Say it quietly if you like, but businesses are grown and maintained through increases in customer numbers and/or customer value. Undoubtedly cost management is also a critical factor, but ultimately sales and retention activity that provides topline growth is critical to ongoing success and business value.

We all know that the chances of winning or retaining a customer are increased when you provide a great product or service. And that those who deliver, not just on price but perceived value, are in prime position to pick up customers from competitors when they do not.

Yet many businesses are focused on the potential cost savings that could be achieved through AI and automation. Have they have lost sight of the potential benefits of delivering a personalised service and those golden opportunities to encourage a customer to buy more or stay for longer?

Are you getting the best sales through service opportunities from AI and automation?

There are two key scenarios that could be playing out for many organisations, both B2B and B2C. Either of which could be limiting sales success:

1. The technology is doing great stuff

Customers are getting the service that they need in the moment they need it. Which means the brand is working on the assumption that because they’re well-served, they will come back to buy more. However, they are not engaged with these customers, they are simply dealing with their admin when they need to and as a result are being passive in their habits. This may work for on a number of levels, and it is reducing the cost to serve. However, is this a step away from brand bypass, as ultimately a gap in the connection with customers will result in them moving on when they see a better offer?

2. The technology isn’t hitting the mark

Customers are trying to resolve their issues, but are struggling. The automation or self-serve models don’t provide the right options and/or have no ‘way out’ for customers and as a result they become frustrated. So at the first opportunity, they are going to look to an alternative brand.

The examples are out there in key sectors.

Ofgem March 2024 data

Harder to contact and less satisfying to deal with?

