Lewis on breakfast TV!

Closer to home, we are all familiar with the confusing marketing email campaign, changed app or IVR menu options or a competitor’s service failure – all of which encourage customers to make contact, service levels to plummet and customer experience to degrade.

And that’s the important thing. As we all know, peak demand is notoriously hard to manage operationally

- Short-term extra staffing is difficult to resource and – especially with growing customer management complexity – quality in the short-term will rarely match that of existing staff

- Asking existing staff to repeatedly work overtime can sap enthusiasm and goodwill

- Degraded service levels can lead to repeated contacts across multiple channels, as well as post-contact process backlogs

But the longest-term impact is on your customers, who will remember their personal experience of failure demand, lengthy wait times and delayed resolutions long after the end of the peak season.

Can you defeat the peak?

As already mentioned, the traditional Christmas peak seems to be diminishing for a variety of reasons including:

- Online retailers are increasingly managing to automate or self-serve most simple query types

- For many consumers the cost of living crisis not only continues, but is worsening – with the Office for National Statistics (ONS) reporting a 0.7% fall in retail sales in October and an increase in the energy Price Cap due in January. Which means that for lots of customers Christmas is a reduced affair

- The institutionalising of Black Friday (or, more accurately, a ‘Black Friday period) serves to smooth the retail impact of Christmas

People working flat-out in retail–focused contact centres right now may smile ruefully reading that, because for them the Christmas peak is still a big deal, but it’s definitely typically less than it used to be.

So, what about other ‘structural’ peaks? We’re all a bit weary of reading about what AI might do for us, but the advent of affordable, scale data analytics and manipulation tools can make a real difference. If an organisation suffers under the long-term impact of initial ‘lumpy’ customer acquisition, annual price changes or contract renewal cycles, then proactive efforts can be made to test and flex communications and offers to best serve both retention and ‘contact smoothing’.

Spontaneous peaks sound like, by definition, they can’t be combatted. Well, up to a point, but a lot of unintended consequences can be better understood. And if colleagues and business partners understand the cost and customer experience impact of their actions then that can be a game-changer. If colleagues regard the contact centre function as fixed cost of doing business, then they will have little incentive to help influence its demand.

Although it’s often easier said than done, ensuring the contact centre has representation and a voice in planning decisions helps guard against ill-timed, confusing or unsettling communications, offers and changes in proposition. In many organisations, the contact centre is closest to the customer base and so best placed to anticipate unintended impacts and customer responses.

Can tech help?

Of course, if you can’t avoid a planned or unanticipated surge in contacts, technology can help you cope. Appropriately deployed technology will help reduce handling time, allow for more self-service and make your frontline advisors’ lives easier – at any time of the year.

But tools to specifically help you manage peak volumes include:

- Queue-buster tools, which allow queuing callers to request a call-back instead

- Visual IVR, which can help steer customers from live calls to a digital self-service option, if appropriate

- Rapid analysis of contacts received to update online guidance, FAQs and your chatbot

And, of course, outsourced contact centre resource can be invaluable in helping you handle an immovable peak.

Your peak experience

What’s your peak experience? Have you found that the traditional Christmas peak is diminishing – or is it just moving to different times?

Would you like to discuss the tools and techniques that are available to both reduce peak surges and better equip you to handle them? Then get in touch, we’d love to chat.

Everest Group have been in the industry since 1991 and are a specialist research firm producing c. 2,500 reports per year, these include their assessment of the state of the Customer Experience Management (CXM) market.

Through this latest report they estimate the CXM market to be in the region of between $112 and $114 billion of revenues in 2023 for work connected to customers looking for support assisted through digital or human channels. There is an expectation that revenues will, however, be flat through 2025.

However, this accounts for only one third of the market which if taking in-house operations into account would be c. $330 billion, which presents a continued opportunity for the outsource community.

Other highlights include views around channel adoption and predictions of the death of voice are still not coming to pass, when considering include both agent supported voice and conversational AI driven interactions then, 72% of revenues were still coming from voice-based activity in 2023.

