BPO operations are built for constant change. Contracts ramp quickly, headcount fluctuates, and compliance expectations never ease, all while margins remain under pressure. Yet one area that underpins all of this is still rarely treated as strategic infrastructure: how devices are provisioned, managed, and recovered at scale.

For many BPOs, device management sits in the background. It is often fragmented across internal IT teams, multiple suppliers, and manual processes that have evolved over time. While this may work at smaller volumes, it quickly becomes a constraint as operations scale.

When Devices Slow Performance

In high-velocity BPO environments, time is directly linked to revenue. Delays in device onboarding mean agents cannot go live, training investment is underused, and programmes lose momentum. Offboarding creates equal risk. High churn and contract changes mean devices leave the estate constantly, and without tight controls this exposes data, compliance, and asset recovery issues.

Alongside risk, cost quietly increases. Idle devices, unnecessary new purchases, repeated configuration work, and reactive support all erode margins, often without being visible as a single problem.

Why Traditional Models Fall Short

Many BPOs still rely on capital-heavy purchasing or piecemeal provisioning models that were never designed for workforce volatility. Buying new devices for each ramp-up ties up capital and leaves surplus stock when demand drops. Limited asset visibility makes it difficult to track usage, ownership, and compliance, especially as remote and hybrid delivery models expand.

A Managed, Circular Alternative

An increasing number of BPO providers are adopting a fully managed, circular IT and asset management model. This approach treats devices as operational infrastructure rather than one-off purchases. Devices are pre-configured, securely deployed, supported in-life, rapidly recovered, refreshed, and redeployed based on forecast demand.

The operational impact is clear:

- Faster onboarding with ready-to-deploy devices

- Reduced risk through controlled offboarding and certified data security

- Lower cost per agent by maximising reuse and limiting capital spend

- Improved productivity through consistent configuration and support

- Measurable ESG benefits through extended device life

Turning a Constraint into a Lever

When device management is treated strategically, it stops limiting growth and starts enabling it. Onboarding accelerates, offboarding becomes predictable and auditable, and costs align more closely to active headcount rather than peaks and troughs.

In a market where speed, compliance, and efficiency define success, rethinking device management is no longer optional. A modern, circular approach to IT and asset management is becoming a foundational capability for BPOs looking to scale without adding risk or complexity.

Want to know more?

AI regulation is no longer just a tech or compliance issue, it’s becoming a boardroom priority.

In the US at a federal level the government seems to be actively opposed to AI regulation and in the UK, despite an interesting Private Member’s Bill, there’s no sign of any overarching AI law. But while the US and UK are still debating their approaches, the EU is ahead of the game with the world’s first comprehensive AI law: the EU AI Act. If you do business in or with Europe, this will affect you.

Why Should You Care?

No EU presence? Doesn’t matter. If you have EU customers or suppliers, you’ll likely be contractually required to meet the Act’s standards

Remember GDPR? The EU’s data privacy rules became the global benchmark. Expect the AI Act to have a similar impact

The Risk-Based Framework: What’s In, What’s Out

1. Unacceptable Risk: Banned

- Social scoring, manipulative AI, and biometric categorisation based on sensitive traits are prohibited

- Watch out: Using “black box” AI for things like fraud prevention or dynamic pricing could put you at risk

2. High-Risk AI: Strict Controls

- Applies to recruitment, education, healthcare, credit scoring, policing, and safety-critical infrastructure

- Requirements: Detailed risk assessments, transparency, human oversight, and conformity checks before launch

- Don’t assume you’re exempt: Even apparently innocuous recruitment screening tools could be caught by these rules

3. General-Purpose & Generative AI: New Obligations

- Foundation models (like ChatGPT or image generators) must ensure transparency, label AI-generated content, manage systemic risks, and clarify use of copyrighted data

4. Limited-Risk AI: Transparency Required

- Chatbots and similar tools must clearly inform users they’re interacting with AI.

- Heads up: Many bot providers still advise clients to hide from customers that they’re talking to machines —this will need to change

5. Minimal-Risk AI: Largely Unaffected

- Spam filters, video game AI, and similar tools are mostly out of scope

The Compliance Challenge

For UK and global businesses, the message is clear: even without local laws, EU standards will shape your obligations. Cross-border operations will face growing compliance pressure, just as they did with GDPR.

Balancing Innovation and Compliance

The real challenge? Staying innovative while meeting new regulatory demands. Businesses must:

- Identify which AI systems are in scope (which will include understanding exactly which parts of the business are using AI, to do what)

- Ensure transparency and risk management

- Be ready to demonstrate compliance to customers and partners

Need Help Navigating the EU AI Act?

