Since the launch of ChatGPT and subsequent proliferation of AI-driven technologies across the customer contact technology landscape, the pace of change has accelerated exponentially. From communication analytics, quality management and agent assist, to replacing IVRs with their omni-channel equivalents and real time translation services, the impact of AI on our industry has almost been as big as the invention of the telephone itself. Not only is this a source of organisational stress, are there implications for outsourcing and contract mechanisms?

While the telephone fundamentally changed human-to-human communication, AI technologies are transforming human-to-machine interactions. And given how we now communicate with each other, that can only mean that change is both permanent and ongoing.

This permanent change is putting increasing stress on organisations to restructure how they equip themselves to communicate with both their customers and their target market, irrespective of the sector they operate in.

We are seeing organisational stress in three areas:

- Understanding the impact of these changes across the customer and target market demographic

- Properly evaluating the ability of existing technology platforms to accommodate change and realign to new communication paradigms in the mid to long term

- Fully understanding the mid to long term commercial impact of bolt on technologies to deliver short term performance and cost reduction gains.

In helping organisations cope with these stress areas we see striking parallels to the changes seen when organisations first began to interact with customers remotely. The evolution which began in the 90s to get more value from data, media and communication spend resulted in specialist operational activity often being outsourced as few organisations had the specialist people, process or technology to support those functions as cost effectively as outsourced providers could.

As customer became core to operations and remote customer management became an operational necessity, organisations began to establish their own capabilities, leveraging existing data management infrastructure to control and drive insight. Customer contact levels boomed, the technology to enable customer contact saw similar growth and our industry was born as more organisations grasped the benefits of controlled and managed remote customer contact.

Considering those parallels, we ask “Should organisations be stressing themselves or does that same customer contact outsourcing industry ‘muscle up’ for this second cycle of permanent change to reduce organisational stress in the shape of Outsourcing 2.0, underpinned by end-to-end AI driven technologies and the accelerated levels of operational insight that provides?”

Observing change in the global customer contact outsourcing market

Outsourcing is a very broad church. Our global network of two hundred plus providers gives us a privileged view of the diversity of the services provided, service delivery and how services are contracted. Whilst industry pricing has generally reduced in real terms over time, the way that service pricing is presented has not really evolved that much, it has not been that complicated, clients have had a choice of:

- straight hourly rate,

- the hourly rate with outcome components,

- outcome with activity components and

- outcome alone.

Making money has not been that complicated either. As long as the effective revenue per hour outweighed the total known costs per hour, then outsourcers made money.

The outsourcers’ challenge has always been about packaging service and price to be more attractive than the nearest competitor. Of course, that global mind set has led to an incredibly diverse and attractive industry offering, but it is doing little to relieve the level of stress we see in organisations today. Especially as permanent change begins to impact on mid to long term business performance forecasts.

What we see in the global outsource community is the emergence of some clear lines of distinction between service offerings. Principally between those that have the capability (or plan to have the capability) to relieve mid to long term organisational stress and those that don’t. Whilst those customer contact outsourcers that don’t have (or don’t plan to have) this capability to de-stress, continue to be well placed to solve organisations’ immediate and short-term challenges, we have seen some significant levels of technology and skills investment towards an Outsourcing 2.0 capability, amongst those that can.

What we are not seeing enough of is an evolved, Outsourcing 2.0 contracting proposition. One that is equitable for both parties. A simple contract proposition that provides an upside for the technology and skills investment of the outsourcer and in return, long term risk and cost reduction for the client.

Striving to deliver an equitable position to accommodate permanent change

Our view of the customer contact world is that its typically the client that makes the decisions on how they want to automate customer contact to reduce friction and cost in their operations. We also understand that the client may also want to:

- know more about how changes in customer contact are going to flow through product and service delivery,

- be able to make active decisions on what those changes mean in terms of risk and profitability,

- identify service solutions that will de-risk their journey to deliver customer contact at lower cost,

- deliver value and benefits that justify the time, cost and effort in enabling process change

- potentially deal with specific customer use cases where they do not have the physical capacity or technical capability,

- do all this without compromising service delivery in terms of quality and data governance i.e. the regulatory and contracted controls supporting data privacy and data security.

We also recognise that the world of customer contact tech is changing faster than it probably ever has; and it’s hard to tell what the next few years will bring in terms of time saving and service enhancing technologies.

SaaS based technology is easier to deploy, easier to recognise ROI, is already impacting on the flow of low complexity tactical work into the global outsourcing industry. This trend is also evidenced by more work. being delivered via the client’s own technology, enabling them to leverage their existing back-end systems integrations and continue BAU without interrupting the established end to end data flows supporting their existing operational reporting and decision-making processes.

Whilst the outsourcer community is continuing to strive to deliver uncompromising value, to positively impact service delivery and comply with regulatory and contractual data governance, there is clearly an acknowledgment of the impact that customer contact automation brings to their core market.

Contracting to deliver mid to long term value by de-risking the transition to a permanent change in customer contact

Global outsourcing capability now has a firm dividing line across it. Those that have (or plan to have) the infrastructure and technology to deliver permanent change (2.0) and those that have not.

For those that have (or plan to have), we can see the opportunity for a new type of contracting relationship with clients. A contracting relationship that:

- de-risks the client from the turbulence of technology change whilst delivering the permanent changes we see in human communication and the impact that has on customer contact service delivery,

- will enable the outsourcer to deliver appropriate levels of automation without compromising the clients service objectives and targeted cost reduction when expressed as simply as a ‘cost per customer per annum’.

In the context of customer contact, clients find the idea of managing permanent change, de-risking the potential downside of getting that change wrong and doing that at a fixed and reducing cost very attractive. Especially when that contract properly considers how service quality is measured and underpinned as well as being directly linked to cost.

There are then two big variables in the client conversation that are both fundamental to a new contracting proposition.

One is the composition and contracting position of the legacy technology overhead that delivers existing levels of customer contact, especially how that customer engagement technology stack is connected into the ‘back office’ technology of the organisation.