The average number of FTE has reduced by 15% since 2018/19 in the 2022/23 report. We know this has been driven by automation, elimination activities, improvements in efficiency, deployment of technologies especially around agent assist. The impact of generative AI has clear contributed to the ability of agents to be more efficient and reduce AHT. However, a survey of over 200 enterprises showed that 20.6% expected no impact to headcount, the majority (37.3%) expected a moderate impact of 5 to 15% and the smallest proportion of respondents (14.3%) expected a significant impact of greater than 15%.

What are clients or prospects looking for?

What insights can we gather from the session that can be applied in our conversations?

- There is still a strong demand for voice

- Deal cycles are longer than they used to be (as we’ve heard in many discussions)

- Increased adoption of GenAI is happening

- There is a desire to develop strategic partnerships, with longer relationships to enable access to better solutions

- Cost optimisation including movement to offshore locations to balance costs remains a focus,

However, when it comes to locations the list of new ones for global English support is growing. More attention is being paid outside the traditional locations and people are talking more about sub-Saharan Africa. Whilst limited numbers have been signed so far, there is a clear interest here. This could be in part be due to people being keen to understand what talent will be needed in 3 years and what skills those people need should also be a consideration as potential clients are now asking these questions.

Priorities for businesses working with service providers still include looking for smart optimisation, operational efficiencies and the collation of insights and data that can inform decision making in the business.

There is a continued focus on the development of agent experience, driving staff satisfaction and making agent roles easier through the use of technology and GenAI to ensure that talent is retained within business, to the ultimate benefit of customer experience, of course.

What businesses want to know is how you can solve a specific problem or challenge. They are now less inclined to say “this is my volume can you staff to that” and more likely to say “this is the problem, how can we create better outcomes together?”.

Customer experience remains critical and there is a movement from delivering an OK experience at the lowest cost, to instead now looking at the end-to-end experience from marketing through the customer lifecycle and then back into the next phase of marketing.

The impact of technology?

As with all changes, consideration needs to be made as to what is appropriate for the needs of your customer. For example, the use of voice in sales environments means that there 82% of activity is still voice led, whereas in Tech support this falls to 61%.

Technology will be beneficial when used in the right contexts, modernisation of existing solutions, the ability to collate data to make decisions around both customer and employee experience, but it needs to be an enabler not just an offering. We need to be clear as to what problem you are using it to solve.

Some clients will forge strategic partnerships with suppliers bringing the right technology and people to solve an issue. Using an outsource provider can bridge the gap from the migration to emerging technologies as outsource partners have people with the skills, knowledge and experience to support that change and can flex staffing requirements as necessary.

Decision making, however, will take longer as a result of the impact of technology change across the wider organisation. Changing experiences using systems and using better data to bring a consolidated view and benefits across the wider organisation means that there will be more stakeholders in the decision making process and therefore it may take longer to make those changes – which could then contribute to the feeling that deals need to be longer in duration to ensure benefits have time to be realised

“Clients don’t want people just running around hitting things with a technology stick, they need to ensure that they consider the benefits”

Sector specific outlook

Healthcare has grown quickly last year and it appears it will continue to do so, Retail has again grown well this year and is forecast to grow faster in 2025, travel and hospitality whilst flat this year is expected to grow faster next year as the sector starts to look more at connected experiences using generative AI.

There is expected to be some reduction in headcounts in the Telco and Media space as providers look to squeeze costs and use technology to deliver savings.

Of course, the willingness of customers to engage with AI differs by sector. Healthcare and travel and hospitality have been among the slower adopters. As technology has moved faster, BFSI and Retail are embracing these changes too, with a focus on use cases to improve experiences and end to end solutions. Agent assist, post call automation and agent training are all areas where AI solutions are moving into production. Less progress has been made on knowledge management and least of all on the use of sentiment analysis.

Most progress has been made with transitioning to production, where there is a direct impact to the customer. The focus so far in the past 12 months has been to deploy Gen AI into “safe” internal use cases, initially.

Evolving expectations

Clients expect more than ever before from outsource providers. In terms of the top 5 capabilities / requirements, some themes are consistent with those that have always existed, however in some cases there may be more openness or need for support, especially when using new and evolving technologies.