At Customer Contact Panel, we help organisations find compliant, effective AI solutions—so you can innovate with confidence and accountability.

In our earlier whitepaper, we explored how AI adoption is reshaping customer contact – an area in which great risk and reward intersect. Six months on, the case for agentic AI has grown stronger, particularly in sensitive customer interactions where honesty and trust are essential.

Drawing on academic research and industry data, we now understand that AI can do more than just automate processes. It can unlock “more honest” conversations, especially in situations where fear of judgment by others or shame might inhibit disclosure.

This isn’t just a theory! Research from Stanford, MIT CSAIL, and NUS Business School reveals a striking trend: people are more open with AI than with human agents in contexts like mental health, financial distress, addiction, and relationship issues.

Why?

Because AI doesn’t judge.

Stanford calls this the social desirability bias, where people moderate their speech based on perceived perceptions. Removing this perception leads to greater honesty.

The ‘confession booth effect’, a term coined by NUS, also demonstrates this. In anonymised AI conversations, people admitted behaviours they hid from humans, like not reading terms and conditions or sharing passwords. In an insurance use case, initial disclosure accuracy rose by 40% when AI agents led the conversation.

MIT CSAIL found that people expend less mental energy managing impressions when talking to AI. This frees cognitive bandwidth for self-reflection and better problem-solving.

Now taking this approach, judgment-free AI agents can be implemented in high-trust, high-friction industries, such as mental health screening, legal triage, financial support, and trust & safety work. These artificial agents are more scalable and effective than humans.

The paradoxical truth is that people often feel more ‘heard’ by AI than by humans, because they don’t feel the need to pretend.

Yet traditional AI platforms struggle with emotional nuance, privacy, and secure escalation. It is essential to overcome these hurdles with strict compliance (GDPR+), contextual accuracy, and human-aligned escalation protocols.

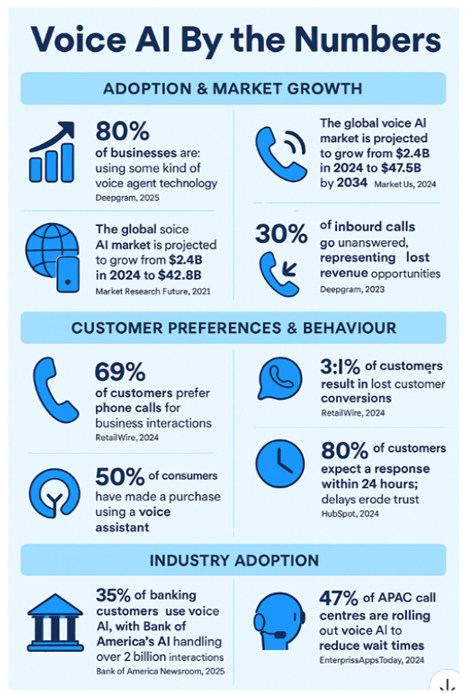

The case for AI grows when combined with market data

Perhaps considered in the context of the long forecast demise of voice as a channel, recent research from the Synthflow white paper brings together a number of key usage stats which when considered with the findings of the academic research support the notion that AI voice will be here to stay?

What does all this mean for CX leaders?

- Trust is key. Sensitive topics require the psychological safety of customers to be part your AI solution.

- Design your AI agent around customer fears, not just FAQs.

- Measure resolution accuracy and emotional sentiment, not just AHT.

- Voice AI, when built correctly, can be the most honest channel for customers.

- Integrated agentic AI ensures a consistent experience across platforms.

Customers don’t need AI to sound human. They need AI to “feel safe”. The leading approach to agentic AI will redefine what honest, efficient, and compliant customer interactions can be – especially in a world in which truth drives trust, and trust drives revenue.

The health & wellbeing sector has always been rooted in human connection. Whether it’s supporting someone on their fitness journey, guiding a patient through treatment, or reassuring a customer about a sensitive health concern, the role of empathy is central.

But as the industry expands fuelled by digital-first healthtech, growing demand for wellness subscriptions, and rising consumer expectations, customer contact teams are under strain. The question for leaders is clear: how can we scale, stay compliant, and still deliver a deeply human experience?

From Cost Centre to Care Hub

Contact centres in health & wellbeing have traditionally been seen as a cost to control. Yet every conversation from a dietary query to a mental health support call has the potential to strengthen or weaken customer trust.

Forward-looking organisations are reframing service operations as a growth driver. For example, brands in this sector are exploring:

– Streamlined renewals and cancellations to reduce friction in subscription journeys.

– Smart routing for repeat callers, ensuring recurring issues are addressed quickly.

– Consistent omnichannel service so customers feel supported whether they call, chat, or message via an app.