The second is about existing costs. This is the client’s understanding of their current cost of managing their customers. Specifically, how that’s calculated especially in the context of a desire to express that as a ‘cost per customer per annum’.

Recognising the barriers to change

It is easy for us to oversimplify what we see as a new contracting paradigm. But we also recognise that the old contracting models don’t proactively and deliberately reduce the organisational stresses that put mid to long term business performance at risk.

Of course, some business verticals carry significant levels of technology debt. However, unless we explore, and explore deeply, what the possibilities are, then the weight of technology debt will drown organisations and fail as a lifejacket to guarantee ongoing survival.

Unless your technology is able to destress your organisation now, then the same technology stands little chance of keeping you afloat in the mid to long term.

Customer communication and customer contact management has changed permanently and is different from customer contact pre-the explosion in generative AI. This means new risk and new levels of risk for both client and the customer contact outsource communities. Our view is that contracting between the parties needs to change fundamentally.

Outsourcing 2.0 offers a mid to long term view of how both client and service provider can benefit whilst reducing risk on both sides. By looking at contracting differently, both parties can focus on their core strengths and experiences to set and deliver against service goals and commercial objectives. To do that mutually establishing, expressing and agreeing the existing technology stack directly supporting customer engagement and the cost per customer per annum to deliver growth and service objectives.

What next?

What are your thoughts on the future of customer contact outsourcing contracts? Do you think we’re thinking along the right lines, or have we underestimated the complexity of clients’ current position, especially in the context of technology debt? Whether you’re a client or service provider we’d love to hear what you think.

Say it quietly if you like, but businesses are grown and maintained through increases in customer numbers and/or customer value. Undoubtedly cost management is also a critical factor, but ultimately sales and retention activity that provides topline growth is critical to ongoing success and business value.

We all know that the chances of winning or retaining a customer are increased when you provide a great product or service. And that those who deliver, not just on price but perceived value, are in prime position to pick up customers from competitors when they do not.

Yet many businesses are focused on the potential cost savings that could be achieved through AI and automation. Have they have lost sight of the potential benefits of delivering a personalised service and those golden opportunities to encourage a customer to buy more or stay for longer?

Are you getting the best sales through service opportunities from AI and automation?

There are two key scenarios that could be playing out for many organisations, both B2B and B2C. Either of which could be limiting sales success:

1. The technology is doing great stuff

Customers are getting the service that they need in the moment they need it. Which means the brand is working on the assumption that because they’re well-served, they will come back to buy more. However, they are not engaged with these customers, they are simply dealing with their admin when they need to and as a result are being passive in their habits. This may work for on a number of levels, and it is reducing the cost to serve. However, is this a step away from brand bypass, as ultimately a gap in the connection with customers will result in them moving on when they see a better offer?

2. The technology isn’t hitting the mark

Customers are trying to resolve their issues, but are struggling. The automation or self-serve models don’t provide the right options and/or have no ‘way out’ for customers and as a result they become frustrated. So at the first opportunity, they are going to look to an alternative brand.

The examples are out there in key sectors.

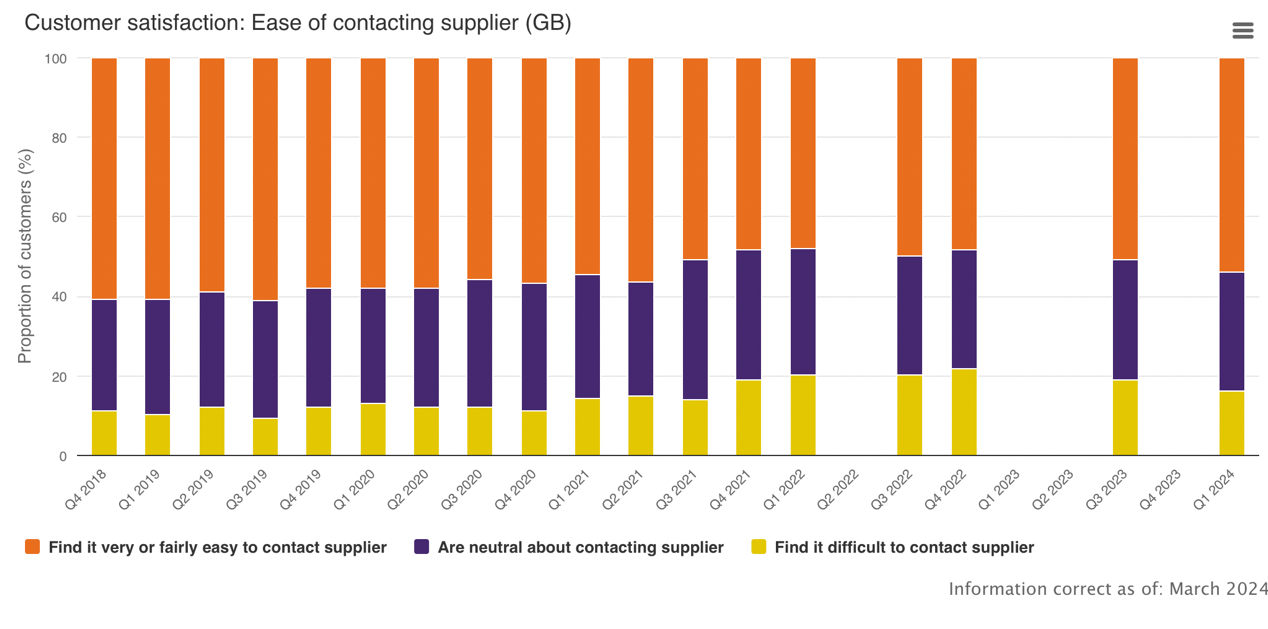

Ofgem March 2024 data

Harder to contact and less satisfying to deal with?