- Uplifting quality

- Elevating customer experience

- Implementing new tools and technologies

- Productivity

- Ability to introduce new ideas

AI skilled agents who are supported by automation allowing them to be more efficient and effective and deliver better experiences as a result, is becoming a standard expectation. Future capabilities will include near real time voice-to-voice translation with minimal lag. The opportunities that this may present need to be considered, but this could support many clients, as a result there needs to be careful consideration.

If you wish to chat about or need support in any of the areas discussed then feel free to contact us.

There are several universal truths, one of which is that we all have at least one subscription! Though I think that if we were asked to list all the things we pay a monthly or annual fee for we would probably come across some we’d forgotten about. We questioned how many subscriptions we have that you may not feel we’re getting value from?

Another consideration is that even if we’ve not been using our Netflix, Disney+, AppleTV, or whichever service one as much as we’d like, we may be holding onto the knowledge that we will likely binge some boxsets over the festive period and how many of us then realise we are all subscribed to Amazon Prime and other subscriptions may have been unnecessary.

A third is that we are often encouraged to review our discretionary expenditure in January and cancel any that we don’t need or to look for a better deal.

It is always good to speak with experts in a field to understand how these elements all play out, Jonathan West is Client Development Director at Step Change Outsourcing and knows only too well the first-hand challenges of a subscription-based business model having led the Sky Business Division as National Sales Manager and Head of Indirect (Consumer) Channel at Three. Simon Kissane is highly experienced in delivering CX and Contact Centre Performance Improvement having supported a number of interim positions and extensive experience as a Head of CX and Operations in the mobile and broadband space.

What does the data tell us?

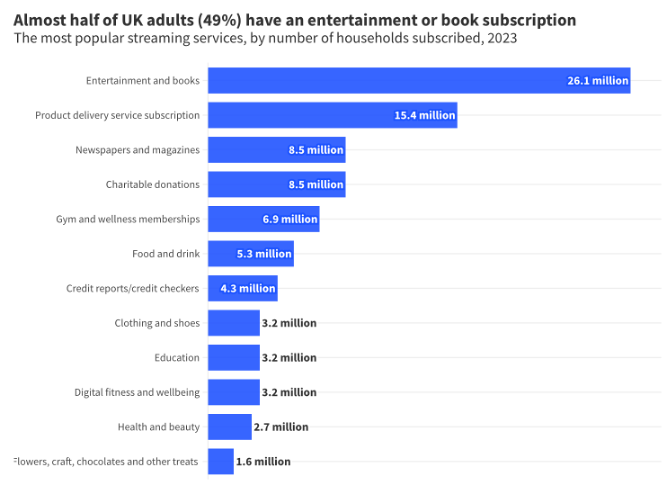

Data from Barclaycard in 2020, Whistl in 2022 and from Statista suggest that on average a UK household has 8 subscriptions ranging from streaming services to food kits, healthcare and pet products.

Finder.com suggests 2023 research shows 79% of UK adults (42 million of us) have at least one subscription service. However 23% of us feel these services are too expensive and 51% would be willing to cut that subscription to save money. Some research data which claims that we are spending an average of £500 each annually seems to focus on streaming services.

Further subscriptions which saw significant growth during the pandemic were the subscription box services. Whistl report an 18.9% year on year growth in in in the UK in their reports and referencing data from the Royal Mail in stating the market will be worth £1.8bn in 2025.

Whilst a little dated, the Whistl report shares some insights around key metrics for subscription boxes, their data suggests,

- 81% of households have at least one box subscription

- average spend of £52 per month in 2021 with annual spend to £620

Those subscriptions typically last 9 months

- 40% of us subscribe for convenience and 55% to save time

- 74% wish that companies made it easier to manage subscriptions

“how likely they would be to cancel their subscriptions if they were to increase slightly in price”

Clearly the different types of subscription are driven by differing motivations. Time and convenience are a key element, howeverthe value of the subscription is a vital consideration, too.