When the contact centre is positioned as a core part of the brand experience, it moves beyond cost reduction and becomes a foundation for loyalty.

Automation with Empathy

The volume of routine contacts in this sector is significant – booking appointments, tracking deliveries, resetting passwords, updating payment details. These are tasks that can be handled by AI and digital workers, delivering instant, 24/7 responses.

The real opportunity is in blending automation with human empathy:

– Real-time agent assistance: AI surfaces the right knowledge at the right moment, helping advisors answer health or wellbeing queries accurately and sensitively.

– Vulnerability detection: AI can flag signs of distress in a caller’s tone or language, prompting the advisor to adapt their approach or escalate where appropriate.

– Conversation wrap-up & QA: Every interaction can be automatically summarised, with 100% of calls checked for compliance and quality, giving leaders confidence that standards are met consistently.

This partnership between people and technology doesn’t replace the human connection. It amplifies it, giving advisors the space to focus on empathy while automation handles repetitive, time-consuming tasks.

Scaling Securely & Sustainably

The growth in health & wellbeing services from digital fitness programmes to home diagnostics demands agile operating models. Customer demand can spike rapidly, whether during seasonal health peaks or major product launches.

To stay ahead, organisations are:

– Leveraging flexible sourcing models (nearshore, offshore, hybrid) to expand capacity quickly and cost-effectively.

– Adopting workforce management (WFM) tools to optimise scheduling and keep wait times short.

– Embedding compliance and security (PCI DSS, GDPR, sector-specific regulations) to ensure every interaction is safe and brand-protective.

By combining these capabilities, health & wellbeing brands can scale without losing sight of what matters most: trust, care, and the customer’s wellbeing journey.

The Strategic Shift Ahead

The contact centre is no longer just a helpdesk. It is becoming the front line of wellbeing experiences, where automation drives efficiency, and skilled advisors deliver empathy. For leaders in the sector, the challenge (and the opportunity) is to design operations that are both sustainable and human-centred.

At Customer Contact Panel, we connect organisations with over 220 delivery providers and 115 technology partners. We help health & wellbeing brands navigate their options, align technology with their customer journeys, and build resilient, customer-first operations fit for the decade ahead.

The promise of utilising AI in contact centres is enticing: faster service, lower costs, and increased productivity that pleases the CFO. Initially, the numbers support this claim. Efficiency increases by 30 to 55%, costs decrease, and there is the opportunity to scale without increasing headcount.

However, this success story hides a hidden threat that can quietly undermine every gain made.

It is the paradox at the heart of traditional AI implementations: the more you optimise for productivity, the faster you accelerate burnout.

If you’ve engaged them properly in your AI project, then at first agents will welcome the support. AI can take on routine admin, provide helpful prompts, and cut down on cognitive load, but as performance improves, expectations rise. The business begins to see these AI-powered gains as the new normal.

Over time, this creates a silent squeeze. Agents have less recovery time, more pressure, and fewer moments of meaningful human connection. Stress builds, job satisfaction falls, and staff turnover rises. It is suggested that within 12–24 months, many contact centres could face a reversal of their early gains.

This is the AI productivity half-life—a concept backed by both data and human psychology. Traditional AI shows impressive results in the first year, but by year two burnout sets in, staff turnover increases, training costs rise, CSAT drops and the contact centre enters a cycle of decline.

The numbers paint a sobering picture:

- Training new agents costs £15,000–£25,000 per head

- AI systems degrade when experienced agents leave

- Customer loyalty falls when interactions lose their human touch

Ironically, the very systems designed to enhance performance can end up eroding it, because the human layer was never fully accounted for.

So, what is the alternative?

The better agentic AI solutions that we are now seeing take a fundamentally different approach. It’s not about replacing humans, it’s about augmenting them in sustainable, psychologically informed ways.

The AI agents don’t just answer questions; they complete tasks, make decisions, and manage workflows. They take pressure off humans without cutting them out.

And the results?

- Better job satisfaction

- Longer-lasting productivity

- Reduced turnover

- Stronger customer outcomes

More importantly, these systems are designed with long-term ROI in mind, not just how efficient your contact centre is today but how sustainable it will be two or three years from now.

How to Mitigate the AI Burnout Trap

- Develop an agentic AI that reduces workload without diminishing human agency.

- Shift KPIs beyond AHT to include FCR, CSAT, and engagement scores.

- Implement phased rollouts to monitor human impact before scaling.

- Prioritise agent training and involvement in AI design and deployment.

- Track agent wellbeing alongside operational performance.

- Combine automation with empowerment, ensuring humans retain control over complex and meaningful tasks.

- Regularly audit AI value, evaluating cost, sustainability, and satisfaction.