Despite and improving picture, the latest Ofgem data shows that 16% of customers find it difficult to contact their supplier, up from the low of 10% in Q1 2019. Meanwhile, the same Ofgem data suggests that overall satisfaction with customer service across the energy industry currently sits at 66%, down from the peak of 74% seen in Q2 of 2020.

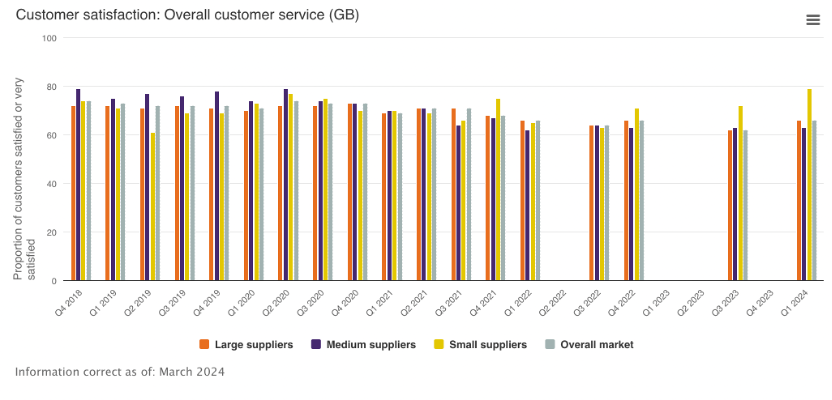

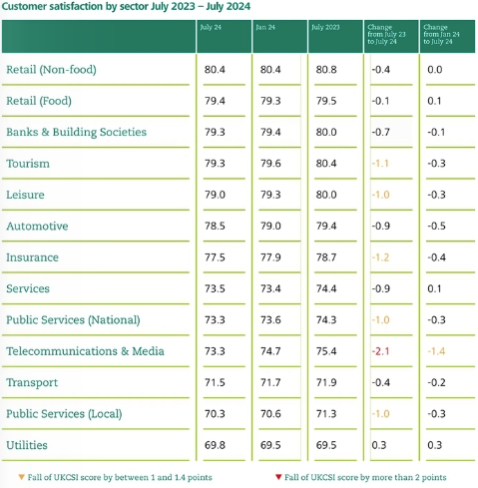

What’s more, the latest UKCSI data shows utilities performing the poorest with a score of 69.8. Telecommunications and Media brands are doing a little better at 73.3 (though down from January’s 74.7), but are still some distance short of the podium positions achieved by Retail (non-food) at 80.4, Tourism at 79.3 and Banks & Building Societies at 79.3. However, we can see drops in satisfaction across the board.

Could automation be contributing to those less satisfying experiences?

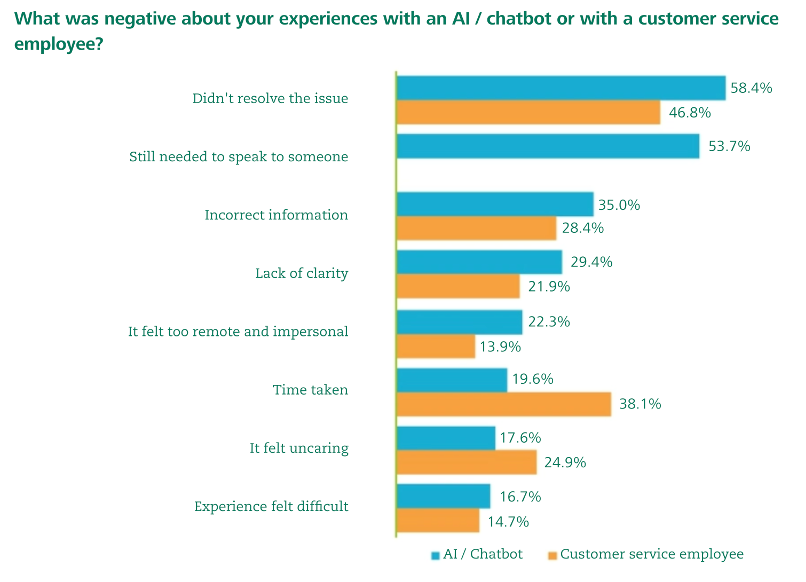

UKCSI data from earlier in the year tells us that for 53.7% of automated contacts, the customer still needed to speak with a human being.

Equally concerning, though, was that neither AI/chatbot or customer service employees are managing to resolve customer queries more than 54.2% of the time, as seen in the January results. Quite the damning indictment.

Consider also that 45.4% of customers would avoid using an organisation again due to poor use of technology.

Clearly there is work to be done.

Companies with higher customer satisfaction show stronger growth

But what is the impact of this on a brand’s fortunes? Is the 2-point drop in score for Telcos material?

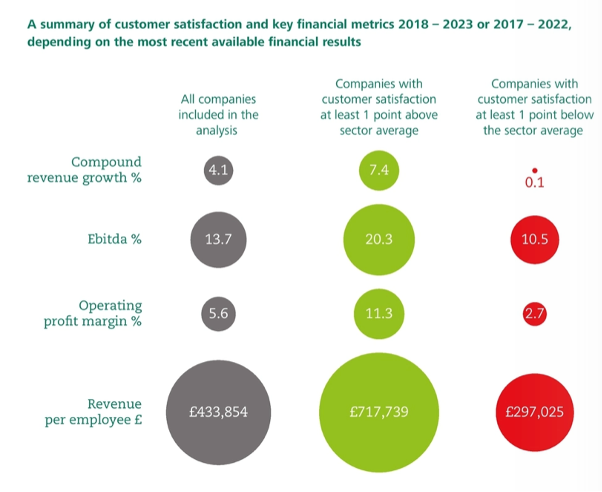

Research in the UKCSI report from January 2024 shows that between 2017 and 2023 “companies with customer satisfaction at least one point higher than their sector average achieved stronger revenue growth”.