Data from the Department for Business & Trade, published in April 2023 (based on research with 2,000 UK adults conducted by Opinium Research in November 2021) showed the following level of subscription holdings:

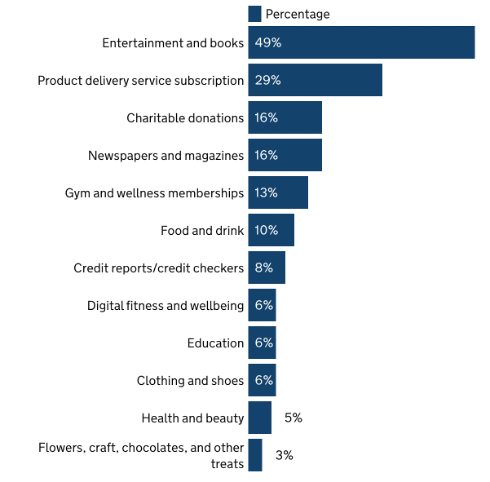

Respondents were asked the critical question as to their expected behaviour if prices were to increase and unsurprisingly, they were more likely to consider cancellation as listed below by subscription type (key sectors):

- 79% Food & Drink

- 76% Digital fitness and wellbeing

- 73% Health and beauty

- 66% Flowers, craft, chocolates and treats

- 64% Entertainment and books

- 64% Product delivery services

- 38% Charitable donations

Subscriptions to telephone and broadband services don’t seem to appear in the data. Perhaps they have ‘crossed the line’ into the utilities space? Digital connectivity may have become a physiological need, in the words of Maslow even. This seems fair considering that we all need data connectivity to live our day to day lives today.

But if we consider for a moment the broadband and fixed landline space, the regulator Ofcom has been busy making changes in the past few months that could impact the sector. On this basis, have sensitivities around price and service ever been so important to that sector – and are there considerations that can be applied across all subscription markets?

So, what does that mean to the customer contact community?

Well, there is a chance that a broken process earlier in the year – which made your contact centre hard to deal with – is going to result in customer retention issues when that customer reaches the end of their contract.

Or that automation process that you are thinking of implementing due to pressure from the business to reduce operational costs needs to be just right, or else it may result in driving customers not only to self-service, but away from your business altogether.

It could mean that you have an amount of retention work to do, or that you need to start thinking about additional marketing spend next year to attract new customers to maintain your numbers, never mind growing the customer base.

For many customers managing, their relationships digitally – like with NOW TV, for instance – should be easy. But my personal experience of trying to cancel a NOW subscription over the weekend was time-consuming and frustrating:

- Cancellation was not possible via the App which means logging onto my account,

- then being asked no fewer than 6 times whether I really wanted to cancel,

- and being presented with offers and discounts to retain me.

This feels like an example of when an understandable business desire to create a bit of friction has gone too far, turning off customers from coming back in the future.

However, the first that businesses with digital based relationships may know of my intent to cancel is when I’ve clicked on a box and my money stops the following month. Many will then commence an e-mail campaign, or outbound calling perhaps, to ‘win-back’.

One touch switching

The implementation of the Ofcom rules on one touch switching from September 12th enabled customers to move to a new provider with just one contact. This means that alternative network providers (alt-nets) – despite huge investment in their infrastructure – are now in a place where customers can simply walk away without having to contact them, similar to my cancellation of my NOW TV subscription.

The new provider manages the switching process and the incumbent has little option but to go with it. Are the developing the expectations that customers will have about the ease of cancelling their telco and broadband subscriptions being mirrored across other services?

Additional considerations

In our discussion, Simon, Jonathan and I also considered whether there is a clear role for NPS in customer retention and operational performance. This was a topic which was discussed also on a Scorebuddy webinar that I supported, recently. With the level of insight available from the contact centre, do you really still need to ask the question around likelihood to recommend a product or/service? It could be that you can see this through all the other data and insights at your disposal. However, you need to ensure that you have the time and knowledge to implement the changes needed, which is where businesses can fall short.

“CX has never been so important, moments of truth matter and there is a need for experience and empathy”

When it comes to growing any form of subscription business, there is a clear need to balance acquisition with the realities of ongoing customer service. The work of retention and win-back teams should not be underestimated, but if you get the customer service right then retention is less likely to be needed.