This Location Watch was prepared with valuable contributions from Temo Magradze, Founding Partner of Evolvexe BPO, as well as Davit Tavlalashvili, Head of the Investment Department, and Ketevan Kanashvili, Senior Investment Relations Manager at Enterprise Georgia. It also draws on research and insights from Ryan Strategic Advisory, specifically the report “2025 CX Technology and Global Services Survey”. Their perspectives on the evolution of Georgia’s outsourcing industry are especially insightful in highlighting why the country is gaining attention from UK, EU and North American companies as a nearshore and offshore delivery hub.

Georgia is rapidly gaining recognition as a promising BPO destination, thanks to its modern infrastructure, strategic government support, and a clear ambition to grow within the global outsourcing ecosystem. The recent BPO Leaders Summit 2025 in Tbilisi, hosted by Enterprise Georgia and Ryan Strategic Advisory, brought together industry experts, investors and government officials who confirmed the country’s strong potential.

1. Outsourcing Popularity & Market Positioning

As Temo Magradze emphasises, Georgia’s outsourcing industry has grown significantly in recent years. Its appeal lies in affordability, a highly skilled workforce, and a government eager to attract investment. Positioned at the crossroads of Europe and Asia, Georgia combines geographic advantage with a dynamic, pro-business climate, making it an increasingly popular hub for European operations.

According to the Ryan Strategic Advisory – 2025 CX Technology and Global Services Survey (see screenshot), Georgia scores 2.8, placing it slightly below mid-tier in offshore favorability. Yet, several countries ranked lower continue to be regarded as more mature outsourcing destinations due to their established ecosystems and long-standing track records:

- Turkey (2.6) – Longstanding BPO hub with strong multilingual capabilities, particularly in European market support.

- Colombia (2.7) – A leading nearshore delivery market for North America, well known for Spanish-English bilingual services.

- Nigeria (2.7) – Growing rapidly in scale with an established IT-enabled services sector and a deep labor pool.

- Slovenia (2.7) and Bulgaria (2.7) – Both EU member states with recognized nearshore outsourcing reputations, especially in IT, finance, and multilingual service delivery.

Although these markets rank lower than Georgia in the 2025 survey, they are considered more mature thanks to their larger delivery ecosystems, deeper outsourcing experience, and stronger global visibility. The fact that Georgia now scores ahead of such established players underlines its growing credibility and demonstrates how it is winning favorable attention against locations traditionally chosen for offshore and nearshore outsourcing.

2. Cost Competitiveness & Commercial Advantage

Labour and operational costs in Georgia are 40–50% lower than in established Central and Eastern European hubs such as Poland. Average salaries for customer service roles remain in the £456–£608 range, while programmers earn around £1,140 monthly.

One of Georgia’s strongest incentives is its International Company Status, which grants significant tax advantages, including reduced corporate tax rates. Coupled with government-backed grants and subsidies, this positions Georgia as one of the most cost-efficient outsourcing environments in the region.

3. Workforce, Language Skills & Talent Pool

Georgia boasts a multilingual workforce fluent in English, German, Russian and other European languages. Deloitte research estimates over 500,000 multilingual professionals across major cities. The most common roles include customer support, IT helpdesks, finance and accounting, and software development.

Universities and vocational institutes actively integrate English and technical training. Georgia’s education system, including institutions such as Kutaisi International University (developed with Germany’s Technical University of Munich), is producing a steady pipeline of outsourcing-ready professionals, many of whom are multilingual and STEM-focused.

4. Time Zone, Accessibility & Nearshoring Appeal

Situated in the UTC+4 time zone, Georgia overlaps conveniently with European working hours, while also complementing North American operations by enabling round-the-clock coverage.

Infrastructure for travel and remote collaboration is strong: Tbilisi, Kutaisi and Batumi airports all provide direct flights to key European hubs. This accessibility allows easy site visits and integration with international teams.

5. Infrastructure & BPO Ecosystem

Georgia has invested heavily in digital infrastructure, with 97% broadband coverage and widespread 4G/5G access. Tbilisi remains the primary outsourcing hub, but as Temo highlighted to me, there is rapid growth of secondary cities. For example, Evolvexe recently launched a major tech support project with ASUS from Kutaisi, servicing Germany, Switzerland and Austria. Batumi is also attracting investment and fast becoming a secondary BPO location.

6. Government Support & Incentives

The government, through Enterprise Georgia, plays a pivotal role in supporting BPO expansion. Simplified business registration (often completed in a single day), tax incentives, and subsidies for training make it easier for foreign companies to establish operations. While GITA focuses on supporting IT infrastructure and the ICT Association concentrates on IT-related initiatives rather than BPO specifically, these organisations contribute to the broader tech ecosystem that benefits the sector.