With c.80% higher compound revenue growth, 6.6% higher EBITDA, more than double the operating profit margin and a whopping £283.9k – more than half as much again – revenue per employee on the table for that increase of just one point, the importance of customer satisfaction to both the topline and the bottom line is stark. On the other side, the virtual lack of revenue growth and much reduced operating profit margin for 1-point lower puts into context the plight of Tourism, Leisure, Insurance, Public Services and the rather more beleaguered Telcos.

The same report highlights that 27.6% of customers who score an organisation 9 or 10 out of 10 for overall satisfaction will look to buy other products or services from them, whilst 20.8% of customers scoring 1 to 4 will spend less with the organisation and 41% scoring them at 1 to 4 will avoid dealing with the organisation again in the future if possible.

And so, it is easy to see why investment in customer service is critical to the success of an organisation. Why an organisation should be – and hopefully is – highly focused on it. And why a pure cost-reduction focus for automation or AI is short-sighted.

While these numbers tell quite the story, let’s assume things are the right side of the line service-wise, whether through AI or not. The next question then is, are you following up with the appropriate sales activity to effect further topline growth?

Are you ready to pick up the sales baton?

Effective sales operations depend on 7 key factors for growth, the same apply to both sales team and those required to deliver sales through service:

- Access to the best people with the necessary sales and communication skills,

- Clear reward and recognition structures with incentives, creating a culture and environment which encourages growth,

- Appropriate product knowledge and ongoing team development, ability to handle objections effectively and to share learning to advance the performance of the team,

- Effective technology which the team can leverage to access customer insights, understand which are the best customers to be contacted, when to contact them and what solutions to offer,

- Practical approaches to sales compliance, which provide clear guidelines but can be managed without excessive burden to managers, allowing sales to be signed off effectively and if necessary, learning applied in a timely manner,

- Ability to manage data and reporting to maximise sales opportunities which benefits the organisation, the sales agents and also the customers through ensuring access to right information at the right time,

- Understand market conditions, customer behaviours and how your team needs to react to these.

If just one of these seven isn’t working too well, sales will suffer. But so may customer service or perceived value. For example, an intrusive offer in the middle of a customer complaint is likely to occur as unempathetic and may see the customer running for the hills. A well-handled complaint can increase value – or at least maintain it.

A colleague described a recent interaction about a problematic return with a well-known retailer, where mid-conversation they were invited to look at product that may interest them. Unsurprisingly, their reaction was not to immediately head to the link to browse, but instead to give a sharp retort – and then tell anyone who cared to listen how annoyed they were.

Not only did the retailer not make the sale, they likely turned the customer off. An excellent example of numbers 1, 2, 3, 4 and 7 (at least) not working. Not only was it bad scripting and a lesson in not what not to do, it may speak to overly aggressive reward structures and an environment that favours sales over growth. The nuance of which is important and why point four is critical – this was not the best customer to be contacted in this way at that time.

The same colleague similarly experienced rather odd service (from a Telco…) in store recently, where a service conversation without a satisfactory outcome turned to an attempt to upsell on a different product, followed by a recommendation to leave the brand for the product where the service outcome was unsatisfactory. Quite the rollercoaster! And no doubt an experience driven by a particular sales focus that the brand’s managers would be horrified to learn they have – let’s hope – inadvertently incentivised.

Picking your moment to turn service into sales is critically important and relies heavily on the skill of the individual, their training and incentivisation, supported by culture, technology and management.

With so much focus on customer service, do you have the need, will and capacity to optimise sales?

Great agents who can both serve and sell can be hard to find, and can be even harder to retain..

The use of technology and automation is increasingly expected for customer service – and rightly so, simple service issues don’t need complex solutions. But they do need human intervention when the service question isn’t simple, or the automated response fails. Or perhaps when a sales opportunity requires a more personal service.

The ability to deal with customers, their nuanced needs and when selling, their objections, still has a high level of dependency on human interaction.

Yet the data from Ofgem and UKCSI both illustrate that customers are frequently frustrated by both automated and agent interactions. Service delivery in many sectors is still some way short of previous highs, meaning there are still gaps to fix in customer service before you can even think of perhaps selling.

And to some extent, when improving customer experience can deliver increased revenue, getting the basics of service right first is a significant route to growth and building value – whether you agree or not about whether they ought to be, measures such as revenue growth, EBITDA and revenue per employee are important to investors and share price.

How you achieve optimised service, then layer on sales through service or even pure sales activity is a significant question. Each have their own challenges, but successful outcomes add up to an organisation that both sells to and retains customers optimally.

Guest Author – Elaine Seculer (Head of Marketing at Taskaler)

As we dive deeper into the knockout stages of the Euros (dare we mention it), did you know that Pakistan is the largest producer of hand-sewn footballs? In fact, the official footballs used in the last two FIFA World Cups were crafted in Pakistan.

But there’s more to Pakistan than footballs; it’s also emerging as a leading location for outsourcing, offering unique benefits over many offshore countries that might first come to mind, which places Pakistan as an attractive alternative well-worth considering.

We speak with Jawad Farooq and Elaine Seculer of Taskaler to get the inside track on Pakistan as the latest outsourcing destination of choice!

1. The Rise of Pakistan in the Outsourcing World

When you think of outsourcing, countries like India, South Africa, and the Philippines are the destinations you probably first think off. They’ve been popular choices for years. However, these markets are becoming saturated, with increased costs being felt of late – that’s where Pakistan steps in!

A hidden gem if you may, not yet overrun with competition, meaning you can find high-quality talent at very competitive rates. Early birds in the market are already reaping the benefits!

2. Why Pakistan is Cost-Efficient?

Pakistan’s stock market has seen unprecedented levels of growth of late. The KSE-100 Index, tracking the largest companies listed on the Pakistan Stock Exchange is at a 6 year high, making it the top performer among Asian frontier markets, thanks to improving economic conditions and a favourable IMF deal which boosted investor confidence.

Whilst the country’s currency (rupee) is relatively weak, this has been highly favourable for international businesses who receive a healthy exchange rate against the dollar.

