There are several universal truths, one of which is that we all have at least one subscription! Though I think that if we were asked to list all the things we pay a monthly or annual fee for we would probably come across some we’d forgotten about. We questioned how many subscriptions we have that you may not feel we’re getting value from?

Another consideration is that even if we’ve not been using our Netflix, Disney+, AppleTV, or whichever service one as much as we’d like, we may be holding onto the knowledge that we will likely binge some boxsets over the festive period and how many of us then realise we are all subscribed to Amazon Prime and other subscriptions may have been unnecessary.

A third is that we are often encouraged to review our discretionary expenditure in January and cancel any that we don’t need or to look for a better deal.

It is always good to speak with experts in a field to understand how these elements all play out, Jonathan West is Client Development Director at Step Change Outsourcing and knows only too well the first-hand challenges of a subscription-based business model having led the Sky Business Division as National Sales Manager and Head of Indirect (Consumer) Channel at Three. Simon Kissane is highly experienced in delivering CX and Contact Centre Performance Improvement having supported a number of interim positions and extensive experience as a Head of CX and Operations in the mobile and broadband space.

What does the data tell us?

Data from Barclaycard in 2020, Whistl in 2022 and from Statista suggest that on average a UK household has 8 subscriptions ranging from streaming services to food kits, healthcare and pet products.

Finder.com suggests 2023 research shows 79% of UK adults (42 million of us) have at least one subscription service. However 23% of us feel these services are too expensive and 51% would be willing to cut that subscription to save money. Some research data which claims that we are spending an average of £500 each annually seems to focus on streaming services.

Further subscriptions which saw significant growth during the pandemic were the subscription box services. Whistl report an 18.9% year on year growth in in in the UK in their reports and referencing data from the Royal Mail in stating the market will be worth £1.8bn in 2025.

Whilst a little dated, the Whistl report shares some insights around key metrics for subscription boxes, their data suggests,

- 81% of households have at least one box subscription

- average spend of £52 per month in 2021 with annual spend to £620

Those subscriptions typically last 9 months

- 40% of us subscribe for convenience and 55% to save time

- 74% wish that companies made it easier to manage subscriptions

“how likely they would be to cancel their subscriptions if they were to increase slightly in price”

Clearly the different types of subscription are driven by differing motivations. Time and convenience are a key element, howeverthe value of the subscription is a vital consideration, too.

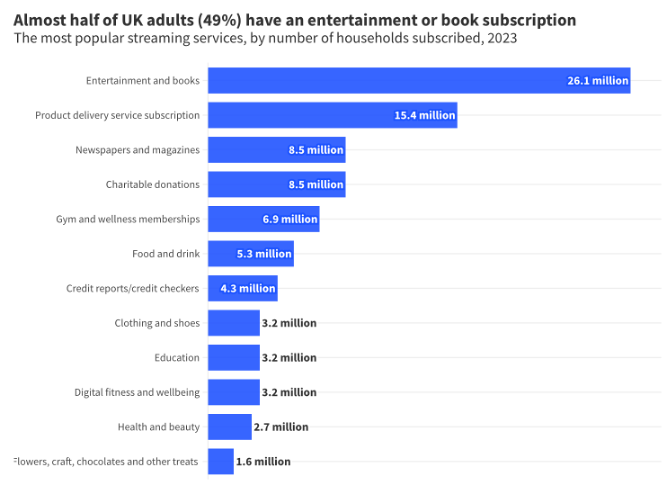

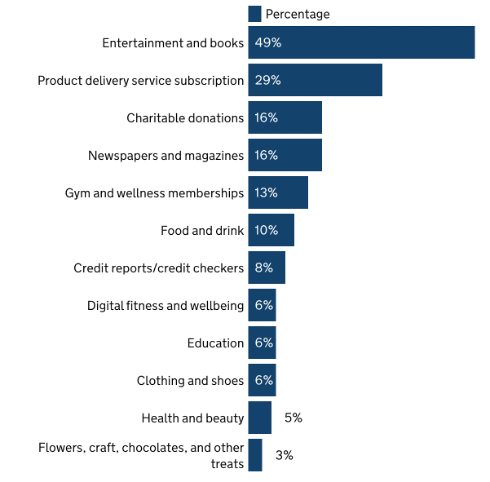

Data from the Department for Business & Trade, published in April 2023 (based on research with 2,000 UK adults conducted by Opinium Research in November 2021) showed the following level of subscription holdings:

Respondents were asked the critical question as to their expected behaviour if prices were to increase and unsurprisingly, they were more likely to consider cancellation as listed below by subscription type (key sectors):

- 79% Food & Drink

- 76% Digital fitness and wellbeing

- 73% Health and beauty

- 66% Flowers, craft, chocolates and treats

- 64% Entertainment and books

- 64% Product delivery services

- 38% Charitable donations

Subscriptions to telephone and broadband services don’t seem to appear in the data. Perhaps they have ‘crossed the line’ into the utilities space? Digital connectivity may have become a physiological need, in the words of Maslow even. This seems fair considering that we all need data connectivity to live our day to day lives today.