Industry associations, such as the ICT Association, also provide a strong bridge between policy-makers and BPO operators, ensuring that the sector’s needs are addressed. Tavlalashvili and Kanashvili stress that this alignment of public and private stakeholders has been critical to the sector’s momentum.

7. Industry Success Stories

Georgia is already home to a mix of international and local players. Companies such as Making Science Sweeft (software development) and Evolvexe Outsourcing (customer support and tech services) demonstrate the ability of Georgian firms to deliver value across Europe and North America. Majorel, Concentrix, EPAM Systems and Viber have also scaled their operations in Georgia, validating the country’s growing importance on the global outsourcing map.

8. Cultural Fit & Service Excellence

Georgians are often described as the “first Europeans”, with a cultural heritage rooted in hospitality, loyalty and respect for education. This translates into a natural customer-service orientation, where tone, empathy and relationship-building come naturally. This cultural foundation gives Georgian agents an edge in handling sensitive, customer-facing interactions with empathy and professionalism.

9. Innovation, Growth & Future Trends

Georgia is moving beyond traditional call centres into higher-value areas such as software development, fintech, AI-enabled services and digital operations. With IT exports surpassing $1 billion in 2024, the country is positioning itself as not only a cost-effective outsourcing hub but also a source of innovation and digital transformation expertise.

Looking ahead, Temo Magradze predicts that in the next three to five years, Georgia will transition from being primarily a low-cost option to a recognised hub for quality-driven, technology-enabled outsourcing, while still maintaining a commercial edge over EU and US markets.

Final Thoughts

Georgia is establishing itself as one of the most dynamic emerging BPO destinations in Europe. Its multilingual workforce, strong government backing, cost advantages and expanding digital ecosystem make it an attractive nearshore and offshore option for companies across the UK, EU and North America.

As Magradze, Tavlalashvili and Kanashvili each highlight, the country’s unique blend of hospitality-driven service culture and tech-driven innovation gives Georgia a competitive edge. While the sector is still developing compared with more mature hubs, Georgia’s momentum is undeniable, positioning it as a location to watch very closely in the years ahead.

Want to find out more or meet vetted providers in Georgia? Drop us a line, we’re happy to help you explore your options.

As self-serve improves, agents are increasingly left with the most complex queries.

Of course, it’s not always the case as many customers continue to prefer conversations over digital interactions, or are even digitally excluded, but for the most part, the expectation is that agents deal with call after call still, but with less and less respite where the query is nice and straightforward. And complex queries often involve multiple systems or multiple previous contacts, as they aim to follow the story. Which, if we go back to use case 1 – autowrap, we know our corporate memory can be patchy.

Yet customer expectation is that all of the necessary information is at the agent’s fingertips. And why shouldn’t they think that? Customers are often time poor and a bit frustrated already, so a longer than necessary call that may or may not answer their enquiry simply compounds their frustration.

What is the AI doing in Agent Assist?

As with all use cases to date, the AI is listening to calls to summarise key points. In Agent Assist – or ‘conversational guidance’, it is also retrieving and analysing previous data, so that, as with use cases such as auto coaching, it can make suggestions and guide processes during the customer interaction. It is, in effect, accessing and presenting the corporate memory that customers expect, but with bells on as it is also providing direction to the agent.

Key Benefits of Agent Assist: Assess customer needs

From the outset, the AI can help an agent understand what type of call they’re dealing with. Is this a customer with a quick query who is in a hurry, so it needs to be efficient, or do they have more complex needs that need to be addressed? Or even, is there an opportunity to cross- or up-sell to this customer?

Not only does this help to direct the nature of the call, it has an obvious impact on how the brand is perceived and even on topline revenue if it is possible to make a sale. Equally, it can prevent a clumsy attempt at a sale at the wrong moment, which could denude rather than enhance customer lifetime value.

This is also a key consideration in the push to self-serve, as customer experience becomes less personal and less represented by the people of the organisation. While a poor customer experience on a call can erode brand value, a great one can build far more than pure self-serve experiences.

Lower cognitive overload

In the context of agents needing to take more calls that are more complex, fatigue and cognitive overload is real. So while the last 15 years have been about focusing more on natural conversations and active listening, in a high-pressure, high-volume environment, doing that on every call is intense.

Of course, some agents may enjoy the need to think on their feet more than others, and therefore may be the ones who are trickier when it comes to adoption, but there are times when we all need a break from the mental strain of 100% concentration.

Optimise handling time

Agent assist can help to optimise handling time by keeping the agent on track, and reducing the amount of time spent unnecessarily building rapport. Of course some rapport is good, but if overdone, it can be confusing for the customer and result in repeat calls to resolve their actual query, rather than have a nice chat.