Did you know? Pakistan’s outsourcing rates are even more competitive than India’s, which has long been the go-to for outsourcing!

3. English Proficiency and Education

Pakistan’s Constitution and Laws are written in English. English is recognised as the official language and is widely used in business and higher education. This means that communication is smooth and easy, with about half of the educated population speaking English.

4. Big Brands and Business Environment

Pakistan is already attracting big brands, with businesses like Audi, BMW, Samsung, Unilever, Nestle, Carrefour, and Standard Chartered all successfully running their operations in Pakistan for years now. This shows that Pakistan has the infrastructure and capability to support large-scale business operations. Plus, with Pakistan being four hours ahead of British Summer Time (BST), you can easily set up shift patterns that cover your core business hours, making it convenient for meetings and collaboration.

5. A Thriving Start-Up Scene

Pakistan isn’t just about established companies; it’s also buzzing with start-up activity. There are numerous start-up incubators, funded by both private investors and global giants like Google, fostering a vibrant and innovative ecosystem.

Piqued your interest?

If you’re curious and want to explore more, drop us a line – we’d be more than happy to help you discover all that Pakistan has to offer for your business!

Over the past few years Bulgaria has certainly made it’s name in the world of contact centre outsourcing. Not only are business in Europe choosing Bulgaria as their nearshore destination of choice, but businesses in the US are now casting their eye over towards the east.

If you did ever find yourself in Bulgaria’s bustling capital city Sofia, you might be greeted by one of its 1.3 million residents with “Zdraveĭte, radvam se da se zapoznaem!” (Hello! I am glad to meet you). However, if you’re like me and rely on a translator, there’s absolutely no need to fear as over 1.7 million people in Bulgaria can speak English. Other European languages spoken in Bulgaria include (but not limited to):

- Bulgarian (obviously)

- Turkish

- Russian

- German

We recently caught up with waterdrop®’s very own Martin Vatchkov to get an on the ground view of Bulgaria. Not only is Martin a Bulgarian national living in Austria, Martin has also previously outsourced his customer service operations within Bulgaria:

“Здравей (Bulgarian “Hello”)! Diving straight in on why Bulgaria, which is mainly driven by the fact that Bulgaria has a highly effective language school system, where most European languages are extensively and effectively thought, the baseline is rather high and difficult to beat.

The university of “St. Kliment Ohridski” in Sofia has added another building block to the already high level of schooling within Bulgaria. This has brought some rather rare languages to Bulgaria such as Japanese, Korean, Arabic or the Nordic languages to name a few.

Once you get past the languages, another strong positive for Bulgaria would be the Geographic location. +2 hours from GMT and +7 hours from EST in the US, with US shifts (16:00 to 01:00) being something normal. Distance in my opinion is another asset at around a 3-hour flight, from most places in the European peninsula which is a rather short flight. Companies have started to explore the whole country with the opening of offices at the seaside (Varna and Burgas) and not only the capital, Sofia.

On another note, the fact that Bulgaria is part of the EU and NATO, brings GDPR with ease (contractual wise, as no data is leaving the EU) as well as economic stability. Internet downtime is almost nonexistent with high speeds.

Last but not least, the BPO and ITO industries are rather filled with the younger part of the generation which bring a lot of ideas and high engagement rates. AI is no foreign word and working efficiently is certainly a big asset as both industries have been embodied quite well in the countries’ economy.”

Thanks Martin! Contact Centre Panel too has had some terrific experiences with contact centre’s in Bulgaria, and we think you will too.

Like what you hear about Bulgaria and want to find out more? Get in touch, we’re here to help.

Are there really no bad ideas? This age-old question plagues organisations that are trying to innovate while managing realistic resources and budgets. None of us want to stifle creativity—we’re all encouraged to think creatively and bring new ideas. As we alluded to above, maybe it’s the execution of ideas that results in undesirable outcomes.

Distributed and Contact Centre Panel (CCP) recently teamed up to help more organisations turn their ambitious ideas into reality. Any idea is worth exploring, but without proper execution, outcomes are often lacklustre at best and failures at worst. In a tech landscape where 70% of transformation projects end up failing according to McKinsey, it’s critical to get the strategy and process right at the onset.

We want to set business leaders on the best path possible toward successful digital transformations. With our combined expertise and years of experience in helping companies implement change across industries and geographies, we’ve compiled the guiding principles that will be foundational to any large-scale technical project.

Be clear on strategy and your “why” at the start

Nobody sets out to do a bad job. The execution of a project—especially in an outsourced environment—is complex, so it may not be a specific decision that halts progress, but a situation where people fail to make a decision, or don’t work through the priorities and therefore are trying to work with limited resources.

Distributed Founder, Callum Adamson shares, “Make sure you’re in love with the problem you’re trying to solve, not the solution you think is needed. I see people thinking, ‘I’ve got this great idea for an app,’ rather than ‘This problem needs to be solved.’” Clearly defining the priorities of a project will ensure that everyone is working towards implementing the agreed upon change. When resources are limited, there’s no more important factor to a project than knowing exactly how it will affect the organisation once the project is finished. In order to better track the impact of your change implementation, make sure to identify:

- Key KPIs that will be measured before and after the project

- Goals for those KPIs in order to track against expectations

- Teams that will be affected directly by the transformation

- Stakeholders who deeply understand the problem you’re trying to solve

Make sure you have the right resources dedicated to the project

Change is inevitable in any organisation and if we fail to acknowledge this then those organisations are destined to fail. Opportunities to deliver additional customers, revenue, or margin are dependent on successfully implementing change. The step that makes something a “bad idea” is potentially the decision to not apply the appropriate level of thinking and resources to the project.

Once you understand the parameters of your project and exactly how the change will affect your organisation, it’s time to set out for the right resources. Good ideas become bad ideas when the levels of critical thinking and creativity don’t match the complexity of the project. Make sure there’s enough time, budget, and talent dedicated to the transformation project in order to move forward completely. If there isn’t, be realistic about what you can accomplish with what you have, and flex your creativity to stretch those resources in ways that will help your team make more progress.