Scaling a business to cope with customer demands can be challenging. The transition from small in-house operations with wider departments helping where they can in supporting customer needs in those moments of truth (when something hasn’t been delivered as promised) can take people away from their roles in the wider business and risk future growth ambitions. Where customers have bought/subscribed via a click then the first time your team speak with them could be at the point of disconnection and considering the costs of developing your business or network, there is a need to maximise customer lifetime value.

When growing a business and a contact centre team, you need to ensure that you are properly supporting and developing your staff. As businesses grow it is not just customers numbers where retention may become a challenge. With Simon and Jonathan I discussed these challenges around recruitment and training, this is where we have seen outsourcers taking the load, so that “you do you and let the outsourcer do the heavy lifting”.

Is your customer contact approach fit for purpose?

With the potential challenges of growth and increasing costs in 2025 from minimum wage and national insurance increases ahead, maybe it is time to review where you are on your journey and whether there are opportunities to optimise current operations – through either process review or implementation of new contact centre technology?

Perhaps you’ve reached a point where you need additional support from an outsource partner who has walked this path before and can help you grow customer numbers and/or evolve to the next stage of your growth, whether that is with

- acquisition activity

- out of hours support,

- peak capacity or

- end to end customer service which allows you to focus on your core activity and growing your business.

You may have an existing operation that requires review, but whatever your customer contact challenge feel free to contact us so we can talk it through.

At Customer Contact Panel we have extensive experience in supporting our clients in identifying the right fit solution for their business.

Connectors

I came across one of those at the weekend on Nick Clark of Boston Consulting Group’s Service Matters newsletter on Substack (which is always a good read and I’d recommend you subscribe to).

In this brief article, Nick highlights an often-forgotten factor in the (never ending?) quest to deliver seamless, omnichannel service. Whilst acknowledging that data and platforms are vital, he says we should focus on the ‘connectors’, that is the technologies or techniques that customers use to transition from one contact channel to another. We know they are vitally important. And unless they work well and with minimal friction for consumers they will be neglected, often undermining an organisation’s channel shift ambitions.

However, mapping their function and availability in customers’ service and support journeys is something that’s often only done late on in an extended programme of work. Or maybe not at all.

Nick describes the graphic we’ve re-used above as non-exhaustive, but it’s a great starting point and framework to use when seeking to understand how you currently support omnichannel service and how it could work better in the future.

The matrix is a simple concept, but it allows you to rapidly summarise what needs to be in place to allow your customers to pivot between channels – in a way that works for them (easy and intuitive) and you (transitioning data and context across channels, along with the customer).

Building that dynamic, customer-led view of how you can help customers shift channels will also help you better serve them within a single channel. As you develop scenarios and journeys, overlaid with an awareness of consumers’ real-world behaviours, you can better design quicker resolution and outcomes.

So, that’s connectors. A new term and concept to me, that I think I’ll be re-using a lot in the future, thanks to Nick Clark.

Connections

And connections? Creating valuable, effective connections is what Customer Contact Panel’s all about:

- Connections between you and your customers and prospective customers

- Connections between you and service and technology providers who can elevate your customers’ experience

- Connections between any of us who are interested in the world of the customer

Nick Clark has generously shared his insights and when we at CCP have what we think are useful connections, ideas and examples of CX success we’ll do the same. A lot of our challenges are shared and we’re at our best working together to meet them.

Want to explore how best to help your customers get the most effective service, through the channel and at the time of their choice?

Then get in touch, we’d love to chat.

When you assemble a room of people with extensive levels of contact centre experience, as we did for our event hosted at Sutherland Labs, you know from the noise levels over coffee there are going to be some great conversations! Add some fantastic speakers from our outsource and technology networks to share their views of the market and a lively, open dialogue around challenges and opportunities (new and old) will follow.

We are looking forward to continuing these conversations and scheduling another event. But in the meantime, how do we bring so much collective experience together in a short article that does justice to the quality of the conversations?