Accelerating the development of new starters

Dynamic conversational guidance allows new starters or less experienced agents to fly solo faster. They need to refer less to their supervisors for guidance (which in itself interrupts the flow of the call) and build confidence more quickly.

All of which translates to an increase in customer satisfaction from the use of corporate memory to deliver a better experience and faster call handling with responses that are right first time.

Implementation Considerations: Agent behaviour change

Aside from non-negotiables, such as good data (an absolute pre-requisite here) and systems integration, a key consideration for Agent Assist is to understand that it requires a much greater change in agent behaviour than the uses cases to date. Because you are in effect re-engineering conversations. So while it can accelerate the performance of a new starter, a longer tenured agent may be more ‘stuck in their ways’.

That means it typically takes 8 to 16 weeks to realise all the benefits of agent assist, possibly more if everyone is remote rather than office based. However, a two-to-four-month window to embed such change is both a really short time in the grand scheme of things and a small price to pay for the benefits available. Even considering that there will be a degree of things being a little slower in the first instance as you go through the J-curve of implementation.

However, almost all those aiming to realise AI benefits are jumping straight to this use case. Whereas they could prove the case for AI on much quicker and easier wins that are less likely to fail. What’s more, if those use cases have been implemented first, they lay the foundations for agent assist, and make both implementation and adoption easier and faster too. Without having proved the case for AI to the humans in the equation, adoption is slower, if accepted at all, and the benefits won’t come.

Knowledge base quality

Secondly, jumping too quickly to pure LLM Agent Assist and simply connecting to a knowledge base of historic conversations, then presenting information based on that alone as guidance, is a dangerous place to be. Because that assumes that all previous conversations were exactly as you wanted them, and not littered with the conversations of poorly trained or poor performing agents. Mojo’s advice here is to use the LLM to read in your script and build out the flow for that script and the associated dynamic pop ups. And it is essential that the knowledge base is part of continuous improvement too.

Measuring Success

There are some obvious key metrics that will be impacted by Agent Assist, from AHT and FCR to CSAT. More broadly, agent progression and job satisfaction can be measured through agent feedback, and customer lifetime value through customer analytics.

In summary, the key benefits are:

-

Increased agent satisfaction through reduced stress and increased performance

-

Increased customer satisfaction through faster and more accurate call handling

-

Reduced average handling time through more pointed conversations

-

Increased FCR through more accurate assessment and solutions

-

Improve opportunity spotting for x-sell and up-sell and guide to a sale

-

Improved customer lifetime value (CLV/LTV)

Done well, Agent Assist tools can enhance the capabilities of contact centre agents through intelligent support that enables agents to navigate complex queries or attempt to make sales with confidence. Which leads to more effective and satisfying customer interactions, greater customer lifetime value and even the potential to shift mindset from the contact centre as a cost centre to a value-driving profit centre.

To find out more about how CCP can help you make the right technology choices, read more here or get in touch.

This series of articles is drawn from our webinar with Jimmy Hosang, CEO and co-founder at Mojo CX. We explored seven key use cases for AI in contact centres, starting from the easiest productivity gains to value generating applications. You can find a summary of all seven use cases here, or watch the webinar in full here.

In an article published in the run up to Christmas 2024, I discussed the growing tendency in many organisations of the traditional Christmas peak starting to diminish, due to a variety of factors. Musing on the question of whether we had “…passed peak peak” (see what I did, there?) I wondered whether a reduction in the scale of ‘peak seasons’ was being paralleled by a growth in other sorts of both structural and spontaneous increases in contacts.

I was reminded of this article – and the discussions with colleagues and partners that inspired it – when I came across what was a new term to me, last week. The phrase is ‘perma-peak’ – the concept of a long-running or perpetual series of periods of high contact demand.

If the old, usually Christmas-related, peak season was the product of a society-wide, predictable (but hard to handle!) patterns of behaviour, then a perma-peak reflects a very different world. One in which both consumers and brands exhibit or can leverage greater personalisation, but in which demand patterns can spread and grow very rapidly:

1. Brands now have the ability to test and flex proposition and pricing, with instantaneous digital communication to customers and prospects

2. Social network effects can massively amplify the features and virtues of an offer or product – be that from an ill-prepared start-up or a settled, established big player. And, of course, negative aspects or faults can also be shared and multiplied, resulting in a flood of questions, complaints or claims

Pattern non-recognition

Despite advances in analytics automation and machine learning / AI, understanding and responding to demand changes in real time remains difficult and rare. Contact centres have always been operationally flexible and able to display great agility, but this is typically still a manual, even instinctive, response.