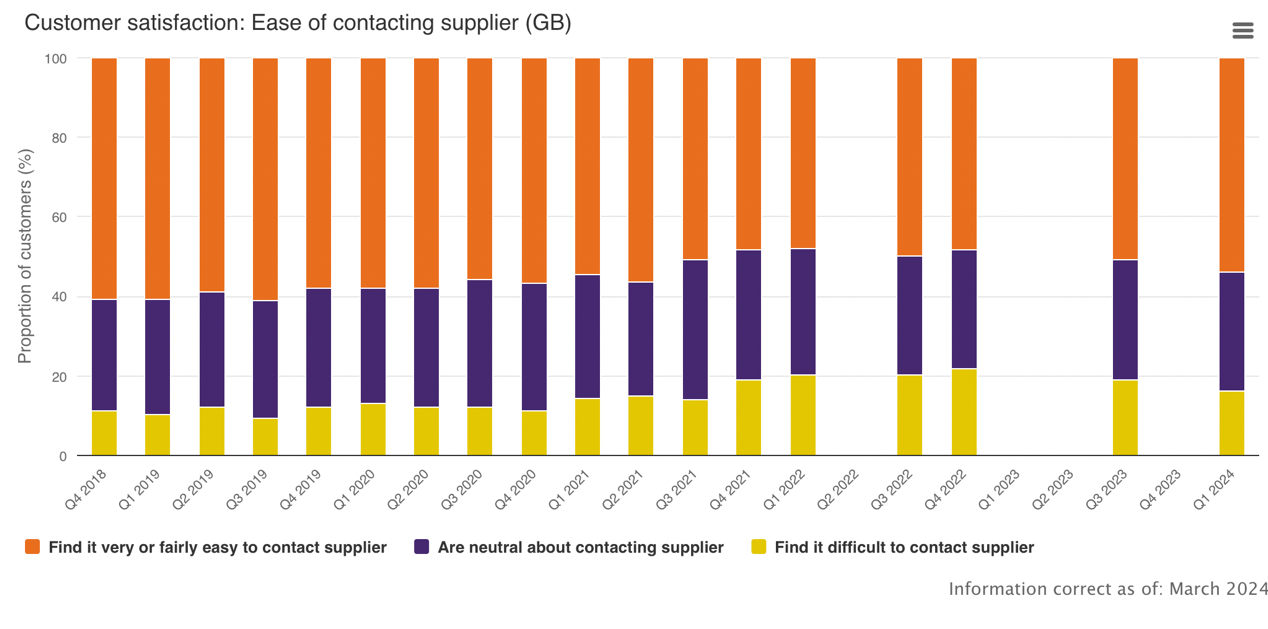

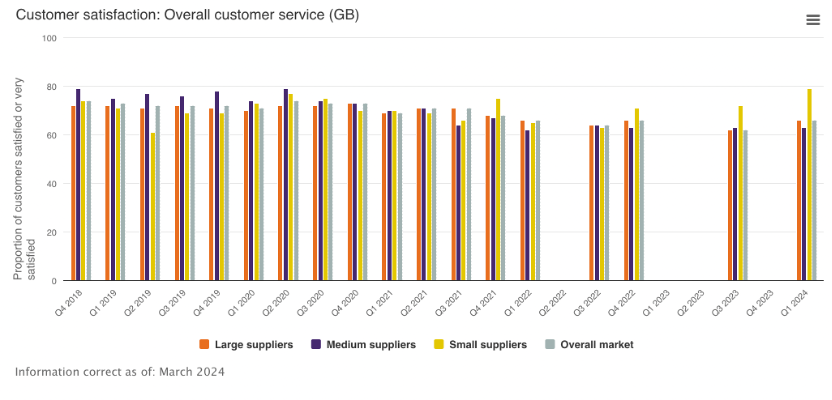

Despite and improving picture, the latest Ofgem data shows that 16% of customers find it difficult to contact their supplier, up from the low of 10% in Q1 2019. Meanwhile, the same Ofgem data suggests that overall satisfaction with customer service across the energy industry currently sits at 66%, down from the peak of 74% seen in Q2 of 2020.

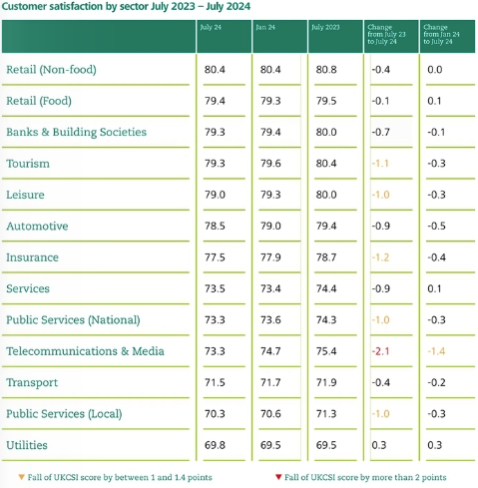

What’s more, the latest UKCSI data shows utilities performing the poorest with a score of 69.8. Telecommunications and Media brands are doing a little better at 73.3 (though down from January’s 74.7), but are still some distance short of the podium positions achieved by Retail (non-food) at 80.4, Tourism at 79.3 and Banks & Building Societies at 79.3. However, we can see drops in satisfaction across the board.

Could automation be contributing to those less satisfying experiences?

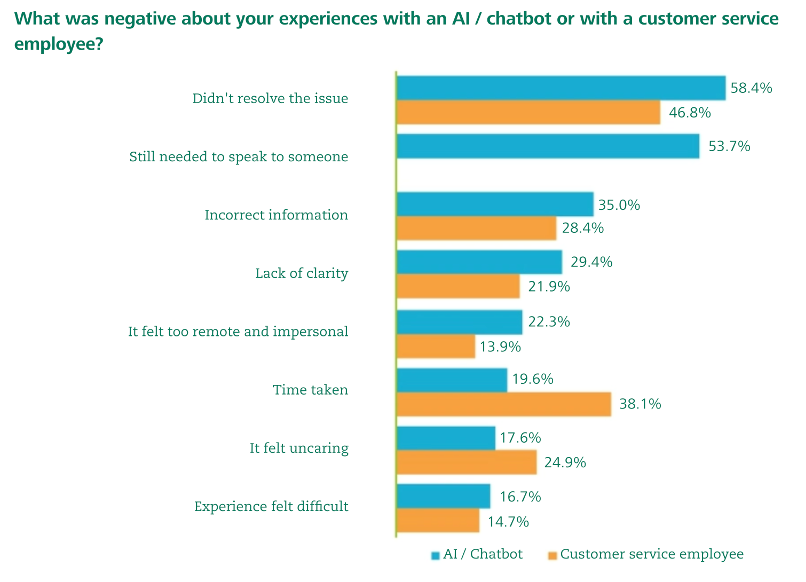

UKCSI data from earlier in the year tells us that for 53.7% of automated contacts, the customer still needed to speak with a human being.

Equally concerning, though, was that neither AI/chatbot or customer service employees are managing to resolve customer queries more than 54.2% of the time, as seen in the January results. Quite the damning indictment.

Consider also that 45.4% of customers would avoid using an organisation again due to poor use of technology.

Clearly there is work to be done.

Companies with higher customer satisfaction show stronger growth

But what is the impact of this on a brand’s fortunes? Is the 2-point drop in score for Telcos material?

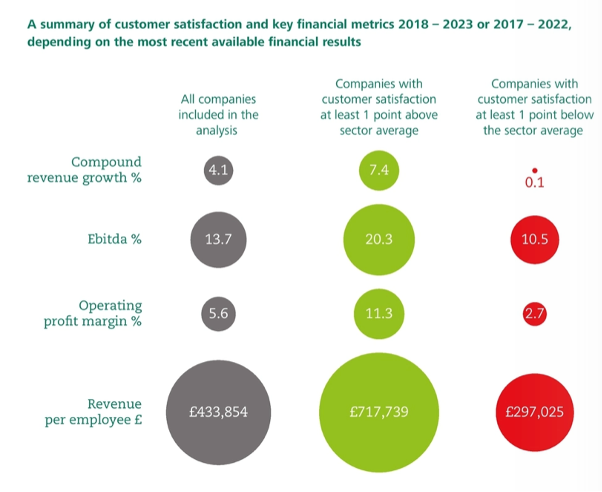

Research in the UKCSI report from January 2024 shows that between 2017 and 2023 “companies with customer satisfaction at least one point higher than their sector average achieved stronger revenue growth”.