Navigating Business Decisions in a Rapidly Evolving Landscape

In the current environment, companies face a range of critical decisions, from implementing new technologies to fostering employee engagement. Despite knowing what needs to be done, many organisations struggle to translate that knowledge into actionable outcomes. This disconnect is often a result of inadequate systems, outdated training and coaching models, and an inability to adapt to change.

In our recent L&D survey it was apparent that there is a clear gap between knowing and doing. Results show that while employees understand their roles, there’s a significant disconnect between knowledge and execution. This is particularly evident in how businesses approach training, often relying on outdated, “once-and-done” programmes that fail to evolve alongside the changing work environment. As companies shift to remote work, many are noticing a reduction in employee loyalty and engagement, partially because of the lack of in-person interaction and relationship-building.

Addressing the Changing Needs: Evolving Training and Technology

To bridge this gap, organisations must rethink how they train their employees, particularly if they are to continue with a work from home or hybrid working model. Has enough been done to redesign training and refresher modules that better fit a virtual environment? Equally, more needs to be done to focus on continuous education rather than static, one-time courses which tick a box for compliance. Furthermore, conversational AI can be a powerful tool in reshaping learning; allowing employees to ask dynamic, evolving questions rather than relying on predefined solutions.

“Businesses recognise the correlation between staff development and brand reputation, but may not always apply the budget to ensure delivery”

AI offers the potential to unlock the true capabilities of people and data, but as we have said before is not a silver bullet. It can revolutionise business processes by supporting employees in their roles, reducing friction, and enhancing decision-making. AI can also help agents manage customer queries more efficiently, giving them access to foundational knowledge in real-time. However, the challenge lies in positioning AI correctly: not as a threat to jobs, but as a tool for augmenting human capabilities.

For example, AI’s ability to analyse customer intent and apply insights to guide agents through complex interactions can dramatically improve customer experience (CX). By properly integrating AI into business workflows, companies could potentially resolve the eternal challenge of moving from being seen as a cost centre to profit centre, unlocking new value opportunities across the customer journey.

Location strategy is still a consideration as the global market evolves. The outsourcing industry, particularly in sectors like fintech, IT support, and healthcare, appears poised for significant growth. We know countries such as South Africa have already emerged as strategic hubs for business services, offering talent and capabilities that align with the growing demand for multilingual and technologically adept service providers. Whilst there are valid concerns as to the capacity that remains available, with 33% unemployment in South Africa (60% for young people) as well as the wider continent opening for business, then combined with the capabilities of technology great opportunities remain available.

Overcoming Challenges in AI Adoption

While AI presents numerous opportunities, it also comes with significant challenges. Many process owners may be hesitant to adopt AI due to concerns about how it will impact their workforce and customer relationships. Meanwhile, senior leadership may be focused more heavily on the potential cost saving benefits. There’s a widespread misconception that AI will replace jobs, particularly in customer service. However, AI’s true value lies in assisting and enhancing human roles, not replacing them.

For businesses to adopt AI successfully, they need to:

- Align AI with company goals and culture: AI should be seen not as a technology investment, but as a strategic asset that drives both customer and employee experience.

- Shift from a cost-saving mindset to a value-driven approach: Technology shouldn’t be about cutting costs; it should unlock value, address problems at their root cause and improve service quality.

- Build the right business case: Secure buy-in from different budget owners by emphasising how AI can enhance outcomes across the organisation.

Aligning Metrics and Culture for the AI-Driven World

To fully leverage AI’s potential, cultural and operational changes are required. Business leaders need to:

- Align metrics with an automated world: Ensure that technology handles routine tasks, allowing people to focus on complex, human-centric work.

- Redefine the agent role: The agents of the future will need to deliver more value and possess different skills compared to traditional customer service roles.

- Foster a culture of continuous improvement: Embrace ongoing evolution, where AI serves to complement human skills and free up time for higher-value tasks.

- Focus on proactive engagement: Let technology handle the repetitive, allowing people to engage with customers in a more meaningful way.

- Encourage bravery in decision-making: Leaders must support bold decisions around AI investment to drive long-term success.