At CCP, nearly a decade of work has been dedicated to honing in on connecting organisations to the best resources for their projects. CCP Founder Phil Kitchen shares, “We always see that the best fit organisations to support our clients or network have three key components to their offer. These are:

- Solution, that the needs are clearly understood and the partner is aligned to the same objectives

- Commercials, ensuring sustainability for all engaged to deliver a win/win outcome

- Cultural alignment, to ensure open and transparent communications and delivery

Leverage the right talent at the right time

What truly needs to be considered when making any critical change is that there needs to be the necessary capacity to deliver change whilst managing the day-to-day goals. Impactful change can only be achieved with impactful teams, and sometimes those teams need additional expert perspectives and skill sets in order to more holistically drive a project forward.

This is where leveraging external talent becomes the key to driving innovation at growing organisations that are moving quickly while simultaneously implementing ambitious transformations. We have a deep understanding that success can’t be achieved in a silo. In order for internal teams to excel in their “zones of genius,” they need the right support to enable an open, empowering environment for better productivity and workflows.

Freelancers make up 40% of the digital workforce today. That’s a tremendous amount of talent that can potentially help organisations shift their businesses through successful transformation projects. This talent remains largely untapped today, even as business leaders become more open to the idea of leveraging talent ecosystems outside their own companies. With this leap comes global perspectives, remote working practices, and increased productivity that can be unlocked with the right talent strategy.

We’re building the future of tech transformation—join us

CCP and Distributed are partnering to help organisations achieve greater change at faster speeds—without compromising on quality. Keeping this balance is important to us because we know it’s important to business leaders worldwide. As we continue our work, see how good ideas can become great ideas when the right talent teams can contribute their unique skills sets and expertise to your projects.

Words cannot even begin to describe what the people of Ukraine have had to endure over the past 18 months, since the war began. However, through this adversity, the outsourcing industry in Ukraine has remained resilient and is still very much open for business – providing a lifeline to those who need it most.

Before the conflict, Ukraine was well on its way to becoming the European hotspot for incredible tech talent and cost-effective solutions for both BPO and ITO services. Has the war changed this? Well, the simple answer is no. Ukraine has had to adapt, there’s no question about that, including looking at how employees in the sector operate and remain safe (which is of the upmost priority). However, the country is still able to rival its Eastern European neighbours in terms of quality of service and cost effectiveness.

When it comes to outsourcing in Ukraine, it’s employees speak English to a very high level – which includes adapting to cultural nuances of other countries with ease. We would say Ukrainian’s have a firm grasp of how Western businesses work. This means Ukrainians are excellent at collaborating with teams from other countries, especially for those business who already have an inhouse team and are looking for an outsourced partner to supplement the numbers they already have internally.

I recently pulled up a chair and had a chat with another of Ukraine’s own, Konstantin Ryzhov, the CEO of Simply Contact. Operating since 2012, Simply Contact has several offices operating in Ukraine, including their Poland office as part of recent expansion. I asked Konstantin a number of questions about outsourcing in Ukraine, with the most pertinent one being, “why outsource to Ukraine?”.

“In Ukraine, we place a strong emphasis on education, especially language skills. This means our contact centers have people who are adept in various languages and also deliver services with high quality. Plus, Ukraine is amazing at adjusting and coming up with new ideas when times get tough. The way Ukrainian companies remain stable and grow during hard circumstances is truly impressive.”

As Konstantin mentioned, the advantages of outsourcing contact center services to Ukraine are quite noteworthy. Let’s take a moment to review these key points:

1. Multilingual agents

Ukraine can offer a broad range of languages, with high proficiency in English and other main European languages. It is an ideal choice for serving a global customer base.

2. Cost-effectiveness without compromising quality

In the realm of outsourcing, balancing cost and quality is crucial. Ukraine excels here, offering competitive pricing without compromising service standards. This balance is particularly attractive to businesses looking to optimise their customer service operations.

3. Time zone advantage

Ukraine’s geographical location and time zone are beneficial for serving European and Asian markets. Also, it offers reasonable alignment with North American business hours. This enables more effective and timely customer service across different regions, 24/7.

4. Diverse talent pool

Ukraine has a large and diverse talent pool. This variety enables you to find the right match for your specific customer service needs, whether it’s technical support, multilingual services, or industry-specific expertise.

Are you considering outsourcing to Ukraine, but want to find out more? Reach out to CCP, we’d be more than happy to help.

Just last week, an associate ruefully observed “There’s no future for UK contact centres. They can’t compete on cost; clients won’t pay”. They were specifically referring to outsourced service providers, but the root cause of their – regretful – sense of despair could apply to all sorts of contact centres:

- The cost impacts of an increasingly competitive job market and mandatory increases in living and minimum wages (incidentally, I’m assuming that no-none could object to notoriously under-valued frontline contact centre staff getting better paid, but increased costs do inevitably create commercial pressures);

- The post-Covid shifts in the employment market, the ongoing impacts of the ‘Great Resignation’ and a general raising in employees’ expectations of their roles; AND

- An often-toxic combination of increased emotional and cognitive loads for frontline staff:

- Emotional – as they deal with rising levels of customer frustration and rage, compounded by increased financial vulnerability

- Cognitive – more channels, more applications, more complex queries, more rules, more oversight

All of which serves to make a contact centre advisor job even less attractive!

As more and more contact centres roles are transitioned to relatively new offshore locations like South Africa, does this quiet ‘second wave of offshoring’ really signal the end of the mainstream, volume UK outsourced contact centre market?

What’s happening out there?

Even without a degree of informed insight, nearly all contact centre industry insiders would agree that South Africa – which for many years has been a ‘left field’ location, more talked about than utilised – has in recent years grown massively in importance and profile.