When insights are predominantly based on pattern recognition, increasing unpredictability makes operational flexibility a consistent challenge.

Likewise, agent assist and self-service tools and guidance will largely be optimised on the basis of prior experience. Unexpected demand spikes might be driven by either new query types and failure demand triggers, or factors in a novel combination.

Planning for the unplannable

In traditionally ‘peaky’ business sectors like retail, peak planning is an intrinsic part of how businesses are run. If you have a Christmas peak then thinking about how to handle it the following year typically starts in January, before the backlog of post-Christmas complex queries and complaints has even gone! Planning for the unpredictable is a different challenge.

So, if we really are entering an era of perma-peaks, will contract centre operations find themselves back in the era of watching service level charts drop precipitously whilst wondering what on earth is going on?

Not necessarily.

Perma-peaks need perma-flex

Just because tried and tested techniques are strained or start to fail, doesn’t mean that they can’t be revisited, adapted and fine-tuned.

• Workforce Management may become more orientated around rapidly identifying the different characteristics of peaks and corralling real-time shift flexing – and less about aligning scheduled staffing to forecast demand

• Your attempts to match staffing to demand may be less focused on seasonal efforts with shift banking and the use of temporary or fixed-term contract workers, but instead looking at incentivising intra-day shift flexibility or the peak use of a ‘gig’ model, using either in-house or outsourced workers

• Customer guidance, contact steering and self-service options will need to be able to be changed and weighted immediately in the light of peaks or troughs in demand. Root causes of demand spikes need to be identified and addressed – including restricting the promotion of or access to certain contact channels for limited periods, if required

• ‘Unforced errors’ by which organisations inadvertently trigger customer contact need to be avoided. Experience shows that the best way of doing this is through ensuring the contact centre has ‘a seat at the table’ when initiatives and campaigns are being designed

Whether you think that your next peak could be with you at any moment – or you’re confident that it will kick in from the 2nd week of October, just like every year – how to do you anticipate, plan and prepare?

Let us know; we’d love to share experiences and ideas.

What’s next? More of the same, that’s what! As we all know, that’s the nature of the regime; it’s here for keeps.

We know from the FCA’s reviews of firms’ mandatory Consumer Duty Board Reports that their initial assessment of the industry’s response to the requirements of Consumer Duty has been broadly “ok for starters, but you can try harder”!

The FCA’s update on its review of the Consumer Duty rules promised some simplification and removal of some arguably unnecessary, prescriptive requirements (in line with the Treasury’s ‘cut red tape’ agenda), but the range and depth of the permanent change in the treatment of customers that the FCA wants to see will remain.

This is to be expected and no doubt most firms are focused on the FCA’s specific callouts for Board Report improvements such as:

- Improving the quality of data – and the insights derived from it

- More fully reflecting the needs of different consumer cohorts, especially those with vulnerabilities

- Ensuring that boards are challenging – and seen to be challenging – the business to meet the Consumer Duty’s requirements

- Clarity on the timescale, action owners and data to drive planned improvements

But one further area for improvement will be particularly relevant to colleagues in the customer experience and/or contact centre space – “Comprehensive view across distribution chains”.

Yanking the chains

The FCA has long recognised the importance – and potential for the risk of service and experience failure – in distribution and supply chains. Many financial services organisations will have already had to review their supply chains to meet the FCA’s expectations around Operational Resilience.

Meeting the outsourced, sub-contracted and third-party challenge

In the context of Consumer Duty, though, the focus needs to be less on the dangers of total failure than the more subtle risks of poor visibility and exchange of information, and inconsistent consumer treatment and experience.

The way in which financial products and services are sold, delivered and supported can often involve multiple partners in the supply chain – covering sales, payments, customer service, claims, redemptions and other functions.

At nearly every point of the customer journey the way in which consumers are supported and interacted with, both through human-to-human dialogue and automated channels, creates a Consumer Duty risk.

Outsourced and sub-contracted relationships need to be managed to ensure that the standards of consumer data and insight; advisor training and empowerment; online and automated information and decision making; consumer recognition; fairness; and effective compliant recognition and resolution; are all delivered as well as they are in-house. To do so will require a blend of initiatives and efforts, including:

- Contracts and service–schedules; contractual management Information and KPIs

- Data and information security assurance, including payments (and the news that Marks & Spencer’s recent £300m cyber-attack is being blamed on a 3rd party supplier’s error highlights the criticality of this area)

- The quality assurance and provision of guidance and information to both customers and advisors

- The ability to share and identify customer profiles and features (especially vulnerability factors)

- Advisor training and coaching

- The provision of self-serve and assisted support tools and concessionary measures

(and all of these are an ongoing commitment, not just a ‘one time fix’)

In Summary

Managing complex customer supply chains can be tricky at the best of times, but adding in a raft of demanding regulatory expectations and requirements makes it more difficult still.