Rob Wiles, Zoom“AI is not the solution, it is a key to unlocking it”

Irrespective of delivery location, the future of CX delivery will increasingly rely on AI and automation to enhance customer journeys, optimise operations, and drive sustainable growth.

Transformation is never-ending. Businesses must approach AI and automation not as one-time projects but as ongoing evolutions. This requires understanding the unique challenges they face, aligning technology with business goals, and ensuring that AI enhances rather than replaces the human element.

With the right strategy, AI can unlock unprecedented opportunities for growth, helping companies stay competitive in a rapidly changing world. However, without the appropriate attention to employee experience, success will be illusory or limited.

Delivering the right experiences

At Customer Contact Panel we support organisations in delivering contact centres that match their ambitions. In a Deloitte Digital research articles from May 2024 it was cited that 55% of contact centre leaders reported that they didn’t meet their strategic goals in 2023 and 76% reported that their agents were overwhelmed by systems and information*.

If you are facing challenges meeting your strategic goals or fulfilling the ambitions you have for your people, customers or technology, we have the experience to support you. Just ask.

Running a contact centre can be tough and a real challenge, so it is always good to know you are not alone.

However, tapping into our teams experience in running and managing a contact centre operations over the past 25+ years, we thought we’d highlight the top 4 common contact centre challenges seen in centres today:

- Call Duration – this isn’t talking to agents about AHT, but inefficient process resulting in higher AHT is still an issue for many. Agent knowledge/competence could be part of the solution, however so could appropriate automation.

- Repeat Contacts – whether intentional (process requirement) or unintended as a result of unclear information these contribute to:

- Cost to serve

- Customer retention

- Agent frustrations

- Improve Service Levels – in recent years average speed of answer has increased, queries have become more complex and recruitment has become tougher!

- Understanding The Possibilities – Technology is evolving at pace and as a result it can be hard to understand the art of the possible. The CCP network has >120 technology and >220 outsource partners – so there’s plenty of options to find the right fit.

Are you facing similar challenges within your contact centre? Not sure where to start when it comes to finding the right fix? Weel look no further than CCP, we are here to provide both generous and equitable advice when it comes to your customer contact operations.

Click here to contact the team today.

Will changes for other businesses lead to a realisation that contact centres have been progressive in their approach and potentially increase the recruitment pool or will contact centre leaders need to make changes to become more competitive in recruitment of the best talent?

Perhaps we are more progressive in contact centres than we give ourselves credit for?

We’ve written before around the view that despite our collective best efforts, our industry can often have something of an image problem with those on the outside, and, unfortunately, for some who work in the sector as well, because of arcane processes that may have been applied by some managers.

Working in contact centres can be tough and is seen by many as an interim role as opposed to a career path. The use of terms like CX may make it a more noble cause, even if the gap between customer ambition and realities can seem large. However, (I hope!) many people reading this article will recall a journey from a stop-gap role to a ‘proper’ career, which has delivered job satisfaction, personal development, promotions and a level of reward which affords a quality standard of living and the attainment of life goals.

You may also reflect on the flexibility that working in contact centres may have afforded you in your life, initially from being in operations in which there were options as a result of:

- 7 days per week, which may have resulted in working a weekend day, but having time off in the week,

- 24/7 operations where dealing with something through the night resulted in lieu time at a convenient time

- Creating 4 day weeks with compressed hours to enable flexibility for your staff and ensure capacity where your customers needed it

- Split shifts (ok maybe not 25 years ago, when that meant going to work twice in the same day, but post pandemic with home working)

- Part time shifts which worked around the school run or after lectures

- The ability to work remotely and therefore mitigate communing time

So, perhaps when talking about flexible working and encouraging greater control over work-life balance we should already be seeing contact centres of a beacon of what can be achieved (even if that does sometimes mean rolling rotas to ensure that customers have access to support when they need it?).

But it doesn’t end there does it?

Contact centres – through necessity in some cases, of course – have embraced the real living wage and providing better rewards for frontline staff. However, the reality is that skilled contact centre agents may still be earning similar amounts to those in roles where there may be less stress or pressure. Self-service and automation mean there are less “easy” contacts and as customer expectations and levels of knowledge increase, the role does get harder. Put simply, there is more for agents to deal with now, when considering the complexity of queries and vulnerabilities of customers.