It’s over 20 years since the first wave of call centre offshoring to India, when brands first embraced the attractions of delivering customer contact activities from overseas. The long-term results were varied; some preserved successfully, some progressively switched India into a predominantly non-voice delivery location, others recanted and repatriated their contact centres (some quietly, some with a great PR fanfare). Lessons were learned – or forgotten – and the world’s a very different place from the early ‘noughties, but it does seem like we are in the midst of a ‘second wave’ of offshoring.

From CCP’s perspective many clients are choosing to outsource to South Africa, either offshoring their contact centre services for the first time or selecting the location over another other offshore sites used previously.

Of course, South Africa is far from the only newly emerging contact centre location. Certainly for the big, global BPOs, South Africa already feels a bit ‘last year’ and Egypt is the favourite location. The spread of outsourcing ambitions and capabilities – whether that’s driven by home grown entrepreneurs or global BPOs looking for the next source of untapped, inexpensive talent – across Africa is a fascinating subject. One we may return to in the near future.

Countries which feature in the growing list of CCP partners’ operational locations range from Bulgaria to Kosovo in Eastern Europe, and destinations even futher afield like Fiji and Suriname.

It’s not all about cost. But it often is …

There are many reasons and business drivers which can influence an organisation’s decision to outsource its contact centre and customer engagement efforts. These may range from a lack of technical or operational capacity; challenges with staff recruitment and retention; or an acceptance that the organisation’s points of differentiation and value lie elsewhere and that a third party is best placed to deliver contact and support services. But, of course, the decision might be primarily motivated by price. And for a client making the move from an in-house or outsourced UK contact centre to one located in, say, South Africa then they would expect savings in the region of 50%.

Life’s rarely that simple, though. Outsourcing decisions are often propelled by a variety of factors; there are obvious as well as hidden costs in outsourcing, especially at a great physical distance; and simply ‘lifting and shifting’ a contact centre operation will miss opportunities to enhance their customer experience and the tools and processes that deliver them. However, when most businesses are still adjusting to two years of inflation, raised interest rates and fragile levels of confidence, the prospect of delivering unavoidable services for as little as half the cost is compelling.

Game over for the UK?

It might look like it, but there are some good reasons to think otherwise. In fact, in some circumstances – or for some outsourced service providers – we could be on the cusp of a UK contract centre renaissance.

Here are some reasons why:

- Cost vs Value: business drivers are often cyclical. The same companies that are massively focused on cost and/or headcount reductions today, may be far more focused on customer value next year. Going offshore isn’t synonymous with lower quality interactions, but they can more difficult to sustain from afar, distant from the domestic culture;

- The ‘stability premium’: Business continuity planning isn’t just about unusual weather events, or pandemic flu preparations (remember them!?) nowadays. War, cyber threats, climate change, civil unrest and both formal and informal economic sanctions are of growing importance. Having a contact centre in the UK rather than thousands of miles away isn’t a guaranteed insulation from these factors, but it helps;

- Complexity: Analysis, gut feeling and research all demonstrate that simple or ‘transactional’ contacts are increasingly rare. Even consumer queries that are ostensibly ‘easy’ are now frequently evidence of profound underlying challenges – either fixable flaws and barriers in how brands interact with customers, or consumers’ own vulnerabilities. Addressing either requires highly skilled, brand-aligned people; AND

- Collaboration, collaboration, collaboration: As machine learning and Generative AI become integral parts of how brands’ contact centres manage and interact with customers, the need to collaborate :

- Tech with ops

- Proposition with experience

- Clients with service providers

- Advisors with AI interaction guidance and knowledge solutions will become more important. Doing so with colleagues and partners located nearby, with genuinely shared experiences, may be at a premium

Conclusion

None of these factors are guarantees that the UK outsourced contact centre industry will survive and prosper. However, one thing outsourced service providers are above anything else is resourceful and flexible, so the best of them will a find a way to differentiate and succeed.

What do you think? Is the UK outsourced contact centre industry doomed – or, not for the first time, has its demise been predicted way too soon?

Let us know. We’d love to hear your thoughts, whether you’re a client or a service provider, whether you’re based in the UK or abroad.

Article 3 of 3

Our third and final area to highlight is the talent shortage in operations and more focused in areas such as data analytics, AI, and digital innovation. Attracting and retaining skilled professionals is essential for insurers to adapt to changing market dynamics and leverage emerging technologies effectively. But how are they going about doing this, particularly when their operational hubs are positioned outside the talent hub of London?

1. Talent Development and Training

Insurance companies are investing in talent development programmes to upskill their existing workforce. They offer training in emerging areas such as data analytics, AI, and digital technologies to ‘bridge’ colleagues in volume areas with deep experience of the customer, products and processes, into specialist roles where they can build upon that foundation. Additionally, insurers are partnering with educational institutions to create specialised insurance programmes that provide graduates with the necessary skills and knowledge to succeed in the industry.

By investing in talent development, insurers are closing the ‘skills gap’ to cultivate a pipeline of skilled professionals. This takes time to bear fruit and so with that comes an interim need to maintain the shortfall, or at least provide the foundation to build upon. The outsourcing industry is well placed to help here, both short and long term.

2. Outsourcing

In recent years, changing dynamics within the industry has seen employees talking with their feet and finding pastures new. There’s simply more choice for people and if the reward is better elsewhere and the work less complicated (and stressful) then the lure of jumping ship for better pay and conditions is strong, particularly when the commute is no longer a factor for many organisations. Whilst there are advancements in the technology space to soften the blow of the resourcing turbulence, the pace at which these are delivering tangible benefits is nowhere near sufficient to keeping up with the shortfall in resourcing.

We’ve seen the use of UK outsourcers as the stop gap, at least tactically for the initial shortfall, but the winners we are seeing are the overseas territories, South Africa especially for the customer facing roles. We believe those insurers that brave the outsourcing decision for their operations, hand in hand with technology outsourcing, will create strategic advantage versus their peers. We are currently seeing this with US based Insurers increasing offshoring to South Africa but not so much in UK Insurance, just yet…..