With c.80% higher compound revenue growth, 6.6% higher EBITDA, more than double the operating profit margin and a whopping £283.9k – more than half as much again – revenue per employee on the table for that increase of just one point, the importance of customer satisfaction to both the topline and the bottom line is stark. On the other side, the virtual lack of revenue growth and much reduced operating profit margin for 1-point lower puts into context the plight of Tourism, Leisure, Insurance, Public Services and the rather more beleaguered Telcos.

The same report highlights that 27.6% of customers who score an organisation 9 or 10 out of 10 for overall satisfaction will look to buy other products or services from them, whilst 20.8% of customers scoring 1 to 4 will spend less with the organisation and 41% scoring them at 1 to 4 will avoid dealing with the organisation again in the future if possible.

And so, it is easy to see why investment in customer service is critical to the success of an organisation. Why an organisation should be – and hopefully is – highly focused on it. And why a pure cost-reduction focus for automation or AI is short-sighted.

While these numbers tell quite the story, let’s assume things are the right side of the line service-wise, whether through AI or not. The next question then is, are you following up with the appropriate sales activity to effect further topline growth?

Are you ready to pick up the sales baton?

Effective sales operations depend on 7 key factors for growth, the same apply to both sales team and those required to deliver sales through service:

- Access to the best people with the necessary sales and communication skills,

- Clear reward and recognition structures with incentives, creating a culture and environment which encourages growth,

- Appropriate product knowledge and ongoing team development, ability to handle objections effectively and to share learning to advance the performance of the team,

- Effective technology which the team can leverage to access customer insights, understand which are the best customers to be contacted, when to contact them and what solutions to offer,

- Practical approaches to sales compliance, which provide clear guidelines but can be managed without excessive burden to managers, allowing sales to be signed off effectively and if necessary, learning applied in a timely manner,

- Ability to manage data and reporting to maximise sales opportunities which benefits the organisation, the sales agents and also the customers through ensuring access to right information at the right time,

- Understand market conditions, customer behaviours and how your team needs to react to these.

If just one of these seven isn’t working too well, sales will suffer. But so may customer service or perceived value. For example, an intrusive offer in the middle of a customer complaint is likely to occur as unempathetic and may see the customer running for the hills. A well-handled complaint can increase value – or at least maintain it.

A colleague described a recent interaction about a problematic return with a well-known retailer, where mid-conversation they were invited to look at product that may interest them. Unsurprisingly, their reaction was not to immediately head to the link to browse, but instead to give a sharp retort – and then tell anyone who cared to listen how annoyed they were.

Not only did the retailer not make the sale, they likely turned the customer off. An excellent example of numbers 1, 2, 3, 4 and 7 (at least) not working. Not only was it bad scripting and a lesson in not what not to do, it may speak to overly aggressive reward structures and an environment that favours sales over growth. The nuance of which is important and why point four is critical – this was not the best customer to be contacted in this way at that time.

The same colleague similarly experienced rather odd service (from a Telco…) in store recently, where a service conversation without a satisfactory outcome turned to an attempt to upsell on a different product, followed by a recommendation to leave the brand for the product where the service outcome was unsatisfactory. Quite the rollercoaster! And no doubt an experience driven by a particular sales focus that the brand’s managers would be horrified to learn they have – let’s hope – inadvertently incentivised.

Picking your moment to turn service into sales is critically important and relies heavily on the skill of the individual, their training and incentivisation, supported by culture, technology and management.

With so much focus on customer service, do you have the need, will and capacity to optimise sales?

Great agents who can both serve and sell can be hard to find, and can be even harder to retain..

The use of technology and automation is increasingly expected for customer service – and rightly so, simple service issues don’t need complex solutions. But they do need human intervention when the service question isn’t simple, or the automated response fails. Or perhaps when a sales opportunity requires a more personal service.

The ability to deal with customers, their nuanced needs and when selling, their objections, still has a high level of dependency on human interaction.

Yet the data from Ofgem and UKCSI both illustrate that customers are frequently frustrated by both automated and agent interactions. Service delivery in many sectors is still some way short of previous highs, meaning there are still gaps to fix in customer service before you can even think of perhaps selling.

And to some extent, when improving customer experience can deliver increased revenue, getting the basics of service right first is a significant route to growth and building value – whether you agree or not about whether they ought to be, measures such as revenue growth, EBITDA and revenue per employee are important to investors and share price.

How you achieve optimised service, then layer on sales through service or even pure sales activity is a significant question. Each have their own challenges, but successful outcomes add up to an organisation that both sells to and retains customers optimally.