Have you already met this challenge or are you still assessing how to better go about it? Let us know. Get in touch, we’d love to chat.

Identifying and supporting vulnerable customers – such as those experiencing financial difficulties, health issues, or emotional distress – is crucial for ethical, compliant and effective service delivery.

While the FCA has long taken a leading role in this space, other regulators such as Ofcom and Ofgem have also required vulnerability protections to be in place, with the UK’s Digital Markets, Competition and Consumers Act 2024 (DMCC), which came into effect on 6 April 2025, also widening the concept of vulnerable customers.

With thresholds higher than ever, the risks of not identifying vulnerable customers can be significant. Fines can now be imposed without a court order and at eye-watering levels, with reputational risk a compounding facto, not to mention the impact on vulnerable individuals themselves.

What’s more, with the divergence between UK and EU law, any cross-border businesses need to be even more on their toes in different jurisdictions.

What is the AI doing to detect vulnerability?

With the preceding three use cases essentially laying the groundwork for this kind of analysis and management, AI can identify signs of vulnerability by analysing speech patterns, language cues, and emotional indicators.

Key benefits: Categorisation and risk scoring

Vulnerability is a spectrum, and customers can move in and out of vulnerable states or between risk factors. Detecting this manually, however, is fraught with difficulty.

First, different people have different – and subjective – views on whether a customer may be indicating a vulnerability factor.

Second, the cues can be subtle and therefore challenging to pick up, especially when an agent – as a normal part of their job – is multi-tasking across multiple screens, taking notes and trying to hold a conversation at the same time.

But the AI is far less likely to miss those cues, because it isn’t distracted, isn’t having a bad or busy day, and doesn’t have empathy as an emotion. Any AI empathy is trained in data, and consequently consistently applied.

Record accuracy

As with use case 1, the use of AI enhances note taking and record-keeping by transcribing and summarising the call automatically. This avoids any temptation to rush the process, and risk non-compliance, while allowing the agent to focus solely on the customer’s needs.

Compliance alerts

While you could employ this kind of analysis in-flight, where prevention is almost always more desirable than cure, even a post-call analysis allows for flagging of potentially vulnerable customers and pro-active outbound or other management of that customer. retrospectively, and still gain some of the benefit, the nature of the regulatory and legal environment makes a real-time approach more desirable, with a prevention rather than cure approach.

Real-time vulnerability detection

The ultimate deployment of real-time detection during a call allows agents to adjust their approach on the fly. And for a true ‘belt and braces’ approach, if a risk score is exceeded, this can be flagged as a ‘red alert’ to the agent, very clearly instructing them not to sell, to do a welfare check, or provide relevant support information.

All of which not only manages the risk to individuals and the business, but empowers agents with the confidence to handle sensitive situations effectively and retains consumer trust through a commitment to their wellbeing that can also foster loyalty.

Implementation Considerations

Again, systems integration and data privacy are key factors in implementation, especially around matters of data usage and consent. As is training and embedding belief in the AI.

But where in other use cases it may be that the cost (or perceived cost) and complexity (or perceived complexity) of implementation of the AI project make the decision more difficult, in this instance, the potential of the AI is less about an ROI against cost than it is about ROI against the potential cost of those eye-watering fines if getting it wrong.

Measuring Success

Here, measurement may be a little trickier, depending upon how well you are able to understand the current baseline. Consider that manual QA is based on only 1-2% of calls, there could be whole swathes of risk going undetected.

The ideal situation is that there is nothing to measure. No issues, no incidents.

However, you can look at measures such as customer feedback from vulnerable customers, the numbers of interventions such as welfare or information provided, and adherence to regulations, particularly if using retrospectively rather than real time.

But the real benefits come from what doesn’t happen, rather than what does. In summary, they are:

- More frequent and consistent identification of customer vulnerability

- More accurate records

- More confidence in your compliance

- Less perceived risk within the business

Using AI to identify vulnerable customers enables contact centres not only to improve on consumer duty and meet the right ethical standards with empathetic and responsible service, it hugely decreases the risk of the worst possible outcome (from a business viability perspective) of an unexpected knock on the door from the regulator and/or widespread bad press.

To find out more about how CCP can help you make the right technology choices, read more here or get in touch.

This series of articles is drawn from our webinar with Jimmy Hosang, CEO and co-founder at Mojo CX. We explored seven key use cases for AI in contact centres, starting from the easiest productivity gains to value generating applications. You can find a summary of all seven use cases here, or watch the webinar in full here.