Want to hear more on this topic? Feel free to contact us hello@contactcentrepanel.com for further insight and guidance.

Want to read our previous articles? Part 1 and 2 have been linked below:

- Part 1 – Collaboration through partnerships

- Part 2 – AI, Data Analytics and Insights

For lots of contact centres the recruitment and retention of frontline advisors continues to be their biggest challenge. The labour market has shifted, maybe permanently, and potential colleagues’ expectations have changed. At the same time technology developments promise to revolutionise contract centres and how they operate.

Good people are hard to find and good people expect to be recruited honestly and treated properly in work. So, are your current recruitment approaches fit for purpose?

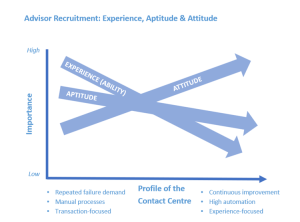

Attitude, Aptitude and Experience

Recently I came across the ‘3As’ hiring model that Ralph Kasuba developed in the late ‘noughties when recruiting technology hires. The three As are the three sets of characteristics that candidates have and Mr Kasuba suggested the priority order in which they should be assessed:

- Attitude – your innate approach to work

- Aptitude – your ability and willingness to adapt, learn and develop

- Ability (or Experience) – what you bring to the table in terms of qualifications, technical skills and experience

The model was developed when Kasuba’s team were struggling to appoint candidates for technical roles; they would pass a pre-assessment but then never get through a team interview with their prospective peers. The 3As sought to make sure that the candidates’ ‘fit’ with the organisation and team were right before going on to assess the level and extent of their – vital – technical skills.

So, do the ‘3As’ help us in today’s contact centre world? Potentially, but perhaps not yet!

The present

Everywhere you turn nowadays you can read predictions and descriptions of the onward march of technology in the customer interaction and contact centre space. Innumerable articles – most written by Chat GPT and some with the aid of human intervention – explain that the old contact centre world of complex manual processes and work-arounds is about to disappear under the shiny onslaught of machine learning and AI.

If these articles are even partly correct then the sort of people we need to attract to work in the frontline of contact centres needs to change. However, as long as contact centre advisors are expected to the below, then Experience and Aptitude will continue to trump Attitude in attracting and selecting candidates:

- Cope with multiple tools and systems (with more added all the time)

- Retain a good understanding of internal and customer-facing processes ‘in their heads’

- Prioritise multiple demands and requirements (mandatory statements, data protection compliance, data capture goals, up or cross-sell targets, quality management criteria, etc)

The future?

As systems are integrated, real time guidance is available to advisors to help them identify and resolve issues and – crucially – the contract centre is seen as a means of identifying and fixing broken processes, then things will change. Maybe then recruiting people mostly for their empathy, enthusiasm and communication skills will become possible.

In the meantime, if we want to retain the right people to help and support our customers it will continue to be necessary to accept that “what they do” is more important than “the way that they do it”.

If you’d like to discuss how well your recruitment model aligns with your present realities (and future ambitions) just drop us a line, we’d love to chat with you.

P.S. if you want to read more about the ‘3As’ approach you can do so by clicking here.

Article 2 of 3

Insurers have long since leveraged data and analytics to gain actionable insights and drive operational improvements. After all, data is at the heart of underwriting, pricing and claims management. Advanced analytical techniques are being increasingly used to analyse large volumes of data, identify patterns, and optimise processes. Insurers are employing predictive analytics and AI for claims forecasting, fraud detection, and risk assessment, allowing them to make data-driven decisions and streamline operations. These run hand in hand with the operation itself and it’s critical the teams work closely together, especially when outsourcing is involved. Insurers are gaining strategic advantage in several ways. Here are some examples:

1. Enhanced Risk Assessment

By leveraging vast amounts of structured and unstructured data, insurers can refine their risk assessment processes. Advanced analytics and AI models analyse historical data, market trends, customer behaviours and external factors to improve risk prediction and pricing accuracy. This enables them to identify profitable segments, develop targeted products, and optimise underwriting decisions.

Insurers rarely let go of this core competence and fully outsource, so if the demand surfaces, it’s likely to be augmenting rather than replacing the mother ship’s in-house capability.

2. Fraud Detection and Prevention

Insurers are employing data analytics and AI algorithms to detect and prevent fraudulent activities. By analysing data patterns and anomalies, insurers can identify suspicious claims, behaviours or patterns that indicate potential fraud. Advanced fraud detection models help insurers mitigate financial losses, improve operational efficiency, and protect honest policyholders from inflated premiums.

Typically, outsourcers work across industry verticals and so bring a distinct advantage in terms of sharing learnings from one business sector to another.

3. Personalised Customer Experiences

By analysing customer data, insurers are gaining insights into individual preferences, behaviours and risk profiles, allowing them to tailor products, pricing, and services to specific customer segments. This level of personalisation enhances customer satisfaction, improves retention rates (increasingly important after the pricing reforms) and drives customer loyalty.

In an industry challenged with differentiation beyond brand recognition and price, personalisation is ever more important to the policy holder.

4. Process Optimisation

Of course, the need to identify and eliminate inefficiencies, reduce waste, and enhance operational performance doesn’t go away just because you enhance your technical capabilities elsewhere. Techniques such as Lean Six Sigma continue to be used to analyse processes, identify bottlenecks, and implement improvements. Reengineering processes to simplify and automate workflows, reducing cycle times and enhancing overall operational effectiveness will continue.

Through the use of process mining (we rate this software highly) and analysis, insurers can identify bottlenecks, eliminate inefficiencies, and create a pipeline of opportunities, driven by date, primed for automation.

If you would like to discuss further the challenges in the Insurance sector, the benefits of data analytics, AI and insights or generally about any of the points raised, feel free to contact us hello@contactcentrepanel.com

Watch out for the next article in the series considering the impact of Talent Management and Skills Gaps.