Admittedly, where costs are key and businesses are feeling pressure to manage the cost of customer service and acquisition, then offshoring has been the norm for some time. As we know, offshoring doesn’t necessarily reduce quality, but it takes hard work to get it right. The manufacturing sector had already followed this route, in many cases years earlier. Unfortunately, our industry faces more scrutiny for moving work out of the UK than others, it seems.

The same customer service ‘exceptionalism’ may also apply to automation, with a recent Gartner survey highlighting that 64% of customers would rather companies didn’t use AI in customer service delivery.

Out of necessity the industry will keep pace with changes to minimum wage, however there will be an inevitable impact to either the cost of the product or margins. In which case more innovative techniques will need to be adopted to maximise margins.

I’d like to think we’ve been pioneers in ensuring equality. When I see news pieces around gender and representation of women in boardrooms, I reflect on the fantastic female influences I’ve had through my career, senior management and directors who have shaped my career and given me opportunities to develop.

I believe that contact centres are (for want of a better term) unfortunately ahead of the changing employment curve. I say unfortunately as contact centres’ relative enlightenment can disadvantage other sectors. I don’t have access to contact centre-specific data on gender pay gaps. And though I assume a gap is still sadly probable, I would think it is relatively lower in contact centres, based on the skill, talent and mindset that we have in the sector,

UK Contact Centre Decision-Makers’ Guide 2024“Women hold about 41% of senior leadership positions within the UK contact centre industry”

So, could this be a new dawn of realisation?

We were discussing last week the same story in multiple newspaper articles around easyJet and their recruitment of people aged 50 and above for cabin crew roles, citing their life and communication skills as a key benefit to passengers and by extension their new employer.

The shift rotas offered the flexibility of working alternate weeks, for example, or four days on four days off (I recall that over 20 years ago in contact centres we called this a continental shift pattern). This type of recruitment should open up the ability to recruit people who previously decided to leave full time employment after the pandemic back into roles.

Admittedly, customer service at 35,000ft may have more appeal for some than dealing with a phone call or webchat concerning a utility bill, for example. However, in contact centres we recognise clearly that life skills and knowledge are of significant benefit to our customers and have been recruiting from all demographics for decades.

Michael Brown, Director of Cabin Services at easyJet“We tackle misconceptions about the job and broaden horizons for even more talented people looking for a new opportunity who can bring their wealth of life experience to the industry”.

We believe that we are well ahead of other sectors in our approach to working practices and rights. Undeniably, negative perceptions evoking the ‘dark satanic mills’ persist for many and horror stories from 20 years ago (and occasionally today) remain. But the contact centre industry is probably in a better place than we are given credit for.

We will however need to manage challenges as a result of changes to legislation around worker rights, there are likely to be changes in WFM that will need to be considered, potential impacts to payroll and management of holidays.

Additionally, there may be changes harder to identify on the surface – maintaining knowledge and communications when more people work compressed hours could be one.

We have the skills and tools ready to support altered employment practices and we’ve demonstrated time and time again that we can change when needed. If you are facing challenges maintaining employee knowledge and experience, managing performance metrics or even protecting a sustainable margin in your contact centre operations then you won’t be alone.

Gerard O’Hare, WorkNest Legal Director“Once seen as a modern-day mills and bastions of the overseer, contact centres should, rightly, be lauded and credited for leading the charge for innovative working practices such as the compressed hours working week, and flexible shifts around childcare responsibilities which the industry introduced at the dawn of the contact centre”.

We are here to help, just ask.

The Customer Contact Panel team is made up of contact centre professionals who have seen a number of challenges and changes in the sector over the past 30 years, we use our experience to support both in-house operations, those wanting to outsource and outsourcers to deliver contact centres that match their ambitions whether that be sales or service.

If you have a thorny challenge then we’d love to hear about it, we share our thinking and have supported fantastic brands in finding the right fit solution for their and their employees’ needs. We have over 220 contact centre partners and 120 technology partners, we don’t have favourites only right fits for your needs.