But if we consider for a moment the broadband and fixed landline space, the regulator Ofcom has been busy making changes in the past few months that could impact the sector. On this basis, have sensitivities around price and service ever been so important to that sector – and are there considerations that can be applied across all subscription markets?

So, what does that mean to the customer contact community?

Well, there is a chance that a broken process earlier in the year – which made your contact centre hard to deal with – is going to result in customer retention issues when that customer reaches the end of their contract.

Or that automation process that you are thinking of implementing due to pressure from the business to reduce operational costs needs to be just right, or else it may result in driving customers not only to self-service, but away from your business altogether.

It could mean that you have an amount of retention work to do, or that you need to start thinking about additional marketing spend next year to attract new customers to maintain your numbers, never mind growing the customer base.

For many customers managing, their relationships digitally – like with NOW TV, for instance – should be easy. But my personal experience of trying to cancel a NOW subscription over the weekend was time-consuming and frustrating:

- Cancellation was not possible via the App which means logging onto my account,

- then being asked no fewer than 6 times whether I really wanted to cancel,

- and being presented with offers and discounts to retain me.

This feels like an example of when an understandable business desire to create a bit of friction has gone too far, turning off customers from coming back in the future.

However, the first that businesses with digital based relationships may know of my intent to cancel is when I’ve clicked on a box and my money stops the following month. Many will then commence an e-mail campaign, or outbound calling perhaps, to ‘win-back’.

One touch switching

The implementation of the Ofcom rules on one touch switching from September 12th enabled customers to move to a new provider with just one contact. This means that alternative network providers (alt-nets) – despite huge investment in their infrastructure – are now in a place where customers can simply walk away without having to contact them, similar to my cancellation of my NOW TV subscription.

The new provider manages the switching process and the incumbent has little option but to go with it. Are the developing the expectations that customers will have about the ease of cancelling their telco and broadband subscriptions being mirrored across other services?

Additional considerations

In our discussion, Simon, Jonathan and I also considered whether there is a clear role for NPS in customer retention and operational performance. This was a topic which was discussed also on a Scorebuddy webinar that I supported, recently. With the level of insight available from the contact centre, do you really still need to ask the question around likelihood to recommend a product or/service? It could be that you can see this through all the other data and insights at your disposal. However, you need to ensure that you have the time and knowledge to implement the changes needed, which is where businesses can fall short.

“CX has never been so important, moments of truth matter and there is a need for experience and empathy”

When it comes to growing any form of subscription business, there is a clear need to balance acquisition with the realities of ongoing customer service. The work of retention and win-back teams should not be underestimated, but if you get the customer service right then retention is less likely to be needed.

Scaling a business to cope with customer demands can be challenging. The transition from small in-house operations with wider departments helping where they can in supporting customer needs in those moments of truth (when something hasn’t been delivered as promised) can take people away from their roles in the wider business and risk future growth ambitions. Where customers have bought/subscribed via a click then the first time your team speak with them could be at the point of disconnection and considering the costs of developing your business or network, there is a need to maximise customer lifetime value.

When growing a business and a contact centre team, you need to ensure that you are properly supporting and developing your staff. As businesses grow it is not just customers numbers where retention may become a challenge. With Simon and Jonathan I discussed these challenges around recruitment and training, this is where we have seen outsourcers taking the load, so that “you do you and let the outsourcer do the heavy lifting”.

Is your customer contact approach fit for purpose?

With the potential challenges of growth and increasing costs in 2025 from minimum wage and national insurance increases ahead, maybe it is time to review where you are on your journey and whether there are opportunities to optimise current operations – through either process review or implementation of new contact centre technology?

Perhaps you’ve reached a point where you need additional support from an outsource partner who has walked this path before and can help you grow customer numbers and/or evolve to the next stage of your growth, whether that is with

- acquisition activity

- out of hours support,

- peak capacity or

- end to end customer service which allows you to focus on your core activity and growing your business.

You may have an existing operation that requires review, but whatever your customer contact challenge feel free to contact us so we can talk it through.

At Customer Contact Panel we have extensive experience in supporting our clients in identifying the right fit solution for their business.